QATAR'S LNG PRODUCTION: NO WAY

PLATTS - 21 May 2020 - Qatari energy minister Saad al-Kaabi said Thursday there was "absolutely no way" Qatar would cut its LNG production despite reduced demand and low global gas prices.

Speaking during a US-Qatar Business Council webinar, Kaabi said if Qatar stopped selling LNG because of cost, "that means there is something drastically wrong in the LNG market."

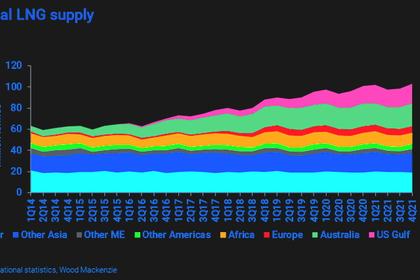

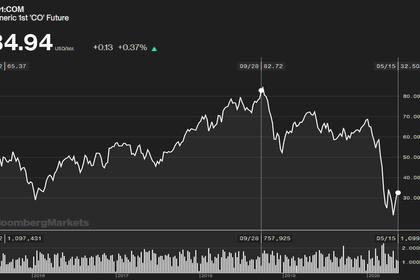

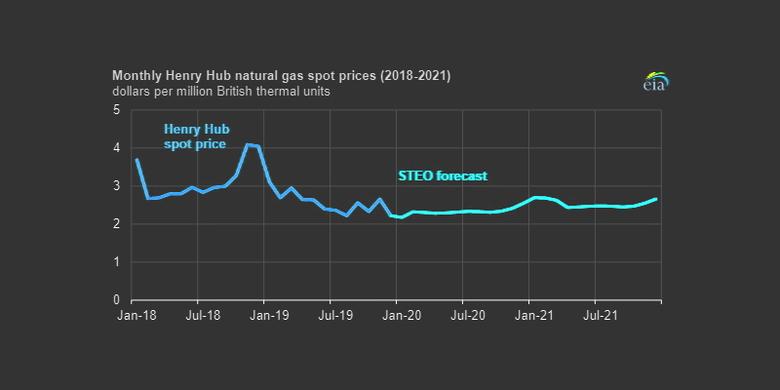

Global gas prices have plunged to record lows in the past weeks due to an oversupplied market and reduced demand due in part to the coronavirus pandemic.

Kaabi said it would be "the most expensive" producers that would be forced out of the market first. He said "a whole bunch" of other producers would have to shut in their LNG production before Qatar, given its low-cost production.

"We are the cheapest LNG producer -- from an efficiency point of view and from a cost of production point of view -- in the world," Kaabi said. "If a lot of people stopped their production, we'd probably get a better price boost," he said. "There is absolutely no way we would be reducing production."

Kaabi acknowledged that prices were very low because of the coronavirus.

"Prices have been at a level that is too low for anybody," he said. But Qatar would be "very low in the pecking order" for feeling the price pain. "I'm not worried about gas at all," he said.

Kaabi even said that cutting prices to defend market share was "something you could do."

CAPACITY EXPANSION

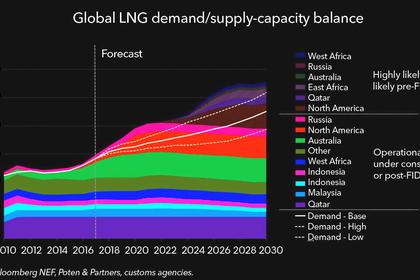

Kaabi also said plans to expand the country's LNG production capacity from 77 million mt/year to 110 million mt/year by 2025 and to 126 million mt/year by 2027 were moving "full steam ahead."

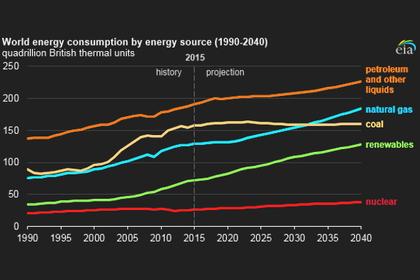

"We're in for the long haul," he said, adding he was "still confident" in the long-term view of the market.

Qatar could even expand its production capacity further, Kaabi said.

"There is room to go above 126 [million mt/year]," he said. "You might hear us in a few years go higher, we have plenty of gas to do that."

Kaabi said the technical bids had been received for the main contractor for the expansion, but commercial bids -- which had been expected in April -- had been pushed back by three-four months after bidders asked for a delay.

Bids should be submitted in September or October, he said, adding that Qatar was "on schedule" to award all the contracts by the end of 2020.

Kaabi added that he was not concerned about the impact of low prices now on the Golden Pass LNG export plant Qatar is developing with ExxonMobil in Texas.

"The way we have structured Golden Pass and our portfolio, we're not worried at all," he said. "More gas out of the US is going to be good for us.:

Kaabi said single US LNG export developments by single players would be most at risk. "In rough markets they're not going to make it," he said. Instead, it would be players with a global portfolio and an integrated gas business that would benefit from exporting US gas, he said.

Kaabi also downplayed the role of LNG in the European gas market, saying it was just a "droplet" compared to gas supplies from Russia and other pipeline exporters. "[LNG] is a very small amount," he said, adding that storing LNG was very expensive compared to pipeline gas.

Pipelines were also a "great place" for storing gas in Europe given the vast network, Kaabi said.

"It is not storage exactly, but it gives you a little bit more room for manoeuver," he said, adding that with LNG, "you don't have that luxury."

Kaabi said he could not foresee a situation "where you have supply that much overriding demand," saying that gas markets were faring better than oil given the different uses of the fuel.

OIL DEMAND RECOVERY

In contrast to gas, Kaabi said he saw the global oil market taking up to two years for demand to return to pre-pandemic levels, with the aviation industry likely to suffer for a while.

"The market is not going to be good for some time, especially for liquid fuels," Kaabi said. "With jet fuel, you're going to have a lot of businesses not having people travel as much."

Qatar Petroleum itself was having 80% of its employees working from home and seeing no loss in productivity due to technological tools, such as videoconferencing, he added.

"Technology is going to help people stay home because it works," Kaabi said. "The airline industry is in trouble for a long time. That entails jet fuel and refineries and all that. You won't have the demand you thought you would."

Kaabi also took another shot at OPEC, the oil producer bloc that Qatar quit at the end of 2018, citing its lack of clout as a smaller member and its gas ambitions.

OPEC in March and April had flooded the oil market after it failed to agree with Russia on new production quotas, exacerbating the global supply glut caused by the coronavirus-induced demand collapse.

OPEC, Russia and several other allies did manage to regroup and forge a historic new production cut accord in late April calling for 9.7 million b/d in supply curbs for May and June, but Kaabi said the damage had been done.

"The entire industry got hit in a big way," he said. "Even the players trying to flood the market immediately realized they got too deep. It's a little bit too late, and will take much longer than people expected because of the COVID and quarantines and so on.

"With what we've seen happen recently," he added, "I'm happy we are out of OPEC."

-----

Earlier: