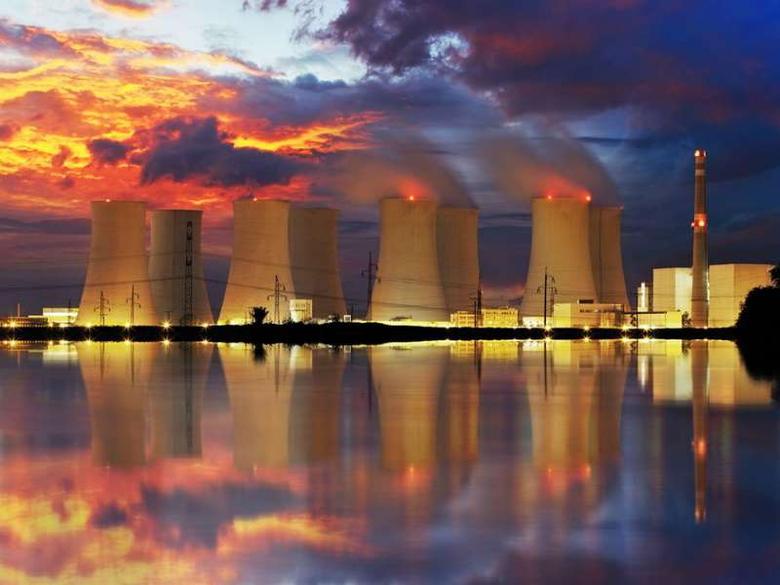

SOUTH AFRICA'S NUCLEAR DEVELOPMENT

WNN - 18 May 2020 - The Nuclear Industry Association of South Africa (NIASA) has outlined six potential options for financing new nuclear power plants in the country. Last week, Mineral Resources and Energy Minister Gwede Mantashe told a parliamentary committee he would be willing to look at innovative funding options as his department begins the process to develop 2500 MWe of new nuclear capacity.

"It is a fact that nuclear power plants require large upfront investments, compared to other sources of energy," NIASA said in an article published in Engineering News. "It is therefore critical how these projects are financed as the cost of borrowing money can be prohibitively high. Given the very high proportion of the cost of energy that the capital repayment element makes up of the overall cost of power from a nuclear plant, the effective interest rate is fundamental to project viability."

The six options identified by NIASA are: either state funding for the entire project or with state-backed loan guarantees and using reserves and cash flows from state-owned companies; an intergovernmental loan; corporate financing; financing by the plant vendor; project financing using a special investment vehicle; and 'build-own-operate'.

The association provided real-world examples of the application of five of the funding models in nuclear power plant projects. One option - project financing using a special purpose vehicle set up solely to fund the specific project and segregating the project from other investments, has not yet been used to fund a nuclear power plant but it has been used for natural gas generation plants, NIASA said.

Mantashe told the country's Portfolio Committee on Mineral Resources and Energy on 7 May that his department would begin preparations for the procurement of new nuclear as mandated in the country's 2019 Integrated Resource Plan, and would consider all options including small modular reactor projects led by private companies and consortia.

The department is also developing an oversight plan for a programme to enable the existing twin-unit Koeberg nuclear power plan to operate for a further 20 years after 2024. Koeberg, operated by state-owned utility Eskom, was commissioned in the mid-1980s and generates some 5% of South Africa's electricity.

-----

Earlier:

2020, February, 5, 10:25:00

SOUTH AFRICA'S OIL & GAS RULES

The question is whether the terms are attractive enough when nations are competing increasingly aggressively for investment from international oil companies (IOCs) and the potential demand destruction from the energy transition looms over the coming decades. The attractiveness of South Africa’s terms will have ramifications far beyond its borders.

|

2019, December, 20, 10:10:00

S.AFRICA NEED COAL

“South Africa is a major producer of coal,” Mantashe added. “Entire towns and settlements exist around coal mining areas, and as such, our focus must be on how to mitigate the impact of coal sector downscaling.”

|

2019, December, 4, 12:20:00

RUSSIA'S NUCLEAR FOR AFRICA

“Rosatom [the Russian nuclear company] is prepared to help our African partners in creating a nuclear industry,” Putin said, with “the construction of research centers based on multifunctional reactors.”

|