CHEVRON WILL CUT 6,000 EMPLOYEES

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

CHEVRON WILL CUT 6,000 EMPLOYEES

WO - 5/27/2020 - Chevron is planning a 10% to 15% reduction in its global workforce this year, the biggest cut to headcount yet among global oil majors following the Covid-19 pandemic.

The company aims to reduce costs to ride out the worst crude-price crash in a generation. Among other big oil companies, BP Plc is reducing senior management roles ahead of a further announcement in June, while Royal Dutch Shell Plc is offering voluntary redundancies. Exxon Mobil Corp. has said it intends to cut operating costs by 15%, not including layoffs.

Chevron's cuts equate to about 6,000 of its 45,000 non-gas station employees. It's "streamlining our organizational structures to reflect the efficiencies and match projected activity levels," the San Ramon, California-based company said Wednesday in a statement. "This is a difficult decision, and we do not make it lightly."

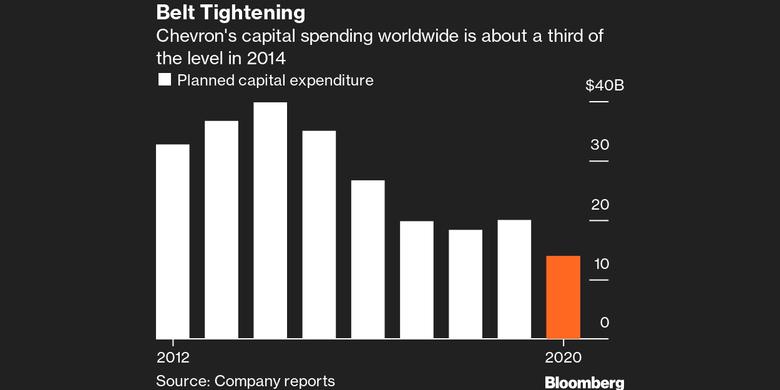

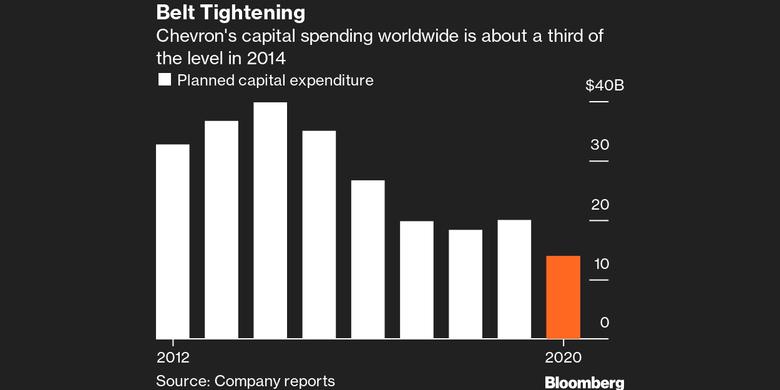

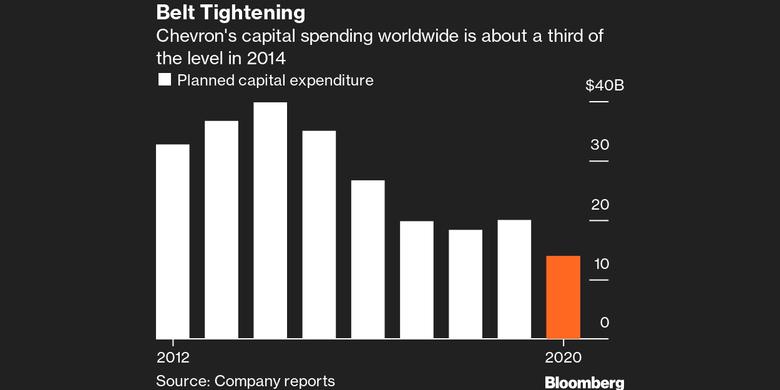

Chevron plans to strip $1 billion of operating expenses this year in addition to slashing capital spending by almost a third. Even before the pandemic, Chief Executive Officer Mike Wirth was leading a cost-cutting drive.

Job reductions will be "across the board but heavy on the corporate functions and the support functions," Chief Financial Officer Pierre Breber said in a May 1 interview. But field workers may also be affected because lower oil prices mean "lower activity levels," he said.

-----

Tags:

CHEVRON