U.S. STOCKS DOWN

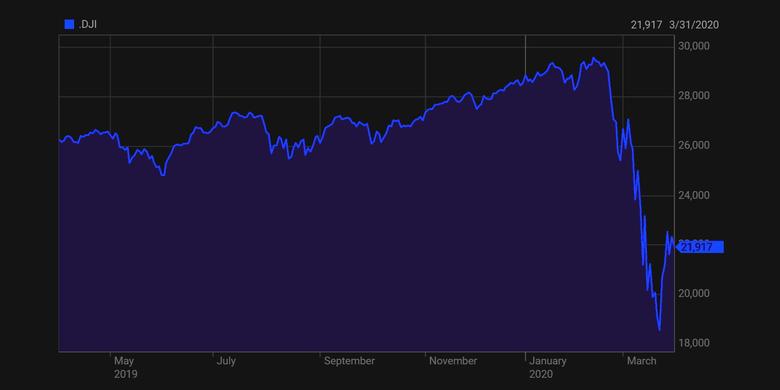

REUTERS - MARCH 31, 2020 - Wall Street's three major indexes tumbled on Tuesday, with the Dow registering its biggest quarterly decline since 1987 and the S&P 500 suffering its deepest quarterly drop since the financial crisis on growing evidence of massive economic damage from the coronavirus pandemic.

In one of the fastest turns into a bear market, the S&P 500 and the Dow both ended the first quarter more than 20% below the end of 2019, as the health crisis worsened in the United States and brought business activity to a standstill.

It was also the S&P's biggest first-quarter decline on record as consumers were advised to stay at home, leading businesses to announce temporary closures and massive staff furloughs.

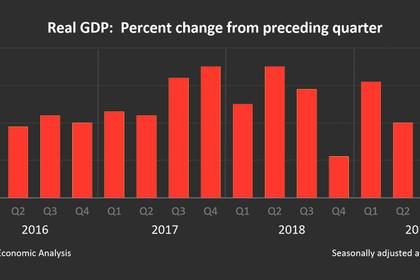

As a result, economists have slashed 2020 growth expectations and investors, eying dismal quarterly financial reports, fear corporate defaults and mass layoffs would lead to a deep recession.

An unprecedented round of fiscal and monetary stimulus had helped equity markets edge higher last week following wild swings that saw the benchmark S&P 500 rise 9% and slump 12% in two consecutive sessions.

But this was not enough to give investors confidence.

"After the battering we've taken in the last month, people aren't willing to make big bets in any direction right now, especially since we'll have more insight from commentary in early earnings reports starting next week," said Carol Schleif, deputy chief investment officer at Abbot Downing in Minneapolis.

Many investors were also likely being cautious ahead of the release of jobless claims data on Thursday and the March non-farm payroll report on Friday, said Steven DeSanctis, a strategist at Jefferies.

“We’re leading into the end of the week that’s going to have more of the fireworks,” he said.

The Dow Jones Industrial Average .DJI fell 410.32 points, or 1.84%, to 21,917.16, the S&P 500 .SPX lost 42.06 points, or 1.60%, to 2,584.59 and the Nasdaq Composite .IXIC dropped 74.05 points, or 0.95%, to 7,700.10.

The technology-heavy Nasdaq registered its biggest quarterly decline since the end of 2018.

The utilities .SPLRCU and real estate .SPLRCR sectors were among the biggest decliners on Tuesday, with 4% and 3% declines respectfully following a recent rally, when investors sought ways to weather the economic slump.

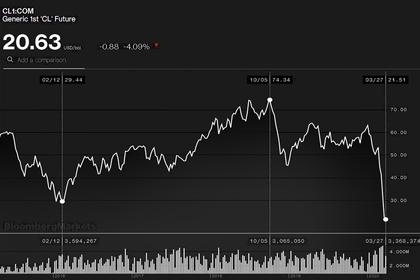

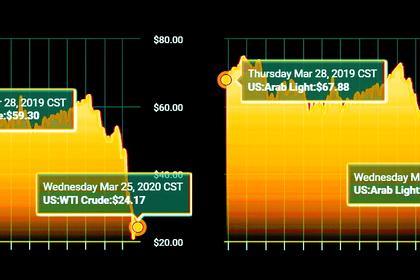

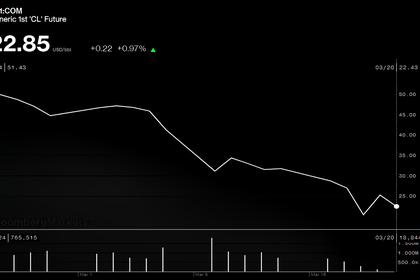

The energy index .SPNY rose nearly 1.6%, boosted by a rebound in prices on the day although crude oil benchmarks ended a volatile quarter with their biggest losses in history, as both U.S. and Brent futures were hammered throughout March by the coronavirus pandemic and the eruption of a price war between Russia and Saudi Arabia.

After bouncing between gains and losses, the technology sector .SPLRCT ended the day down 1.9%.

Declining issues outnumbered advancing ones on the NYSE by a 1.25-to-1 ratio; on Nasdaq, a 1.04-to-1 ratio favored decliners.

The S&P 500 posted one new 52-week high and no new lows; the Nasdaq Composite recorded 14 new highs and 37 new lows.

On U.S. exchanges 13.13 billion shares changed hands compared with the 15.75 billion average for the last 20 sessions.

-----

Earlier: