2020-05-13 12:45:00

OIL PRICES 2020-21: $34-$48

U.S. EIA - May 12, 2020 - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

- Although all market outlooks are subject to many risks, the May edition of EIA’s Short-Term Energy Outlook remains subject to heightened levels of uncertainty because the effects on energy markets of mitigation efforts related to the 2019 novel coronavirus disease (COVID-19) are still evolving. Reduced economic activity related to the COVID-19 pandemic has caused significant changes in energy supply and demand patterns. Crude oil prices, in particular, have fallen significantly since the beginning of 2020, largely driven by reduced oil demand because of COVID-19 mitigation efforts. Despite the April agreement between the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+) to reduce production levels beyond the end of the STEO forecast period, crude oil prices have remained at some of their lowest levels in more than 20 years. Uncertainties persist across EIA’s outlook for other energy sources, including natural gas, electricity, coal, and renewables.

- Brent crude oil prices averaged $18 per barrel (b) in April, a decrease of $13/b from the average in March. EIA forecasts Brent crude oil prices will average $34/b in 2020, down from an average of $64/b in 2019. EIA expects prices will average $23/b during the second quarter of 2020 before increasing to $32/b during the second half of the year. EIA forecasts that Brent prices will rise to an average of $48/b in 2021, $2/b higher than forecast last month, as EIA expects that declining global oil inventories next year will put upward pressure on oil prices.

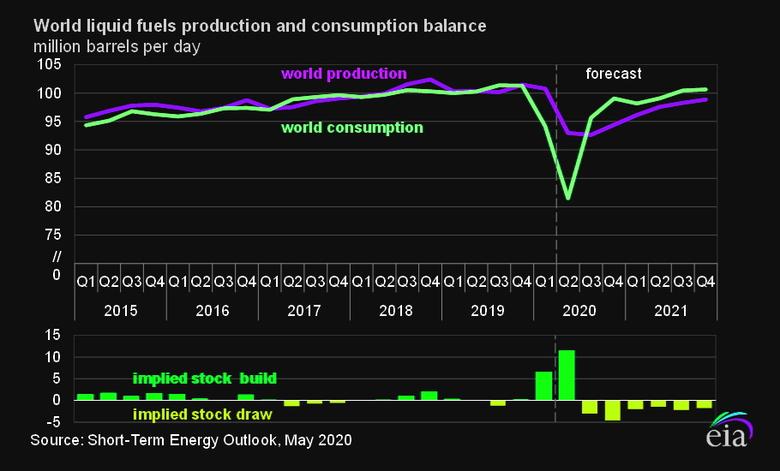

- EIA estimates global petroleum and liquid fuels consumption averaged 94.1 million barrels per day (b/d) in the first quarter of 2020, a decline of 5.8 million b/d from the same period in 2019. EIA expects global petroleum and liquid fuels demand will average 92.6 million b/d in 2020, a decrease of 8.1 million b/d from last year, before increasing by 7.0 million b/d in 2021. Lower global oil demand growth for 2020 in the May STEO reflects growing evidence of disruptions to global economic activity along with reduced expected travel globally as a result of restrictions related to COVID-19.

- EIA expects that global liquid fuels inventories will grow by an average of 2.6 million b/d in 2020 after falling by 0.2 million b/d in 2019. EIA expects inventory builds will be largest in the first half of 2020, rising at a rate of 6.6 million b/d in the first quarter and increasing to builds of 11.5 million b/d in the second quarter as a result of widespread travel limitations and sharp reductions in economic activity. Firmer demand growth as the global economy begins to recover and slower supply growth will contribute to global oil inventory draws beginning in the third quarter of 2020. EIA expects global liquid fuels inventories will fall by 1.9 million b/d in 2021.

- EIA forecasts significant decreases in U.S. liquid fuels demand during the first half of 2020 as a result of COVID-19 travel restrictions and disruptions to business and economic activity. EIA expects the largest impacts will occur in the second quarter of 2020 before gradually dissipating over the next 18 months. EIA expects U.S. motor gasoline consumption to fall from 8.6 million b/d in the first quarter of 2020 to an average of 7.0 million b/d in the second quarter before gradually increasing to 8.7 million b/d in the second half of the year. U.S. jet fuel consumption will fall from 1.6 million b/d in the first quarter of 2020 to an average of 0.8 million b/d in the second quarter. U.S. distillate fuel oil consumption is forecast to decline by 0.6 million b/d to average 3.3 million b/d during the same period. For all of 2020, EIA forecasts that U.S. motor gasoline consumption will average 8.3 million b/d, a decrease of 11% compared with 2019, while jet fuel and distillate fuel oil consumption will fall by 25% and 10%, respectively, during the same period.

- EIA has revised its current forecast of domestic crude oil production down from the April STEO as a result of lower crude oil prices. EIA forecasts U.S. crude oil production will average 11.7 million b/d in 2020, down 0.5 million b/d from 2019. In 2021, EIA expects U.S. crude oil production to decline further by 0.8 million b/d. If realized, the 2020 production decline would mark the first annual decline since 2016. U.S. crude oil production has not declined for two years in a row since the 17-year period of declines beginning in 1992 and running through 2008. Typically, price changes affect production after about a six-month lag. However, current market conditions will likely reduce this lag as many producers have already announced plans to reduce capital spending and drilling levels.

Natural gas

- In April, the Henry Hub natural gas spot price averaged $1.73 per million British thermal units (MMBtu). EIA forecasts that natural gas prices will generally rise through the rest of 2020 as U.S. production declines. EIA forecasts that Henry Hub natural gas spot prices will average $2.14/MMBtu in 2020 and then increase in 2021, reaching an annual average of $2.89/MMBtu. EIA expects prices to rise largely because of lower natural gas production compared with 2020.

- EIA expects total consumption of natural gas to average 81.7 billion cubic feet per day (Bcf/d) in 2020, down 3.9% from the 2019 average primarily because of lower industrial sector consumption of natural gas. EIA forecasts industrial natural gas consumption to average 21.3 Bcf/d in 2020, down 7.1% from 2019 as a result of lower expected manufacturing activity. This expected decline is lower than the 0.3% decline forecast in the April STEO because of large downward revisions to the macroeconomic forecast in the May STEO.

- U.S. dry natural gas production set a record in 2019, averaging 92.2 Bcf/d. EIA forecasts dry natural gas production will average 89.8 Bcf/d in 2020, with monthly production falling from an estimated 93.1 Bcf/d in April to 85.4 Bcf/d in December. Natural gas production declines the most in the Appalachian region and Permian region. In the Appalachian region, low natural gas prices are discouraging producers from engaging in natural gas-directed drilling, and in the Permian region, low oil prices reduce associated gas output from oil-directed wells. In 2021, forecast dry natural gas production averages 84.9 Bcf/d, rising in the second half of 2021 in response to higher prices.

- EIA estimates that total U.S. working natural gas in storage ended April at 2.3 trillion cubic feet (Tcf), 20% more than the five-year (2015–19) average. In the forecast, inventories rise by 2.1 Tcf during the April through October injection season to reach almost 4.2 Tcf on October 31, which would be a record level.

- EIA forecasts that U.S. liquefied natural gas exports will average 5.8 Bcf/d in the second quarter of 2020 and 4.8 Bcf/d in the third quarter of 2020. U.S. liquefied natural gas exports are expected to decline through the end of the summer as a result of lower expected global demand for natural gas.

Electricity, coal, renewables, and emissions

- Although some stay-at-home orders are beginning to be relaxed, the effects of social distancing guidelines are likely to continue affecting U.S. electricity consumption during the next few months. EIA expects retail sales of electricity in the commercial sector will fall by 6.5% in 2020 because many businesses have closed and many people are working from home. Similarly, EIA expects industrial retail sales of electricity will fall by 6.5% in 2020 as many factories cut back production. Forecast U.S. sales of electricity to the residential sector fall by 1.3% in 2020 because of lower electricity demand as a result of milder winter and summer weather, which is offset slightly by increased household electricity consumption as much of the population spends relatively more time at home.

- EIA forecasts that total U.S. electric power sector generation will decline by 5% in 2020. Most of the expected decline in electricity supply is reflected in lower fossil fuel generation, especially at coal-fired power plants. EIA expects that coal generation will fall by 25% in 2020. Forecast natural gas generation is relatively flat this year, reflecting favorable fuel costs and the addition of new generating capacity. Renewable energy sources account for the largest portion of new generating capacity in 2020, driving EIA’s forecast of 11% growth in renewable generation by the electric power sector. Renewable energy is typically dispatched whenever it is available because of its low operating cost.

- Although EIA expects renewable energy to be the fastest-growing source of electricity generation in 2020, the effects the economic slowdown related to COVID-19 are likely to affect new generating capacity builds during the next few months. EIA expects the electric power sector will add 20.4 gigawatts of new wind capacity and 12.7 gigawatts of utility-scale solar capacity in 2020. However, these forecasts are subject to a high degree of uncertainty, and EIA will continue to monitor reported planned capacity builds.

- EIA forecasts U.S. average coal consumption will decrease by 23% to 453 MMst in 2020. The decrease is primarily driven by a 24% decline in electric power sector consumption and persistently low natural gas prices. In 2021, consumption is expected to increase by 10% to 498 MMst because of stronger natural gas prices and an overall economic recovery that results in rising electricity generation.

- After decreasing by 2.8% in 2019, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decrease by 11% (572 million metric tons) in 2020. This record decline is the result of restrictions on business and travel activity and slowing economic growth related to COVID-19. CO2 emissions decline from all fossil fuels, particularly coal (23%) and petroleum (11%). In 2021, EIA forecasts that energy-related CO2 emissions will increase by 5% as the economy recovers and stay-at-home orders are lifted. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2020, May, 12, 14:50:00

OIL PRICE: ABOVE $30

Brent advanced 85 cents, or 2.9%, to $30.48, WTI were up $1.29, or 5.3%, at $25.43.