OIL GAS INVESTMENT DOWN $85 BLN

GLOBALDATA - 04 May 2020 - To protect balance sheets, maintain shareholder pay-outs and preserve cash, oil and gas companies have gone into survival mode, reducing forecast expenditure where possible to weather the impacts of COVID-19 and oil market volatility, says GlobalData, a leading data and analytics company.

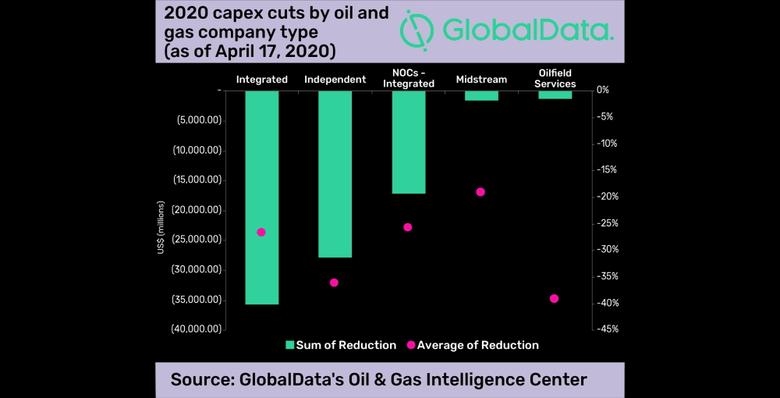

Daniel Rogers, Oil and Gas Analyst at GlobalData, comments: "The bearish near-term outlook for the industry has forced many companies to reassess their forward expenditure. To date, more than US$85bn has been cut from over 100 companies across the industry. These measures have been taken to survive the unparalleled market uncertainty and it is likely that more companies will follow in the near term."

Integrated oil and gas companies have reported the largest volume of capex reductions for 2020. Significant capital reductions have been seen in upstream operations, particularly for US shale drilling but also for global exploration budgets, and unsanctioned developments. The cut announcements continued throughout April, with Exxon Mobil recently reducing 2020 capex by 30%, with the Permian Basin accounting for the largest share of the cut. Additionally, major midstream projects such as expanding and new-build liquefied natural gas (LNG) facilities, including Pluto Train 2 and Rovuma LNG, have been deferred until market conditions improve.

Rogers continues: "The severity of investment cuts in the sector varies across the value chain with midstream-focused companies generally sacrificing less of their original budgets. This is likely attributable to the relatively higher level of protection that the midstream sector offers players (particularly for pipeline operators) during periods of oil price volatility, since cash flow is less dependent on commodity prices and more dependent on supply volumes."

Although not all members of the oil field service group have announced exact capex revisions for 2020, the gravity is clear. The group holds the highest average reduction percentage, albeit at a far lower volume. Coming into 2020 service costs were already beaten down by the previous downturn in 2014/2015 and the latest developments deal another blow to an already struggling segment. Globally, drops in drilling, and exploration and development spending will have a knock on impact for the oil field service providers.

Rogers concludes: "The uncertainty of the duration of the economic impact stemming from the spread of COVID-19, makes it difficult to gauge whether further cuts will be required. The magnitude of the current cuts are likely to have hard-hitting reverberations in the medium to longer term. Companies which seek to preserve financial stability in the immediate term risk longer term implications for production, revenues, and strategic targets."

-----