ASIA'S LNG CLOSING

PLATTS - 20 May 2020 - Asia's pipeline of new LNG import projects has stalled amid ongoing industry turbulence as fundamental assumptions that underpinned the projects -- gas supply, power demand and financing -- have to be recalibrated from scratch.

The projects span the Southeast Asian countries of Vietnam, the Philippines and Myanmar -- which were billed as the next batch of LNG importing countries -- and existing importers like Thailand, Malaysia, Indonesia and South Asian nations who have been expanding gas import capacity.

These projects were meant to usher in the next wave of LNG demand, based off economic growth and electricity demand projections in the pre-COVID 19 era. Most of these growth assumptions have either been totally dismantled or delayed by several years.

"It's obvious to expect delays in the short-term, [and give] time for players to figure out and adjust during this time of crisis," Christophe Malet, senior vice president for upstream and midstream LNG at Chinese gas and renewables company Hanas, said.

"Developers will need to establish how much of the initial projected demand and bankability plus financing assumptions they can still rely on," Malet said.

He said financing will become tougher in the short-term as lenders sort out their priorities in the current crisis, with the exception of some policy-driven stimulus packages.

The banking sector is among the worst hit by low oil prices and COVID-19, and S&P Global Ratings said the credit quality of Asia-Pacific financial institutions has been impacted, with its ratings outlook bias tilted firmly toward negative.

LNG projects in countries like Myanmar and Bangladesh already faced bankability issues, preventing them from backing new producers with long-term offtake agreements. This will worsen as banks reshuffle lending portfolios wary of oil and gas exposure.

Demand uncertainty

The S&P Global Ratings growth forecast for Asia Pacific in 2020 is a meager 0.3% compared to an initial forecast of 4.7%. It expects a flattish U-shaped recovery to pre-outbreak levels, if at all, in 2023; and an elongated L-shape recovery if unemployment surges.

This means energy demand destruction could stretch out several years.

"One of the biggest issues for new terminals has been uncertainties in demand. This is even more difficult to predict in our current circumstances," Daniel Reinbott, partner at law firm Ashurst, said.

Reinbott, who advises on energy projects, said even in 2019 there were no new LNG importing countries, which was remarkable given that both oversupply and low LNG prices create the ideal environment for new terminal development.

He said another demand issue suppressing terminal developments in Southeast Asia and South Asia has been insufficient take-up of regasified LNG, as the initial tranche of demand is often not sufficient for a new terminal.

"A "big bang" approach is still what is essentially required. Project economics allow little margin for demand and capacity utilization ramp-up," Reinbott said.

"Demand uncertainty and credit concerns are exacerbated right now. But these were already difficult issues to manage, particularly for emerging markets. In my view, a key challenge remains to find a suitable business model to deliver these projects," Malet said.

Low prices and opportunities

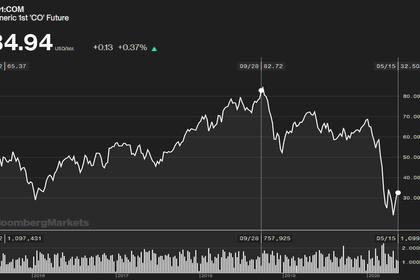

Low LNG prices could incentivize new terminals. The S&P Global Platts JKM for July was assessed at $2.317/MMBtu Tuesday, down 7.1 cents on the day.

"We know low gas prices alone are not sufficient," Hanas' Malet said.

He added cheap gas supports the case for availability and affordability but other project fundamentals need to fit together, even more so for new demand creation from other fuels' switch to gas, which requires a longer conversion cycle.

"Price differential to oil is one aspect of the economic incentive. At the current low oil prices, gas choices may be deferred, especially as they normally require infrastructure investments, which can be difficult to arrange in the current environment," Malet said.

"Fit with climate policy-driven initiatives and the project's carbon footprint need to be worked out and articulated with care," he added.

LNG has always been the marginal fuel in Asia, and with coal and oil prices hitting record lows, it is harder to build a case for a new multi-billion dollar LNG terminal. Gas still benefits from climate-based financing, but this alone is insufficient.

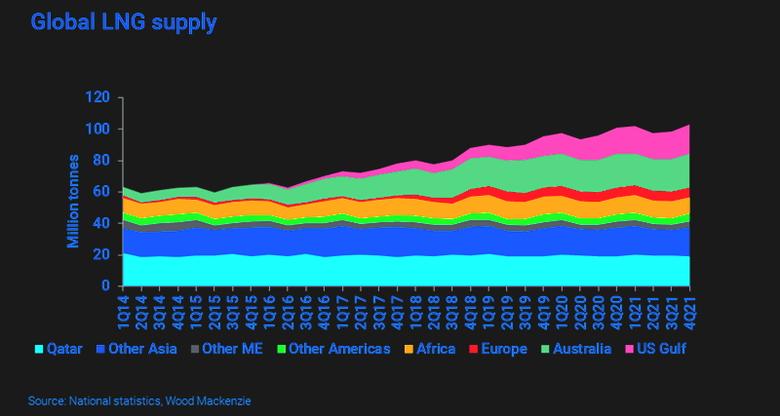

New LNG importers have other considerations. LNG supply post 2025 has become tighter as producers cancel projects, desperate for long-term contracts. This is an opportunity for buyers to negotiate on cargo and destination flexibility, and price indexation.

"Do you want cheap gas? Or do you want less volatile gas? I would argue if you're a utility, volatility is what kills you. And if you link oil prices and natural gas price, it is incredibly volatile," Vivek Chandra, chief executive of Texas LNG, said.

"So I would say this is a great opportunity for us to actually break that link as much as we possibly can," he said. "This is an opportunity for all customers to not sign long-term deals without flexibility."

This could potentially recalibrate the whole LNG market.

-----

Earlier: