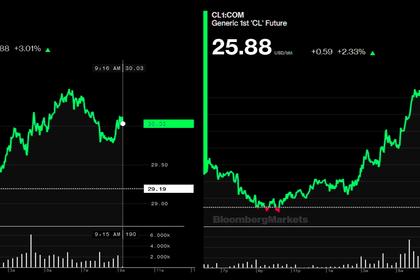

OIL PRICE: NEAR $32

REUTERS - MAY 15, 2020 - Oil prices jumped more than 3% on Friday, touching more than one-month highs amid signs that demand for crude was picking up with China reporting increased refinery runs, and rounding out a week of bullish news on the supply front.

Brent crude was up $1.21 cents, or 3.9% at $32.34 a barrel by 0707 GMT, after touching $32.44 the highest since April 14. Brent rose nearly 7% on Thursday and is heading for a 3% gain for the week after rising the previous two weeks.

West Texas Intermediate (WTI) oil was up 92 cents, or 3.3%, at $28.48 a barrel after reaching $28.54, the highest since early April. WTI jumped 9% in the previous session and is also heading for a third weekly increase, up about 15%.

Amid supply cuts by the Organization of the Petroleum Exporting Countries (OPEC) and other major producers, bright spots are also emerging on the demand side. Data released on Friday showed China’s daily crude oil use rebounded in April as refineries ramped up operations.

The market mood remains less than euphoric, though, with the coronavirus pandemic far from over and new clusters emerging in some countries where lockdowns have been eased.

“Market forces have aligned producers around the world to support fundamentals, and demand is increasingly showing signs of having troughed,” Barclays analyst Amarpreet Singh said in a note.

“However, the sheer size and speed of the disruption and associated inventory overhang will take time to get fully absorbed, in our view,” he said.

Barclays still raised its forecasts for Brent and WTI by $5-$6 a barrel for 2020 and by $16 a barrel for 2021.

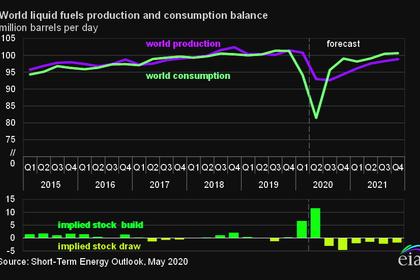

The International Energy Agency said it expects global crude inventories to fall by about 5.5 million barrels per day (bpd) in the second half of this year.

Meanwhile U.S. crude inventories fell after 15 weeks of declines, the Energy Information Administration said on Wednesday.

Output cuts will boost the trend towards lower inventories, but U.S. crude is unlikely to see strong gains.

“WTI crude will struggle to break above the $30 level until both the economic outlook improves for the U.S. and some of the downside risks ease,” said Edward Moya, senior market analyst at OANDA.

On the production side, OPEC and associated producers - collectively known as OPEC+ - had already agreed to cut output by a record of nearly 10 million bpd before Saudi Arabia this week extended its planned reductions for June, pledging to lower supply by nearly 5 million bpd.

Saudi Aramco, the world’s largest oil exporter, reduced the volume of crude it will supply to at least three buyers in Asia by as much as 30% for June, three sources with knowledge of the matter told Reuters on Thursday.

OPEC+ now wants to extend overall production cuts beyond May and June when the group next meets, sources told Reuters earlier this week.

-----

Earlier: