INDIA'S WIND ENERGY UP

GWEC - India Wind Outlook Towards 2022

As the world's fourth-largest onshore wind market by installations, India has 37.5 GW of wind capacity as of 2019. Two fundamental drivers are in place to sustain market growth: rising energy demand and political ambition. Over the next 10 years, electricity demand is set to double in the country of 1.35 billion people.

Accordingly, India's government is targeting 175 GW of renewable energy capacity by 2022, of which 60 GW will come from wind energy, and a whopping 450 GW by 2030, of which 140 GW will be wind-based generation.

In the last decade, this scale of activity attracted multinational utilities, investors and supply chain players to India's wind market. An influx of capital and technology initiated a downward slide in prices, with levelized cost of energy (LCoE) of wind declining by 40% from 2015 to 2019. As a result, wind is now the second most cost-competitive power source on the grid after solar at INR 2.81/kWh, and priced nearly 35% lower compared to conventional fuels.

Meanwhile, project installation is deflating. Only 2.3 GW of wind capacity was installed in 2019 – nearly half of the 4.1 GW installed in 2017. While more than 17 GW of capacity has been auctioned across the country by various power purchasing agencies in last three years, nearly one-third went unsubscribed or was cancelled post-award due to various factors: stringent tender conditions; low tariff caps; off-taker risks; unavailability of grid; and/or land availability.

More than 80% of awarded projects have been delayed by 6-12 months. Clearly, steep pricing competition has come at a cost. Central government tenders have lost steam, following a decision to use the extremely low prices (INR 2.4-2.8/kWh) captured in the first six auctions as a benchmark for an upper price cap in the last two auctions. Such tariffs were not feasible to meet in the face of exhausted grid infrastructure and changes to local land use criteria for awarding new sites.

Furthermore, the seven states which manage wind procurement themselves have seen a major decline in activity. Orders by these states contracted by 60% from 2017 to 2019. Auctions are severely undersubscribed due to the offtaker risk associated with the weak financial position of state distribution companies (DISCOMs) and chronic payment delays to projects installed pre- 2017. Facing financial pressure, most of these states have moved to central auctions to hedge their payments with federal guarantees.

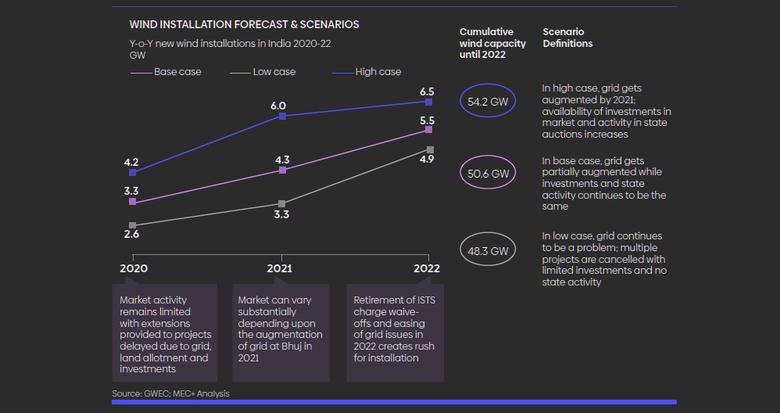

The market is expected to be lumpy in the next three years due to these supply and demand realities, adding 11-17 GW of wind-based power to the installed base. On the supply side, the time required for grid enhancement and site development will likely backload installations to around 2022. Accelerating project timelines would require more expensive land or lower-resource sites; the increased capital requirements would in turn drive wind prices upward. On the demand side, prices that exceed DISCOM-sanctioned budgets will face delays in approval.

The government must maintain realistic price expectations in future auctions and ensure the market – particularly at state level – is sufficiently liquid.

Efforts by the government to lower barriers around pricing, grid and land infrastructure must be intensified, in order to revive auction appetite and resolve the execution challenges facing India’s wind market.

-----