U.S. ENERGY MARKET DOWN

PLATTS - 22 May 2020 - The Federal Energy Regulatory Commission said in a summer outlook that it expects weak energy market conditions to continue due to the coronavirus pandemic. Oil markets are being hit hardest, but power markets also are experiencing lower loads and prices, and natural gas markets are likely to see even lower prices this summer than last.

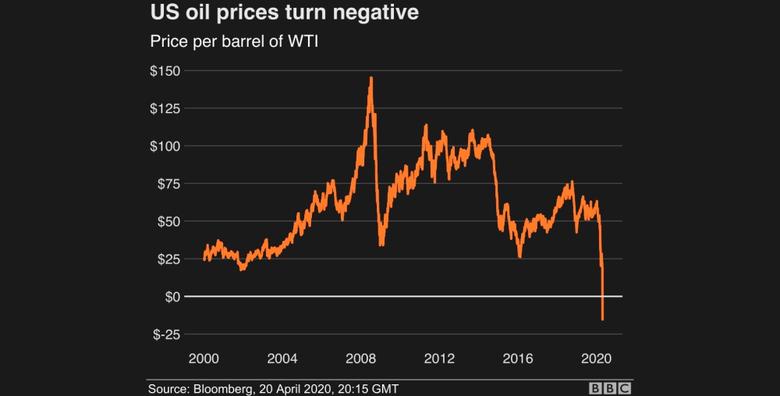

"The most impacted market so far has been the oil market," FERC staff member Alec Stirling said in a podcast released May 21 that summarizes the results of the Summer Energy Market and Reliability Assessment.

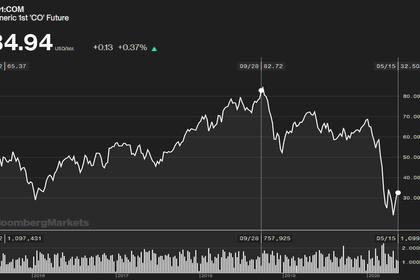

"West Texas Intermediate, or WTI crude spot prices decreased 56% through March alone, then hit a record low of negative $37.63/b on April 20," Stirling noted.

Oil markets are being significantly disrupted due to global market dynamics and the coronavirus pandemic, according to the report, which said the oil price crash was "causing financial and credit challenges, including oil company bankruptcies."

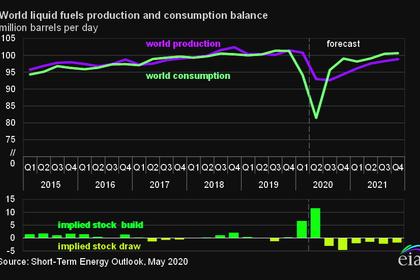

In total, the US Energy Information Administration forecasts that global consumption of petroleum and other liquids will decrease 5.2 million b/d, or roughly 5%, in 2020 compared to average 2019 consumption.

As of April 21, WTI NYMEX futures contracts for June and July were priced at $11.57/b and $18.69/b, respectively. On May 21, those contracts were significantly higher but remained relatively weak at $34.14 and $33.92, respectively. Continued low prices are likely to result in decreased oil production and reduced gas output in the Permian and North Dakota, where oil recovery is accompanied by associated shale gas plays, FERC noted.

More than 2.2 million b/d of US oil production has been shut in response to low prices and weak demand, US Energy Secretary Dan Brouillette said during a teleconference meeting of the Secretary of Energy Advisory Board May 21.

GAS AND POWER

Summer 2020 natural gas prices are expected to be lower across the US, with Henry Hub futures prices at averaging $1.832/MMBtu for June through August, $0.52/MMBtu lower than 2019 settled futures prices.

However, "gas demand has remained relatively strong so far," with monthly total US demand increasing about 7% from the same period last year, Stirling said."Gas demand from the electric generation, LNG feedgas, and residential and commercial sectors have all increased year-over-year, despite the effects of COVID-19," he said, adding that the only sector to see a real decline in gas demand has been the industrial sector where estimated industrial demand this April was down roughly 8%.

S&P Global Platts estimates that industrial demand averaged 1.7 Bcf/d lower in April 2020 compared to 2019, the report noted.

"In late April, S&P Global Platts lowered its June gas production estimate by 10.5 Bcf/d compared to their forecasts in March," Stirling said, adding "that lost supply could certainly raise prices."

There is also "significant downside risk to LNG feedgas demand for summer 2020," due to global LNG market disruption associated with the coronavirus pandemic. Natural gas futures prices in Europe and Asia suggest that US LNG "will be only marginally profitable or even unprofitable through summer 2020," according to the report.

US power markets are expected to be impacted by higher summer temperatures than last year across most of the country, while data from the North American Electric Reliability Corporation and ISOs/RTOs indicate that planning reserve margins for all regions, except the Electric Reliability Council of Texas, will be adequate this summer, the report said.

Wholesale power prices are generally lower than last year at this time, due to reduced loads, as well as mild weather conditions and lower gas prices due to ample supply, FERC said.

For June, July and August 2020, the National Oceanic and Atmospheric Administration forecasts a greater than 50% probability of above average temperatures throughout the western US, parts of the southern US and much of the eastern US.

Elsewhere, the Upper Midwest is expected to experience average temperatures during the same months, FERC said.

ERCOT expects its summer reserve margin will be 12.6%, an increase from the 10.67% initially expected, but below NERC's reference margin level of 13.75%.

In 2019, ERCOT was also below its reserve margin and experienced an all-time peak load and real-time power prices of $9,000/MWh, but continued to operate reliably, FERC noted.

Snowpack varies across the western US this year with California's snowpack 54% below average as of April 1, which is the lowest level since 2018.

"Considering the drought-like conditions in some parts of California, there is again a risk of wildfires and therefore Public Safety Power Shutoffs may occur," FERC staff member Alex Ovodenk said on the podcast.

Drought monitor data indicate that Northern California is drier than Southern California so the shutoffs may be more likely in Northern California, Ovodenk said. "We don't expect those shut-offs to have major impacts on the wholesale markets -- they didn't last year -- but we will need to see what happens," he said.

Several solar, wind, and gas resources are expected to come online by the summer, while certain coal-fired resources are scheduled to retire. Gas is expected to continue to play a large role in the wholesale electric markets during the summer, the report said.

-----

Earlier: