MALAYSIA'S PETRONAS PROFIT 68% LOWER

PETRONAS - Kuala Lumpur, 22 May 2020 – PETRONAS today announced its financial results for the first quarter ended 31 March 2020, amid challenging market conditions and plummeting oil prices, coupled with shrinking global oil demand due to the COVID-19 pandemic and the risk of ongoing economic uncertainty.

As the industry outlook continues to be marred by prolonged volatility, the Group remains focused in strengthening its resilience to weather the downward cycle while not losing sight of its long-term plans to ensure PETRONAS’ future sustainability.

Tan Sri Wan Zulkiflee Wan Ariffin, President and Group Chief Executive Officer, PETRONAS

“We anticipate a very challenging outlook for the rest of 2020, with economic activities expected to only gradually recover in the second half of the year. Industry players, including PETRONAS, will be adversely impacted if the current market situation persists and oil prices remain low.

Against this challenging backdrop, our focus is to preserve cash and maintain our liquidity, continue our cost compression efforts and respond to changing market conditions with pace. We will also continue to uphold the health and safety of our people and communities where we operate as well as contribute towards efforts in overcoming the global pandemic.

In the longer term, we remain committed to our 3-pronged growth strategy to maximise cash generators, expand core business, and stepping out to future proof the organisation and ensure PETRONAS’ long-term sustainability.”

First Quarter 2020 Results

For the first quarter ended 31 March 2020, the Group recorded a revenue of RM59.6 billion, a 4.0 per cent decrease from RM62.0 billion in the same period last year, mainly attributable to the impact of lower average realised prices recorded for LNG, petroleum products and crude oil & condensates. The decrease was partially offset by the impact of higher sales volume mainly for petroleum products coupled with the effect of the weakening Ringgit against the US Dollar exchange rate.

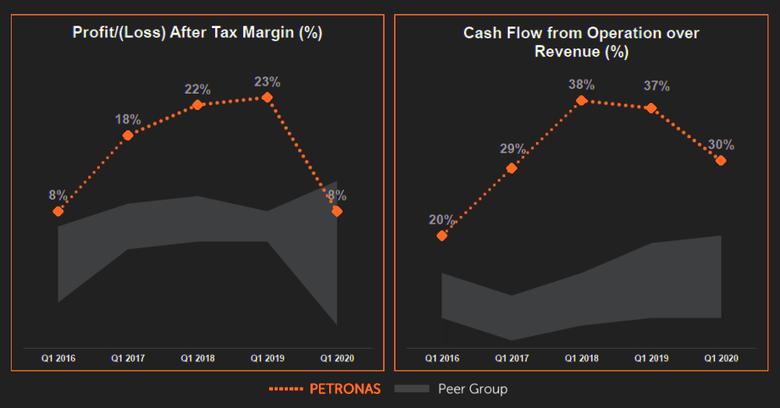

Profit After Tax (PAT) for the quarter stood at RM4.5 billion, 68 per cent lower than the RM14.2 billion posted in the corresponding quarter in the previous year, primarily due to net impairment on assets and lower revenue recorded. However, these were partially offset by lower tax expenses.

PAT excluding impairment, however, stood at RM9.2 billion, a 35 per cent decrease from RM14.1 billion compared to the first quarter last year.

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) dropped 27 per cent to RM20.3 billion from RM27.8 billion in the corresponding quarter last year, in line with lower Profit Before Tax (PBT).

Cash flows from operating activities for the first quarter of 2020, decreased by 24 per cent as compared to the first quarter of 2019 mainly due to lower cash operating profit and net negative working capital changes partially offset by lower taxation paid.

Total assets increased to RM630.0 billion as at 31 March 2020, compared to RM622.4 billion recorded as at 31 December 2019, mainly due to higher capital expenditure and the effect of the weakening Ringgit against the US Dollar exchange rate.

As at 31 March 2020, shareholders’ equity decreased to RM374.1 billion compared to RM389.1 billion as at 31 December 2019, primarily contributed by the final dividend declared for the financial year ended 31 December 2019. This was partially offset by profit generated during the period and an increase in foreign currency translation reserve due to the effect of the weakening Ringgit against the US Dollar exchange rate.

Return on Average Capital Employed (ROACE) decreased to 6.6 per cent as at 31 March 2020, from 8.7 per cent as at 31 December 2019, in line with the lower profit recorded.

Gearing ratio increased marginally to 19.9 per cent as at 31 March 2020 from 19.4 per cent, as at 31 December 2019, mainly due to higher borrowings following the impact of the weakening Ringgit against the US Dollar exchange rate.

The Group’s capital investment during the first quarter of 2020 was RM8.5 billion, mainly attributable to Upstream projects.

-----

Earlier:

2019, September, 20, 15:00:00

PETRONAS PROFIT UP 9% ANEW

Petronas Profit After Tax (PAT) rose 9.0 per cent to RM28.9 billion, from RM26.6 billion in the corresponding period last year. The improved results were delivered on the back of higher revenue, but the increase was partially offset by higher product costs.

|

2019, May, 31, 12:05:00

PETRONAS PROFIT UP 9%

First quarter Profit After Tax (PAT) stood at RM14.2 billion, up by 9 per cent on the back of higher revenue, but partially offset by increased net product and production costs, lower net write-back of assets impairment and higher contribution to the National Trust Fund.

|

2019, March, 13, 10:35:00

PETRONAS PROFIT UP TO RM55.3 BLN

PETRONAS’ Profit after Tax (PAT) rose by 22 per cent in 2018, to RM55.3 billion, compared to RM45.5 billion in 2017, on the back of higher revenue and supported by net write-back of impairment on assets. These were partially offset by higher net product and production costs, depreciation and amortisation as well as tax expenses.

|