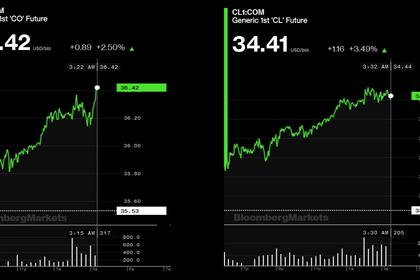

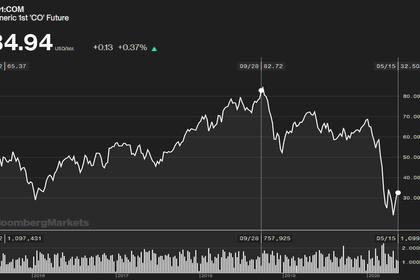

OIL PRICE: ABOVE $35

REUTERS - MAY 27, 2020 - Oil prices fell on Wednesday after U.S. president Donald Trump said he was working on a strong response to China's proposed security law in Hong Kong.

A potential deterioration in relations between the world's two biggest economies could ratchet up the pressure on global businesses and oil demand already weakened by the coronavirus pandemic.

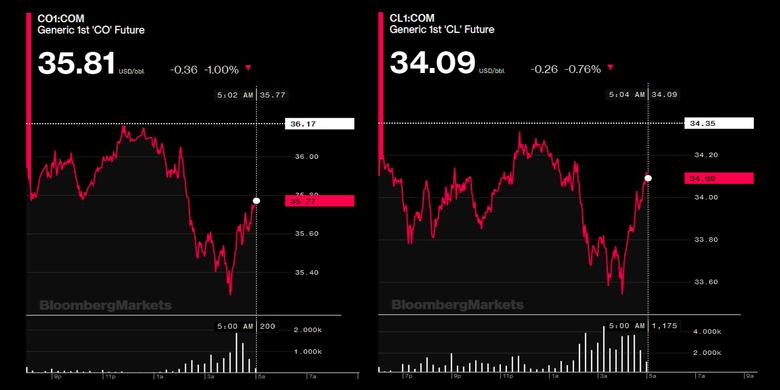

Brent crude fell 53 cents, or 1.5%, to $35.64 by 0827 GMT and U.S. West Texas Intermediate (WTI) crude was down 50 cents, or 1.5%, at $33.85.

"Simmering U.S.-China tensions added pressure on crude again," said Avtar Sandu, senior manager commodities at Phillip Futures.

Gloomy forecasts over the economic impact of the pandemic also weighed on crude prices.

The euro zone economy is likely to shrink between 8% and 12% this year, European Central Bank President Christine Lagarde said, warning that a mild scenario is already outdated and the outcome would be between the medium and severe.

Traders were also paying attention to early signals on a meeting between the Organization of the Petroleum Exporting Countries (OPEC) and its allies in less than two weeks.

The group known as OPEC+ is cutting output by nearly 10 million barrels per day (bpd) in May and June, but the question is whether it will continue to do so as demand recovers after the easing of coronavirus lockdowns in many countries.

“Stock builds are falling and the market will be balanced in June, so who wants to willingly forego millions of crude barrels in sales if he’s able to sell it in a recovering market,” said Rystad Energy’s head of oil markets, Bjornar Tonhaugen.

U.S. crude inventories are forecast to have fallen for a third week last week, according a Reuters poll of analysts.

Global energy investment is expected to fall by about 20%, or $400 billion, this year because of the coronavirus outbreak, the International Energy Agency (IEA) said on Wednesday.

-----

Earlier: