GLOBAL OIL DEMAND WILL DOWN BY 9 MBD

OPEC - 13 May 2020 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

Crude Oil Price Movements

Crude oil prices recorded a second sharp monthly drop in April, amid an increasing oil surplus in the spot market. The OPEC Reference Basket (ORB) value plummeted by $16.26, or 48.0%, m-o-m, to $17.66/b, the lowest monthly level since December 2001. With regard to crude futures, ICE Brent declined by $7.10, or 21%, to average $26.63/b, while NYMEX WTI fell by $13.75, or 45.2%, to average $16.70/b. The contango structure of the forward curves of all crude futures benchmarks steepened further, on further worsening of global oil market fundamentals and a rapid increase in global oil inventories. Money managers firmly raised their combined futures and options net long positions in April in both ICE Brent and NYMEX WTI contracts.

World Economy

The world economy is forecast to face a recession in 2020, declining by 3.4%, following global economic growth of 2.9% in the previous year. Within the OECD, the US is forecast to contract by 5.2% in 2020, following growth of 2.3% in 2019. An even larger decline is expected in the Euro-zone, where economic activity is forecast to fall by 8.0% in 2020, compared to growth of 1.2% in 2019. Japan is forecast to contract by 5.1% in 2020, comparing to growth of 0.7% in 2019. China’s 2020 GDP is forecast to grow by 1.3%, recovering from a sharp contraction in 1Q20, and following growth of 6.1% in 2019. India is forecast to decline by 0.2%, a sharp slowdown from already weakening growth of 5.3% in 2019. Brazil’s economy is forecast to contract by 6.0% in 2020, following growth of 1.1% in 2019. Russia’s economy is forecast to contract by 4.5% in 2020, after growth of 1.3% in 2019, not only due to COVID-19, but also because of the considerable decline in oil prices.

World Oil Demand

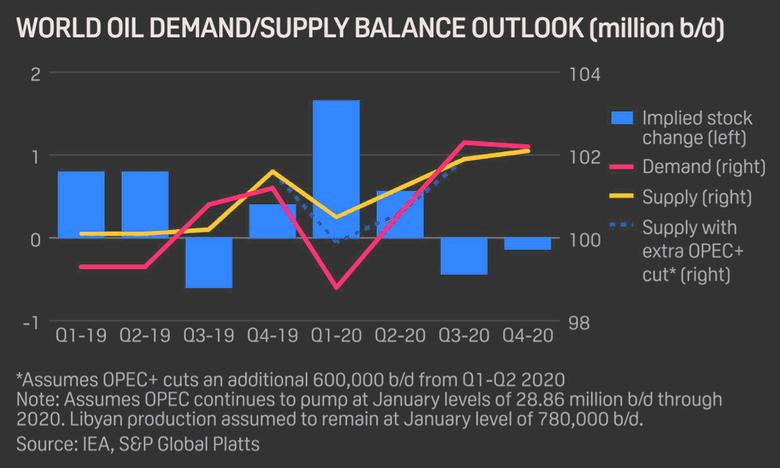

For 2019, world oil demand growth is kept broadly unchanged compared to last month’s assessment, estimated to have grown by 0.83 mb/d, y-o-y, to average 98.72 mb/d. In 2020, world oil demand growth is adjusted lower by 2.23 mb/d and is now forecast to drop by 9.07 mb/d. However, the worst contraction in major oil demand centers around the world is expected to take place in the 2Q20, mostly in OECD Americas and Europe, with transportation and industrial fuels affected the most. As such, OECD oil demand is now revised lower by 1.20 mb/d while non-OECD oil demand growth was adjusted down by 1.03 mb/d, for total oil demand to reach 90.59 mb/d. Indeed, demand contraction in 2020 can be mitigated with sooner than expected easing of government COVID-19 related measures, and faster response of economic growth to the implemented extraordinary stimulus packages.

World Oil Supply

The non-OPEC oil supply growth estimate in 2019 is now revised up slightly by 0.04 mb/d from the previous month’s assessment, due to an upward revision in Australia’s production data, and is estimated to have grown by 2.02 mb/d. For 2020, non-OPEC oil supply is revised down further by almost 2.0 mb/d from the previous projection, and is now forecast to decline by 3.5 mb/d. The main revisions of the month are based on production shut-ins or curtailment plans announced by oil companies – including the majors – particularly in North America. Globally, not including the countries participating in the Declaration of Cooperation (DoC) and as of 6 May 2020, around 3.6 mb/d of production cuts have been announced, so far, in response to the lack of demand, low oil prices, excess supply and limited storage capacity. The 2020 oil supply growth forecast for the US is revised down by 1.3 mb/d to now show a decline of 1.4 mb/d y-o-y. Other large downward revisions are undertaken for Canada and Brazil by 0.3 mb/d and 0.1 mb/d, respectively. Oil supply in 2020 is forecast to show growth only in Norway, Brazil, Guyana and Australia. OPEC NGLs production in 2019 is estimated to have grown by 0.04 mb/d to average 4.79 mb/d and for 2020 is forecast to grow by 0.04 mb/d to average 4.83 mb/d. In April, OPEC crude oil production increased by 1.80 mb/d m-o-m to average 30.41 mb/d, according to secondary sources

Product Markets and Refining Operations

Refinery margins in the Atlantic Basin rebounded in April. Deeper refinery intake cuts as well as low feedstock prices helped offset weak demand. In addition, the relaxation of confinement measures in the US and Europe amid the onset of the driving season, provided much-needed stimulus to the top of the barrel. In Asia, however, stronger product availability, as refineries increased processing rates, outpaced product inventory drawdowns amid a lack of demand from overseas, weighed on the regional product market.

Tanker Market

April was a stellar month for the tanker market with both dirty and clean rates seeing spikes during the month. Dirty freight rates peaked early in April and then trended lower, although remaining at relatively high levels. Rates were supported by a surge in tanker demand, driven by low crude prices and a need to push out excess supplies amid concerns about the availability of onshore storage capacity. Meanwhile, clean tanker rates jumped to historic highs in the middle of April, as refiners and traders looked to boosting product exports and turned to floating storage. However, rates returned to more typical levels by the end of the month. The expected voluntary and involuntary production reductions are expected to weigh on tanker demand in the coming months, although increased floating storage will provided offsetting support.

Crude and Refined Products Trade

According to preliminary data, US crude imports in April fell to 5.4 mb/d – the lowest since 1992 – while the country’s crude exports averaged 3.2 mb/d, down from a peak of 3.7 mb/d in February 2020. In March, China’s crude imports averaged 9.7 mb/d, falling below 10 mb/d for the first time in eight months. Product exports from China surged to 1.85 mb/d, the second highest level on record, led by a jump in diesel exports. India’s crude imports dipped in March to average 4.6 mb/d, impacted by the government-ordered lockdown which began toward the end of the month. India’s product exports rose 10% m-o-m, supported by an increase in diesel exports. Crude imports into Japan increased for the first time in two months, averaging 3.1 mb/d in March, while product imports and exports were slightly lower. The latest official data for OECD Europe shows crude exports continuing to fall in January, reaching 2.2 mb/d.

Commercial Stock Movements

OECD commercial oil stocks rose by 57.7 mb m-o-m in March to stand at 3,002 mb. This was 125.8 mb higher than the same time one year ago and 88.6 mb above the latest five-year average. Within components, crude stocks surged by 49.1 mb, while product stocks rose by 8.6 mb, m-o-m. In terms of days of forward cover, OECD commercial stocks surged by 8.9 days m-o-m in March to stand at 86.1 days. This was 25.1 days above March 2019, and 23.8 days above the latest five-year average. Preliminary data for April showed that US total commercial oil stocks surged by 81.1 mb m-o-m to stand at 1,395 mb. This was 136.1 mb, or 10.8%, above the same period a year ago, and 123.7 mb, or 9.7%, higher than the latest five-year average. Within components, crude stocks climbed by 47.9 mb, and product stocks rose by 33.2 mb m-o-m in April.

Balance of Supply and Demand

Demand for OPEC crude in 2019 stood at 29.8 mb/d, 1.2 mb/d lower than the 2018 level. For 2020, and following the recent agreement reached at the extraordinary OPEC and non-OPEC Ministerial Meetings in April, demand for OPEC crude is expected at 24.3 mb/d, which is 5.6 mb/d lower than the 2019 level. It is worth noting that demand for OPEC crude in 2020 remained almost the same as last month’s assessment, both considering the voluntary adjustment volumes under the Declaration of Cooperation (DoC) framework.

However, additional reductions recently announced by several OPEC member countries, above and beyond their voluntary commitments under DoC, are expected to expedite market re-balancing, and improve the demand for OPEC crude in 2020.

-----

Earlier: