ASIA'S COAL DEMAND UP

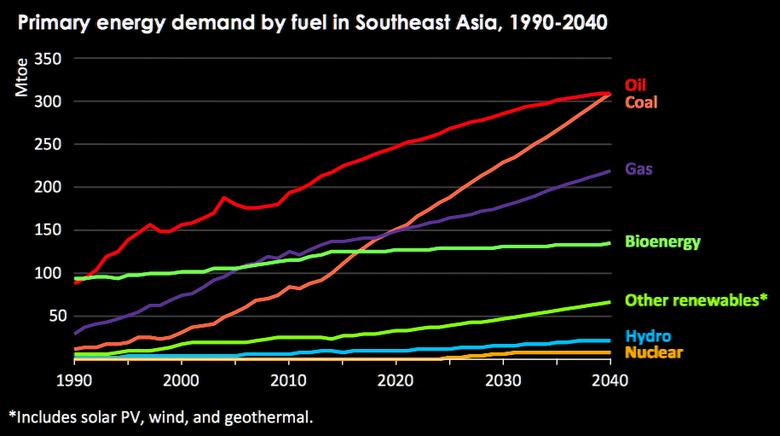

IEEFA - May 6, 2020 - The medium term outlook for thermal coal in Southeast Asia is positive. The region is likely to see a continuation of growing energy demand on the back of strong demographic trends which underpin a strong regional economic growth profile.

HOWEVER, INVESTORS AND CORPORATES SHOULD PROCEED WITH EYES WIDE OPEN to the risks of the global energy transition.

There are an increasing number of technology, economic and financial headwinds which suggest the growth profile for coal is far less certain. The global deflationary renewable energy trends make this an ever more significant competitive pressure.

And while in Asia we are witnessing the first movers to begin divesting from coal financing, global financial markets have for some time been increasingly grappling with the financial flow implications of the need to align with the Paris Agreement and contain global carbon emissions to limit warming to below 2°C.

Southeast Asia today is viewed as the last likely bastion of strong growth in coal demand globally. But just as Indian coal-fired power generation fell an entirely unprecedented 26TWh or -3% during 2019, we note expectations for sustained decades-long growth in Southeast Asian coal-fired power generation is far from a locked-in certainty.

IEEFA CAN IDENTIFY SEVEN FACTORS THAT WE EXPECT WILL MATERIALLY UNDERMINE rather optimistic forecasts of thermal coal demand growth in developing Asia, particularly at a time when the rest of the world is progressively moving in the opposite direction.

Firstly, as illustrated by the unexpected economic headwinds experienced in India during 2019 and the now likely global growth recession of 2020, economic growth moves in cycles, averaging materially below the consistent, smooth growth rates forecast by economists and power sector planners alike.

Secondly, the strong deflation evident in renewable energy tariffs globally over the last decade will likely continue at similar rates over the coming decade. Record low solar tariffs of just US$14-20/MWh have been set in countries ranging from Qatar, the UAE, Portugal, the U.S. and Brazil over the last year, at some 10-15% below previous record lows set only a year earlier in the same countries. To date, Southeast Asia has been the exception to this global rule.

With Indian wind and solar tariffs falling 50% in a single year in 2017, and Chinese solar tariffs falling 40% in 2019 alone, markets can quickly adjust to take advantage of the right government policy changes. And even where government policies are not supportive, finance can very quickly leverage this technology disruption, as Australia saw with solar tariffs dropping 70% in the three years from 2017 to average below US$30/MWh by 2019. Vietnam surprised all with a tenfold expansion in installed solar capacity in 2019 alone. And 2020/21 is likely to see a similar Vietnamese expansion in onshore wind.

A THIRD FACTOR AT PLAY ACROSS KEY GLOBAL ELECTRICITY MARKETS is the impact of policy measures to address chronic air pollution. While China has recently backed off their war on air pollution, Taiwan and South Korea have both taken up the mantle. South Korea introduced, then dramatically stepped up their coal tax, reaching US$40/t in 2019. When combined with their national emissions trading scheme seeing carbon emissions priced at US$20/t and the ongoing collapse of liquified natural gas (LNG) pricing, coal is now being priced out of the market. India has likewise legislated a retrofitting or closure policy for its existing coal power fleet, and mandated significantly tighter emissions standards for new coal builds.

The fourth factor at play is energy security. Assuming a post-pandemic return to strong emerging markets economic growth means a rapid increase in energy demand. The current collapse in LNG and oil prices is providing a short term buffer, but if sustained, will kill the economics of new supply globally.

A fifth factor is the enormous scale of opportunity to build domestic energy capacity in the form of offshore wind. Far from commercially viable in the Asian context as yet, the growth aspirations in offshore wind in Taiwan have illustrated that, on a 15 year timeframe, it could be one of the largest new power sources in markets ranging from China and Japan to India and Vietnam.

A sixth factor acting as a key facilitator in the growth aspirations of Southeast and South Asian economies from Vietnam to Pakistan, has been China ‘Going Global’, the last iteration of this strategy being the “Belt and Road Initiative” (BRI). For example, the China–Pakistan Economic Corridor was reported in 2017 to involve US$62bn of Chinese outbound investment into Pakistan alone, with the majority being directed to power generation and associated infrastructure. However, the prolonged U.S.-China trade war and now the coronavirus has redirected China’s focus inwards towards sustaining domestic economic growth. Having peaked in 2017, China’s new outbound power generation investment by its two leading development banks was down 68% yoy in 2019 to just US$2.4bn.

THE FINAL FACTOR WE IDENTIFY IS THE RAPID SHIFT IN GLOBAL FINANCIAL MARKETS away from coal mining and coal-fired power plants. IEEFA has identified 134 globally significant financial institutions across the banking, insurance and asset manager / asset owner sectors that have introduced formal coal restrictions, divestment or exclusion polices for thermal coal. This is increasingly impacting both the availability and cost of debt and equity finance globally, as well as insurance.

The impact of these movements on the thermal coal export industries of Indonesia and Australia could be profound in the long term. Future increases in coal demand in Southeast Asia look increasingly unlikely to offset the coming import declines in key markets – Japan, China, South Korea and Taiwan. Meanwhile India’s determination to increase reliance on renewables and domestic coal suggests the window of opportunity for thermal coal exporters to find new markets in South Asia has largely closed.

Southeast and South Asia are seen as the last bastion of sustained strong growth in thermal coal demand. This might provide a counter to the massive, ongoing contraction of coal demand evident across Europe and North America, and the probable plateauing of demand in China and India. However, there are a number of policy, technology, economic and financial headwinds that are building to collectively truncate these growth expectations.

-----