WTI PRICE: MINUS $37,63

PLATTS - 20 Apr 2020 - Front-month NYMEX WTI settled in negative territory as a lack of storage capacity forced traders to exit positions ahead of Tuesday's contract expiration.

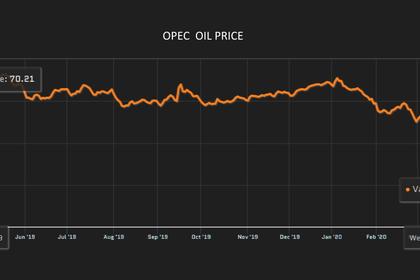

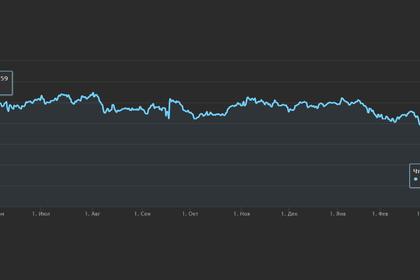

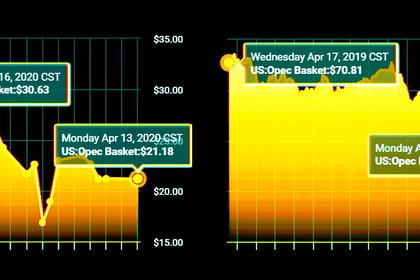

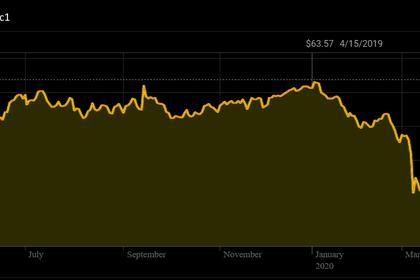

NYMEX May WTI settled at minus $37.63/b, down $55.90 from Friday. The contract had never before traded in negative territory, and the previous record low front-month settlement was $10.42/b on March 31, 1986.

The selloff is "all related to the expiration," S&P Global Platts Analytics senior consultant Sergio Baron said. There is "no space in Cushing and low open interest," he added. "WTI is deliverable via exchange, so a long futures contract with no space doesn't have other alternative to sell."

Traders have been shifting out of the May contract and into the outer months since the beginning of April. Open interest in the May contract stood at 108,593 lots Friday, down 520,000 lots since April 1, CME data shows.

Relatively low volume was adding to the May volatility. Roughly 134,000 lots had traded by Monday afternoon in the May contract, compared to 859,200 contracts for the June contract.

The June WTI contract settled down $4.60 at $20.43/b, significantly stronger than May, but still at a $5.85 discount to July WTI, which settled at $26.28/b.

"The outlook for WTI crude beyond the summer has Wall Street eyeing the $30 a barrel level, but this expiration trade issue could happen again next month if we see inventories and pipelines near capacity," OANDA senior market analyst Edward Moya said. "US shut-ins are growing and that could be the only thing that prevents the most active crude contracts from crashing."

S&P Global Platts Analytics now sees 2020 global oil demand contracting by 7.8 million b/d, revised from a 4.5 million b/d decrease in its March outlook. Oil demand is now projected to contract in every month through December.

The steep selloff was largely contained to prompt US crude. ICE June Brent settled down $2.51 at $25.57/b. NYMEX May ULSD settled down 6.85 cents at 88.78 cents/gal and May RBOB finished 4.24 cents lower at 66.83 cents/gal.

PROMPT GLUT

The relatively modest declines in front-month Brent prices means "this is obviously a problem with spot market and WTI," Tradition Energy analyst Gene McGillian said. "For the US oil market to see this, it shows you this demand crisis we are in is something that until it happened could not have been thought about," McGillian added.

Physical WTI at Cushing was also assessed in negative territory Monday, at minus $37.63/b by S&P Global Platts.

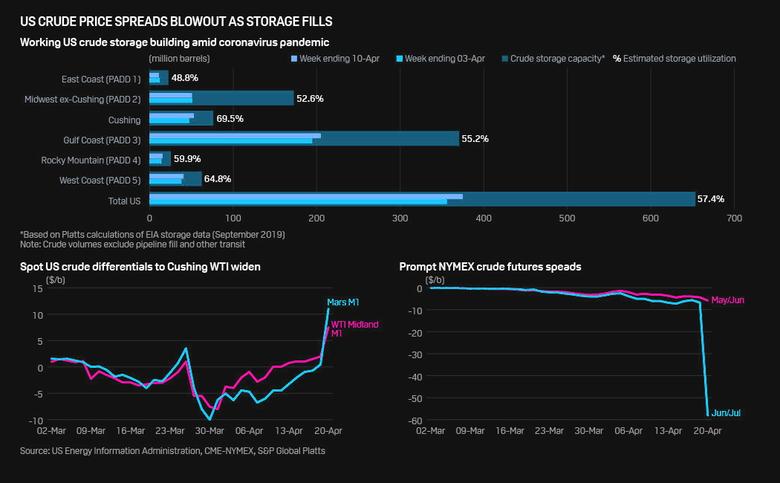

However, the prompt month decline also boosted US spot price crude spreads to Cushing WTI. For instance, heading into the afternoon the WTI price at Midland, Texas was seen traded at an $11/b premium to Cushing WTI.

Global crude inventories are up 270 million barrels year-to-date, leaving approximately 446 million barrels of onshore commercial crude ullage available before pushing up against operational capacity constraints, according to Platts Analytics data.

Storage tanks at the NYMEX crude delivery point of Cushing, Oklahoma, stood at around 70% full as of the week ending April 10, an S&P Global Platts analysis showed. Notably, these figures reflect current barrels in tank and do not account for contracted future storage.

And inventories are rising quickly. Analysts surveyed by Platts Monday are expecting US commercial crude inventories to have increased nearly 13 million barrels during the week ended April 17.

Platts Analytics is looking for US inventories to have risen roughly 24.6 million barrels last week, with 5 million barrels of that at Cushing. That would put Cushing stocks at roughly 76% of capacity.

TEXAS CONSIDERS OUTPUT CUTS

Dozens of producers in the US and Canada have announced spending and production cuts for 2020 as a result of low oil prices. However, while oil rig counts have tumbled, the impact on production so far has been minimal.

Roughly 1.3 million b/d of cuts have already been announced in the US and Canada combined. But Platts Analytics estimates that another 2.5 million b/d and 3.5 million b/d will be needed on top of that to help balance the market.

Texas energy regulators will meet Tuesday to decide if the state should impose 20% crude oil output cuts on producers to help stabilize prices.

Pure-play Permian Basin producers Pioneer Natural Resources and Parsley Energy have led the argument in favor of cuts, while a larger group of opponents have argued the free markets are working and Texas producers already are rapidly scaling back.

Monday's price action could sway the Texas Railroad Commission to favor cuts, said ClearView Energy Partners analysts.

"If nothing else, today's price seems likely to bend longstanding convictions. Last week, we would have argued that the TRRC heard testimony for ten hours because 'no' takes longer than 'yes' (savvy politicians let everybody say their piece). We now see an emergency pro-rationing measure as a viable outcome" of the meeting, the analysts said.

The price collapse may also encourage US President Donald Trump to seek deeper output cuts from OPEC and its allies.

"OPEC+ may already have intrinsic motivation to pursue deeper cuts at its June 10 meeting, and President Donald Trump might push for the group to convene even sooner," the ClearView analysts said. "We would not expect the conversation to start with military threats against the Kingdom (OPEC+ ended the oil war) or with promises to curtail federal lands production (although it could be part of a final bargain). Tariff threats seem a more likely, in our view" considering the increased volume of Saudi crude currently heading to the US.

-----

Earlier: