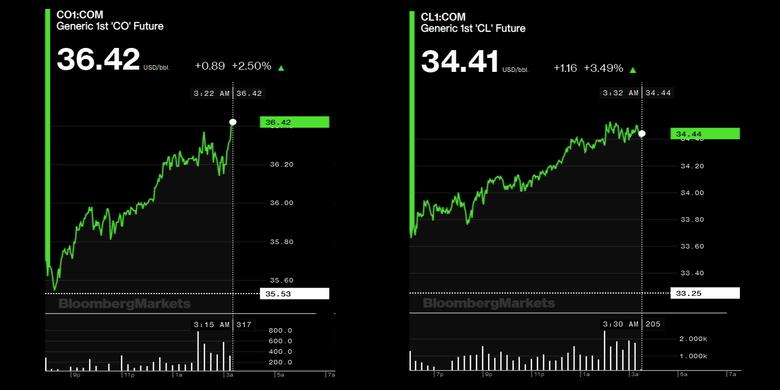

OIL PRICE: ABOVE $36

REUTERS - MAY 26, 2020 - Oil prices rose on Tuesday, supported by growing confidence in the market that producers will come good on commitments to cut crude supply while demand picks up with more cars back on the road as coronavirus lockdowns eased around the world.

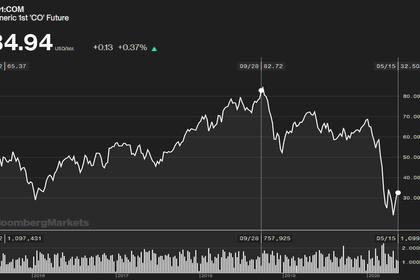

U.S. West Texas Intermediate (WTI) crude futures gained 3.4%, or $1.12, to $34.37 a barrel as of 0652 GMT, just off an intra-day high of $34.54.

There was no WTI settlement on Monday because of the U.S. Memorial Day holiday.

Brent crude futures were up nearly 1.7%, or 61 cents to $36.14, adding to a 1.1% gain on Monday in thin holiday trading.

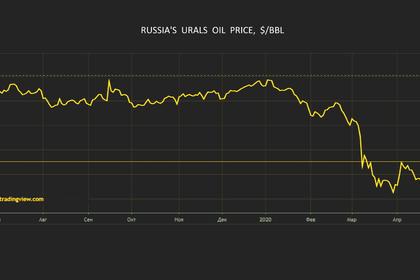

The market was buoyed by comments from Russia reporting its oil output had nearly dropped to its target of 8.5 million barrels per day (bpd) for May and June under its supply cut deal with the Organization of the Petroleum Exporting Countries (OPEC) and other leading producers, a grouping known as OPEC+.

"There's definitely a feeling those cuts have come through as well as you could expect," said Daniel Hynes, senior commodity strategist at Australia and New Zealand Banking Group.

OPEC+ countries are set to meet again in early June to discuss maintaining their supply cuts to shore up prices, which are still down around 45% since the start of the year. The big producers agreed in April to cut output by nearly 10 million bpd for May and June.

Russia’s energy ministry on Monday quoted minister Alexander Novak as saying a rise in fuel demand should help cut the current global surplus of around 7-12 million bpd by June or July.

“With economies restarting, the focus definitely is on the improvement in the fundamentals, rather than what seemed like a complete collapse in demand only a few weeks ago,” said strategist Hynes.

Meanwhile data from energy services firm Baker Hughes (BKR.N) showed the United States’ rig count hitting a record low of 318 in the week to May 22, also indicating lower output in the future.

-----

Earlier: