U.S. LNG CANCELED

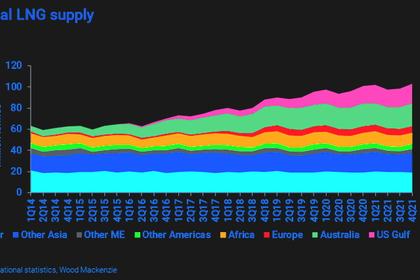

PLATTS - 21 May 2020 - About 45 LNG cargoes scheduled to be loaded in July at US export terminals were said to have been canceled by customers — at least half of them tied to Cheniere Energy's two Gulf Coast facilities, according to market sources.

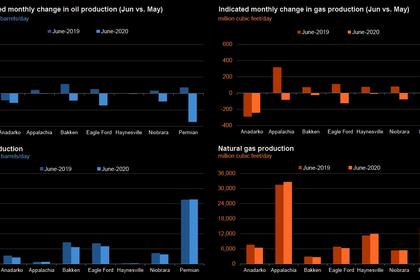

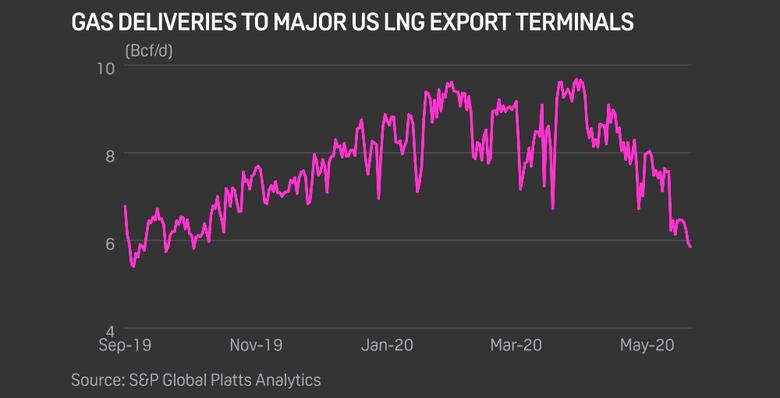

The moves reported Thursday reflect the depth of global demand destruction exacerbated by the coronavirus pandemic, with Asian and European buyers fleeing US supplies as summer approaches. Feedgas flows to US liquefaction facilities fell this week to the lowest level since October 2019.

The July cancellations, roughly double what was reported for June, represent nearly two-thirds the average volume of US LNG that was produced monthly when the coronavirus began to spread globally in January, according to S&P Global Platts Analytics data.

Often billed as a big benefit for US exporters, their contracts call for offtakers to pay a fixed feed when canceling cargoes. Those protections could be complicated if customers were to declare force majeure, something market participants have suggested is possible if the health crisis drags on or deepens. Cheniere has said it doesn't believe the market disruptions from the coronavirus would provide a valid legal basis for an FM claim by one of its counterparties.

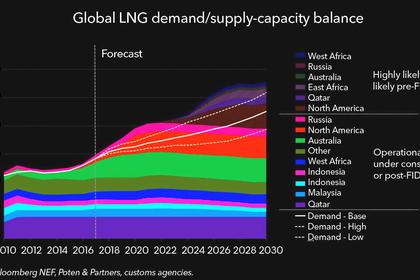

Low international prices and weaker-than-normal demand have been cited as the main reasons for the cancellations at US terminals that largely began in April and picked up in May and June.

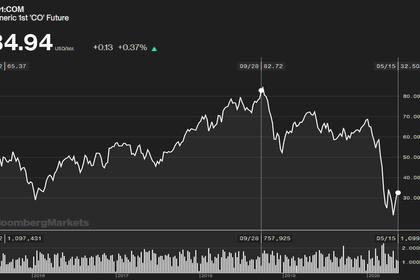

North Asian spot LNG prices extended their downtrend Thursday as cargo availability remained ample despite procurement activity in China gaining momentum. The Platts JKM for July was assessed down by 4.8 cents/MMBtu day on day at $2.125/MMBtu, on lower pricing indications.

In the Atlantic region, a plunging Eurogas market has sent delivered LNG prices to record lows. Platts assessed the DES NWE/MED markets at $1.371/MMBtu Thursday, down $0.134/MMBtu day on day, the lowest level since Platts began assessing these markets in 2010.

The Platts Gulf Coast Marker was assessed at $1.283/MMBtu Thursday, moving lower on bearish sentiment in the Northeast Asian market, which currently provides the most lucrative market for US cargoes. The spread between the GCM and NYMEX Henry Hub front-month has remained in negative territory since late March and implies that the margins on US cargoes being marketed in the spot market are very thin or negative.

As the biggest exporter of LNG and individual physical consumer of natural gas in the US, Cheniere's production is being hit hardest by the cargo cancellations. More than two dozen of the total canceled US cargo loadings for July are tied to Cheniere's Sabine Pass terminal in Louisiana and Corpus Christi terminal in Texas, according to market sources. Royal Dutch Shell, Spain's Naturgy, and commodity trader Trafigura were among the customers that notified Cheniere of cancellations for July for loadings at its facilities, market sources said.

Because of its substantial marketing function, Cheniere could choose to re-market some of the canceled US cargoes on its own or source the relevant LNG for its customers from other terminals around the world.

Cheniere declined to comment.

Shell is the sole offtaker at Kinder Morgan's Elba Liquefaction in Georgia, the smallest of the six major US LNG export terminals. A Kinder Morgan spokeswoman said Elba planned to produce LNG in July, although she would not comment on whether there were any cancellations there.

Elsewhere, amid lower demand and high inventories, Japanese buyers Osaka Gas and JERA canceled a total of three July cargoes from Freeport LNG in Texas, market sources said. Britain's BP and France's Total also have offtake commitments at Freeport LNG.

Total was said to have canceled at least two US LNG cargoes for July, though it was unclear from which terminals. It also has commitments at Cameron LNG in Louisiana and at Cheniere's Sabine Pass.

Representatives of Freeport LNG and Cameron LNG declined to comment on their customers' decisions.

DOMINO EFFECT

Market sources that spoke to Platts did not report any cancellations for July from Dominion Energy's Cove Point export terminal in Maryland.

One source said this was not unusual as they had heard no cancellations for June loading either out of Cove Point, explaining there had been other mechanisms in place such as a recent tender from India's Gail for a FOB cargo. Unlike the other US liquefaction facilities, feedgas flows to Cove Point have consistently remained near capacity in recent months.

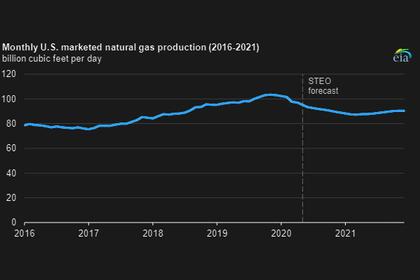

Fewer loadings at US LNG terminals in July will translate to less gas needed to be delivered to those terminals. That impact can trickle down to interstate pipeline operators and to US shale gas drillers. Prices also could face further pressure, according to a trading source.

For tanker operators, some chartered vessels may see slower voyages or canceled voyages this summer, a market source said.

-----

Earlier: