U.S. OIL DEMAND UPDOWN

U.S. EIA - U.S. Liquid Fuels

Consumption

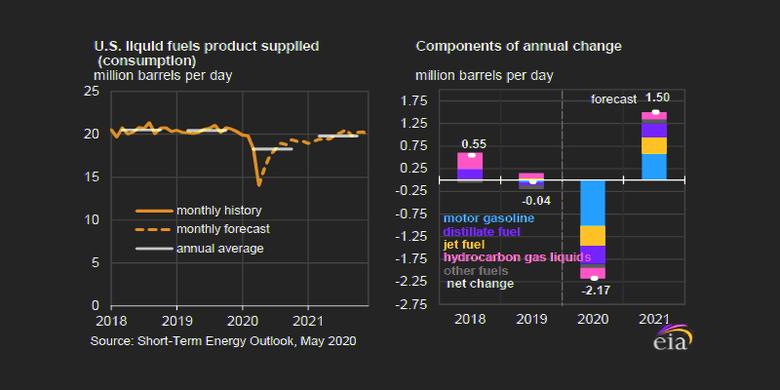

EIA assumes significantly lower levels of U.S. liquid fuels consumption during much of 2020 as a result of the disruptions to economic and business activity because of the strict containment measures related to COVID-19 that have dramatically reduced all forms of travel. These impacts are expected to be most pronounced during the second quarter of 2020, when most containment measures and wide-scale reductions in business activity are assumed to be in place. EIA expects these impacts to persist through most of 2020, but in the second half of 2020, EIA expects liquid fuels consumption will gradually increase from second-quarter levels as some business activity resumes and stay-at-home orders gradually ease. EIA expects U.S. total liquid fuels consumption will rise from an average of 15.9 million b/d in the second quarter of 2020 to 18.7 million b/d in the third quarter of 2020 and then to average 19.8 million b/d in 2021, up 8% from 2020, but lower than 2019 levels. EIA forecasts travel disruptions will affect jet fuel consumption the most in percentage terms, with consumption expected to decline by 25% yearover- year for all of 2020 and by more than 50% year-over-year in the second quarter.

EIA expects gasoline and distillate fuel consumption will both see consumption fall about 10% compared with 2019 levels.

EIA's current forecast for U.S. annual average hydrocarbon gas liquids (HGL) consumption reflects a steeper decline in 2020 followed by a slower recovery in 2021 compared with the previous forecast. The May STEO expects HGL consumption will decline by 7.4% in 2020 and

increase by 5.3% in 2021. The current forecast expects a deeper slowdown in manufacturing that keeps petrochemical feedstock and gasoline blending demand for HGLs lower than 2019 levels in both 2020 and 2021. Ethane consumption begins to rise in the first quarter of 2021 as

manufacturing begins to recover and as ethane-fed petrochemical plants increase utilization.

Crude Oil Supply

EIA's model for crude oil production in the Lower 48 states' includes structural parameters that reduce the forecast for rigs and wells when the West Texas Intermediate crude oil price falls below $45/b or the Henry Hub natural gas price falls below $2 per million British thermal units, based on historical trends in each region. In addition to this model-based drop, EIA assumes a further 30% reduction in drilling activity on average in the second quarter of 2020 and a 6% reduction in the third quarter of 2020 as a result of low oil prices related to the unprecedented effects of restrictions as a result of COVID-19; many producers have already announced plans to reduce capital spending and drilling levels.

EIA expects that steepest declines in U.S. crude oil production will be in the second quarter of 2020, with forecast month-over-month declines averaging 0.5 million b/d during those three months. EIA expects production to continue declining, albeit at a slower rate, through March

2021, when production bottoms out at 10.7 million b/d, which would be a 2.1 million b/d decline from the record monthly production reached in November 2019. EIA expects production to rise modestly through the end 2021 in response to rising crude oil prices. EIA forecasts annual average crude oil production to be 11.7 million b/d in 2020 and 10.9 million b/d in 2021, both of which are about 0.1 million b/d lower than forecast in the April STEO.

The decline in U.S. crude oil production in 2020 and 2021, combined with rising U.S. liquid fuels consumption, results in the United States returning to being a net importer of crude oil and petroleum products in the third quarter of 2020 and remaining a net importer in most months through the end of the forecast period.

-----

Earlier: