RUSSIA'S DEBT WILL UP

REUTERS - MAY 6, 2020 - Russia plans to dig deeper into its rainy day fund and to double state borrowings this year as it expects a 5% fall in gross domestic product (GDP), Finance Minister Anton Siluanov told the Vedomosti business daily.

Russia, which has overtaken France and Turkey in the number of confirmed coronavirus cases, currently at over 155,000, has been largely on a lockdown since late March, which along with weak oil prices is hurting the domestic economy.

Siluanov told Vedomosti that Russian budget revenues are expected to fall 4 trillion roubles below expectations. Lower oil and gas revenues will account for a reduction of around 1.5 trillion roubles. As a result, this year's budget deficit is expected to hit 4% of GDP.

Russia ran a budget surplus of 1.8% of gross domestic product last year and was expecting a 2020 budget surplus of 0.8% of GDP.

To compensate for the lost revenue and to meet its social obligations, Russia will use more funds from the National Wealth Fund (NWF), Siluanov said, as well as proceeds from the recent sale of a stake in Sberbank (SBER.MM). It will also increase state borrowings.

Last month, the finance ministry used the NWF funds to buy a controlling stake in Sberbank from the central bank but the bulk of these proceeds, under the deal, are to be returned to state coffers.

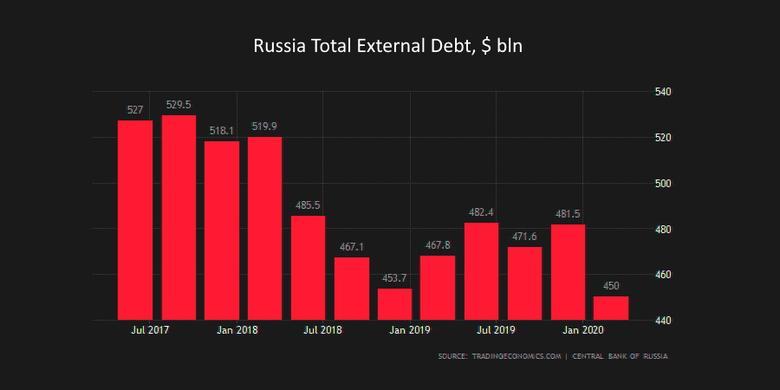

“We do not want to spend much from the NWF, it would not be right to spend it in two years,” he told Vedomosti, adding that the finance ministry plans to raise between 4 trillion roubles and 4.5 trillion roubles ($54.4-$61.2 billion) in debt this year.

Before the coronavirus outbreak, Russia planned to raise 2.3 trillion roubles in rouble OFZ bonds and up to $3 billion in Eurobonds this year.

-----