OIL PRICE: NEAR $30 YET

REUTERS - MAY 14, 2020 - Oil prices rose on Thursday after a drop in U.S. crude stocks and an IEA forecast for lower global stockpiles in the second half, but the Brent benchmark still hovered around $30 a barrel as a weak demand picture curbed gains.

Brent crude futures were up $1.17, or 4%, at $30.36 per barrel at 1056 GMT.

U.S. West Texas Intermediate (WTI) crude futures were$1.1, or 4.4%, higher at $26.39 per barrel.

Prices have ticked up in the last two weeks as some countries relaxed coronavirus restrictions and lockdowns to allow factories and shops to reopen.

However the emergence of new cases in South Korea and China has raised concerns over a possible second wave of infections that would weigh on economic recovery and fuel demand.

U.S. Federal Reserve Chairman Jerome Powell warned on Wednesday of an "extended period" of weak economic growth.

Providing some bullish impetus, U.S. crude inventories fell for the first time in 15 weeks.

U.S. crude stockpiles were down by 745,000 barrels to 531.5 million barrels in the week to May 8, the Energy Information Administration said on Wednesday.

"Cash markets are strengthening, time spreads are tighter and physical demand is picking up. All these will provide price supports in the next few weeks, but this confidence will not last," PVM said in a report.

Physical crude prices, including in the North Sea which is home to the Brent crude stream, have been climbing [CRU/E] and the six-month Brent futures contango is at its shallowest in two months at around -$3.50 a barrel.

But any recovery is seen as too weak to erase a historic demand fall this year.

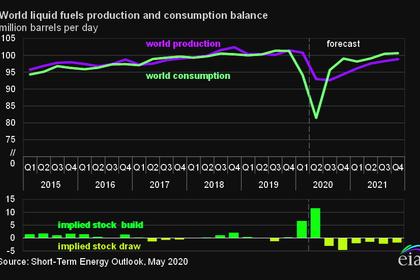

The International Energy Agency (IEA) on Thursday again forecast a record drop in demand in 2020, although it trimmed its estimate of the fall, citing easing lockdown measures.

As demand increases, the IEA expects crude stockpiles to shrink by around 5.5 million barrels per day in the second half.

Goldman Sachs said recovering demand and lower output would push the global oil market into deficit in June. However it maintained its summer price forecasts of $30 per barrel for Brent and $28 per barrel for WTI.

The Organization of the Petroleum Exporting Countries (OPEC) said on Wednesday it expected 2020 global oil demand to shrink by 9.07 million bpd, a deeper contraction than its previous forecast of 6.85 million bpd.

It said it expected the second quarter to see the steepest decline in demand.

-----

Earlier: