U.S. GAS POWER UP

By Kent Knutson Energy Market Content Specialist ABB Inc

ENERGYCENTRAL - Gas power is the most economic dispatchable source of electricity in America today. It is the primary reason coal is quickly fading as a major power generating resource. The development of utility-scale energy storage technology holds great promise in replacing some gas power, primarily in replacing peaking capacity, but large-scale batteries are still years away from making a significant impact on the existing and growing fleet of combined-cycle and simple-cycle natural gas units.

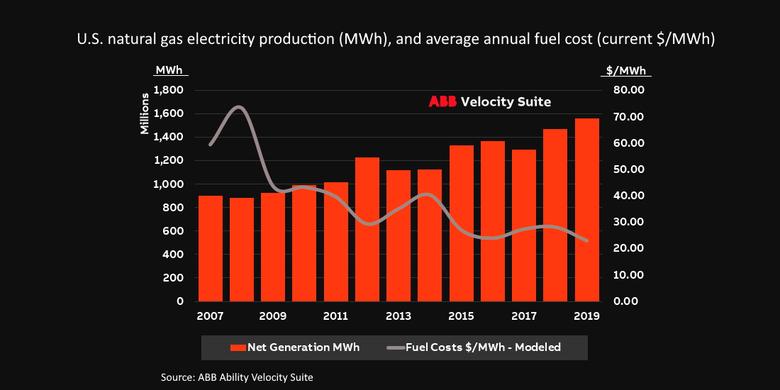

Driven by unprecedented low fuel costs and highly efficient new turbine technology, natural gas power continues to grow. The fuel accounted for a record 38.4% (1.58 billion MWh) of all power generated in the country in 2019, and it keeps expanding. In January 2020, electricity production from natural gas plants accounted for 39.2% of all power production – up from 33.3% one year ago.

In 2019, the average annual price of natural gas delivered to the nearly 2,000 operating gas power plants across the country was $2.89/mmBtu, and through the first month of reporting in 2020, had even dropped further to an average delivered fuel price of $2.62/mmBtu – down 34.7% ($4.01/mmBtu) from deliveries in January 2019. The last time the monthly average price of delivered natural gas to power plants topped $3/mmBtu was in August of last year. For independent power producers (IPPs), which typically pay less for gas than traditional regulated utilities, the average delivered price in 2019 was only $2.68/mmBTU, and only $2.36 through the first month of 2020.

Today's newer fleet of sophisticated turbines has contributed to the continued improvements in average plant heat rates. In 2008, just over a decade ago, the average annual heat rate for operating natural gas power generators was 8,020 Btu/kWh – considerably higher from 2019 when the average heat rate was only 7,578. Meanwhile, the average operating fuel cost in current dollars, during the same period, dropped from $73.44/MWh to $22.91 in 2019, and in January of this year, the average price was just $20.62.

With this cost advantage and the significant efficiency gains in recent years, the expansion of gas as a utility fuel is almost certain to grow even further given the high number of new combined-cycle gas projects that have recently come online, and those projects well along in construction. According to numbers tabulated by the ABB Velocity Suite research team, there are 7,546 MW currently under construction or testing expected to come online in 2020, with another 7,053 MW currently under construction expected online in 2021 and 2022.

Gas power projects recently brought online

On March 30, Westlake, LA headquartered Entergy Louisiana, subsidiary of Entergy Corporation, announced the company had recently begun operation of their new Lake Charles Power Station. The 994 MW combined-cycle natural gas power project was completed well ahead of schedule. Construction on the facility, sited in Calcasieu Parish, started in October of 2017. The new plant was equipped with Mitsubishi Hitachi Power Systems (MHPS) advanced class gas turbines (ACGT) which when fully operational will result in about 40% fewer carbon emissions than Entergy’s older fleet of natural gas turbines. The MHPS turbines incorporate new air-cooling technology, three step-up transformers, and use MHPS’s TOMONI digital platform to monitor and manage operations. American based McDermott International served as the EPC overseeing the construction.

Following Entergy’s announcement, on April 7, Siemens Energy announced they had fired up Duke Energy’s newest generating unit at the 1,200 MW Lincoln County Combustion Turbine Generation Station in Denver, North Carolina. The plant includes 16 simple cycle combustion turbines totaling roughly 1,200 MW and has been in service since 1995. The startup of the new SGT6-9000HL (405 MW) technology marks the first-ever HL-class gas turbine installation. The HL’s engine architecture introduces several technology achievements including the ability to increase firing temperatures which in turn improves the overall heat rate of the unit. The turbine was delivered to the plant site in late November 2019. The new turbine will deliver power to Duke Energy during a lengthy testing period through 2024, and then, when it enters service, becomes part of Duke Energy’s North Carolina fleet. One of the features of the fast-starting technology is that it can support an ever-growing portfolio of renewable resources Duke intends to deploy in the coming years.

Some additional natural gas-fueled projects expected online in 2020 include:

- Entergy Texas, Montgomery County (1,045 MW), TX

- Advanced Power, Cricket Valley Energy (1,000 MW), NY, currently testing

- Hickory Run Energy LLC, Hickory Run Energy Center (1,000 MW), PA, currently testing

- Rock River Energy LLC, Riverside Energy Center (700 MW), WI, currently testing

- AES Alamitos Energy LLC, Alamitos Energy Center (693 MW), CA, currently testing

- AES Huntington Beach LLC, Huntington Beach (640 MW), CA

- Shell Chemical Appalachia LLC, Shell Chemical Appalachia (251 MW) PA

- Entergy New Orleans Inc., New Orleans Power Station (250 MW) LA

- Formosa Plastics Corp., Formosa Utility Venture Ltd (244 MW), TX

- Michigan Hub LLC, Michigan Hub Clean Power Project (168 MW), MI

- Lakeland Dept. of Electric Water Utilities, C D McIntosh Jr (135 MW), FL

- Stanton Energy Reliability Center LLC, Stanton Energy Reliability Center (121 MW), CA

Until energy storage can scale, and new innovations are introduced, and intermittent renewables can compete on a levelized cost basis, natural gas will remain an important transitional dispatchable utility fuel and continue to dominate the generation fuel mix across the United States.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----