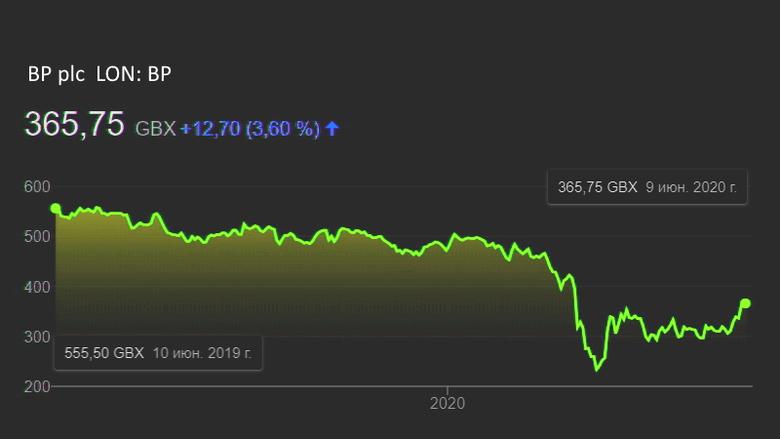

BP CUTTING 10,000 JOBS, $3 BLN

BP - 8 June 2020 - Bernard's note to the bp team: Reinventing bp - next steps

CEO Bernard Looney has spoken about pay, promotions, bonuses, and jobs and how we plan to support all those affected by these tough decisions

Hello everyone

I hope many of you were able to join Kerry and me on our latest webcast, which just finished. We held the call so that you could hear directly from us about the decisions we are taking – and why – on pay, promotions, bonuses and, most importantly, jobs.

I know not everyone can join these calls, so this note is to make you all aware of the news I shared – and provide links to additional information.

As much as I would love to, I can't make your worries disappear. But what I can do is remove uncertainty as much as possible by sharing our plans with you.

Reimagining energy, reinventing bp

It feels like a long time since we launched our new purpose and ambition in February. I am as excited and confident in bp's future as I was then. At the time, we talked a lot about the need to reinvent bp in order to stay competitive and realize our ambition.

It was always part of the plan to make bp a leaner, faster-moving and lower carbon company. That is how we will deliver on our net zero ambition. And that is how we will seize opportunities throughout the energy transition.

Then the covid-19 pandemic took hold. You are already aware that, beyond the clear human tragedy, there has been widespread economic fallout, along with consequences for our industry and our company.

The oil price has plunged well below the level we need to turn a profit. We are spending much, much more than we make – I am talking millions of dollars, every day. And as a result, our net debt rose by $6 billion in the first quarter.

We have to spend less money. And we are in action on that:

We are working to bring down our capital expenditure by 25% this year – which is a reduction of around $3 billion.

It currently costs around $22 billion a year to run the company – of which around $8 billion is people costs.

So we are driving down those operating costs by $2.5 billion in 2021 – and we will likely have to go even further.

To me, the broader economic picture and our own financial position just reaffirm the need to reinvent bp. While the external environment is driving us to move faster – and perhaps go deeper at this stage than we originally intended – the direction of travel remains the same.

Purpose-driven

Before outlining the next steps, here is how we will approach all this.

In February, we said bp would be guided by our new purpose of reimagining energy for people and our planet. We meant it then, we mean it now – and I am making you three promises:

Our core value of safety will not be compromised by the decisions we are taking. We will need your help in this.

We will work exceptionally hard to make sure the process is fair and objective.

The most senior levels of bp will bear the biggest impacts. As an example, our new Tier 2 structure has more than halved the number of most senior level jobs – and we are looking to reduce the number of group leaders overall by around one third.

Announcements

With that in mind, here is a summary of the main announcements from today's webcast.

Pay: Back in March – at the outset of this crisis – we said we were delaying the 2020 pay raises that were due to take effect from 1 April. We have decided to proceed with the raises starting 1 October, but only for employees in levels up to and including level G. There will be no pay rise for senior level leaders or group leaders through to 31 March 2021.

Promotions: In March we also froze all promotions occurring after 1 April. We have now decided to take the freeze off with effect from 1 July. Promotions can then restart at all levels, but in a measured way that reflects the challenges we are up against.

Bonuses: The Board's remuneration committee, Kerry and I have been considering how the current economic environment and our financial condition will affect cash bonuses for 2020. Cash bonuses are paid dependent on performance, and obviously affordability. So, I can tell you now, cash bonuses under the Annual Cash Bonus plan are very unlikely this year. As you think ahead about your personal finances and plans, please do not factor an ACB payment for 2020 into your plans.

Jobs: We introduced a three-month redundancy freeze back in March to ease some of the immediate worry for people. That moratorium ends today. We will now begin a process that will see close to 10,000 people leaving bp – most by the end of this year. The majority of people affected will be in office-based jobs. We are protecting the frontline of the company and, as always, prioritizing safe and reliable operations.

Care for people leaving

Everyone on the bp leadership team realizes these decisions will mean significant, life-changing consequences for thousands of colleagues and friends. And I am really sorry that this will hurt a lot of people who I know love this company as much as I do. And so we have spent a lot of time working on how we can do more than we normally do in these circumstances. In addition to substantial severance packages, we will:

Help people launch a new career – which could be in research, a social enterprise or by setting up a business of their own. We will provide information and webinars, and connect them to training agencies and government programmes.

Sharpen people's job-seeking skills with professional coaching, as well as assistance from our in-house talent acquisition teams.

Provide people with a laptop and support them by building our alumni network, and more.

Next steps

There is a lot to take in here. There will be plenty of opportunities for you to ask questions and seek further clarification. The next big date is 15 June when we launch an Expression of Interest (EOI) programme. If you qualify, this is where you can say if you would like to be considered for the redundancy terms on offer.

In the meantime, you can find the latest information on the intranet – and, as always, please reach out to your line manager or your people & culture representative if you have additional questions.

Changing with purpose

These are tough decisions to make. But the impact – particularly on those leaving us – is much, much tougher. I understand this and I am sorry. But we must do the right thing for bp and this is that right thing. It will help strengthen our finances. And it will help create a leaner, faster-moving and more competitive company for the majority who are staying.

You can and should expect us to do it the right way. We will work hard to make sure the process is fair, and we will treat those leaving with the respect and the dignity they have earned and deserve.

We are going to work through this carefully, but quickly. And while change can be distracting, we must remain focused on safe and reliable operations.

As you may have heard me say on last week's webcast, I really believe we are building something special. We are building a company that can help the world through the energy transition and help improve people's lives.

But to get to do that – we have to take some tough action – and do so now.

Thank you for listening. And I look forward to your feedback.

Bernard

-----

Earlier:

|

2020, April, 27, 12:10:00

BP, HILCORP DEAL $5.6 BLN

The original agreement provided for Hilcorp to pay $4.0 billion near-term and $1.6 billion through an earnout thereafter.

|

2020, February, 5, 10:20:00

BP PROFIT $4 BLN

BP profit was $19 million for the fourth quarter and $4.0 billion for the full year.

|