$23.93 BLN FOR CHILE

IMF - May 29, 2020 - The Executive Board of the International Monetary Fund (IMF) approved today a two-year arrangement for Chile under the Flexible Credit Line (FCL) in an amount equivalent to SDR 17.443 billion (about US$ 23.93 billion, equivalent to 1,000 percent of quota).

The FCL was established on March 24, 2009 as part of a major reform of the Fund’s lending framework (see Press Release No. 09/85). The FCL is designed for crisis prevention purposes as it provides the flexibility to draw on the credit line at any time during the period of the arrangement (one or two years), and subject to a mid-term review in two-year FCL arrangements. Disbursements are not phased nor conditioned on compliance with policy targets as in traditional IMF-supported programs. This large, upfront access with no ongoing conditions is justified by the very strong track records of countries that qualify for the FCL, which gives confidence that their economic policies will remain strong.

Following the Executive Board’s discussion on Chile, Mrs. Kristalina Georgieva, Managing Director and Chair, issued the following statement:

“Chile’s very strong fundamentals, institutional policy frameworks, and track record of implementing prudent macroeconomic policies have been instrumental in absorbing the impact of a series of recent shocks. The strong policy frameworks are anchored in the structural fiscal balance rule, the credible inflation-targeting framework with the free-floating exchange rate, and a sound financial system supported by effective regulation and supervision. The authorities continue to show strong commitment to maintaining very strong policies and institutional policy frameworks going forward.

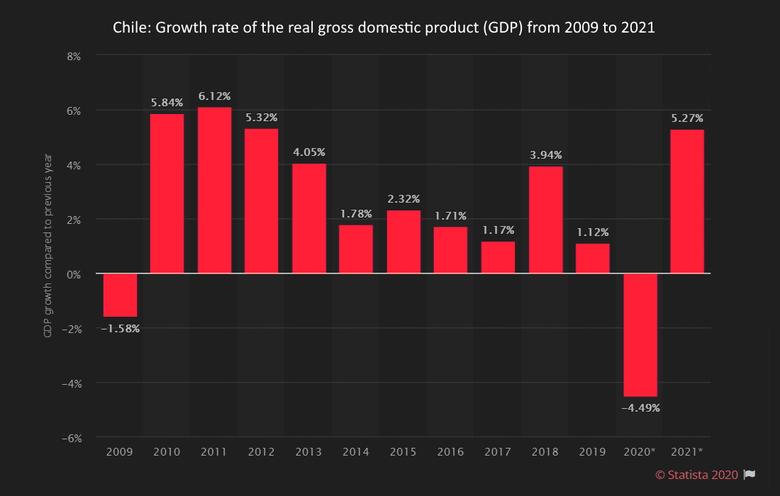

“Notwithstanding its very strong fundamentals and policy settings, Chile’s open economy is exposed to substantial external risks as a result of the ongoing Covid-19 outbreak, including a significant deterioration in global demand for Chilean exports, a sharp decline or reversal of capital inflows toward emerging markets, and an abrupt tightening of global financial conditions.

“Chile meets all the qualification criteria for an arrangement under the Flexible Credit Line (FCL). The FCL arrangement will help boost market confidence amid the elevated uncertainty and volatility in global financial markets as a result of the Covid-19 outbreak, by enhancing Chile’s external buffers and providing valuable insurance against tail risks.

“The authorities intend to treat the FCL arrangement as precautionary and temporary, and to exit the arrangement as soon as the 24-month period is completed, conditional on a reduction of risks at the time of the mid-term review.”

-----