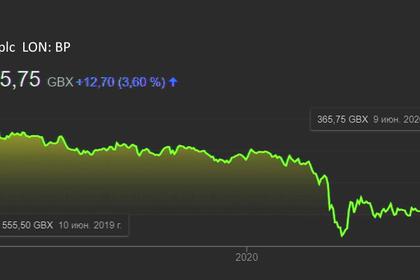

BP WRITE-OFFS $17 BLN

BP- 15 June 2020 - In mid-February, BP p.l.c. (bp) laid out a new purpose – to reimagine energy for people and our planet – and its ambition to become a net zero company by 2050 or sooner and to help the world get to net zero. Since then, bp has focused its work in three key areas:

- Developing its strategy to create a more diversified, resilient and lower-carbon energy company

- Reinventing bp into a leaner, faster-moving and lower cost organisation

- Strengthening its finances in response to the challenging environment.

As part of its strategy development, bp has been reviewing its portfolio and its capital development plans. This work is informed by bp’s views of the long-term price environment and its balanced investment criteria. Together these create a framework that seeks to ensure investments align with its strategy and add shareholder value.

In addition, with the COVID-19 pandemic having continued during the second quarter of 2020, bp now sees the prospect of the pandemic having an enduring impact on the global economy, with the potential for weaker demand for energy for a sustained period.

bp’s management also has a growing expectation that the aftermath of the pandemic will accelerate the pace of transition to a lower carbon economy and energy system, as countries seek to ‘build back better’ so that their economies will be more resilient in the future.

As a result of all the above, bp has revised its long-term price assumptions, lowering them and extending the period covered to 2050 so that it is now consistent with its ambition horizon. As part of its long-term strategic planning, and in the context of its continuing focus on capital discipline, bp is also reviewing its intent to develop some of its exploration intangible assets.

These actions will lead to non-cash impairment charges and write-offs in the second quarter, estimated to be in an aggregate range of $13 billion to $17.5 billion post-tax.

“In February we set out to become a net zero company by 2050 or sooner”, said Bernard Looney, bp chief executive officer.

“Since then we have been in action, developing our strategy to become a more diversified, resilient and lower carbon company. As part of that process, we have been reviewing our price assumptions over a longer horizon. That work has been informed by the COVID-19 pandemic, which increasingly looks as if it will have an enduring economic impact.

“So, we have reset our price outlook to reflect that impact and the likelihood of greater efforts to ‘build back better’ towards a Paris-consistent world. We are also reviewing our development plans. All that will result in a significant charge in our upcoming results, but I am confident that these difficult decisions – rooted in our net zero ambition and reaffirmed by the pandemic – will better enable us to compete through the energy transition.”

Revised long-term price assumptions

bp’s revised investment appraisal long-term price assumptions are now an average of around $55/bbl for Brent and $2.90 per mmBtu for Henry Hub gas ($2020 real), from 2021-2050. These lower long-term price assumptions are considered by bp to be broadly in line with a range of transition paths consistent with the Paris climate goals. However, they do not correspond to any specific Paris-consistent scenario.

As a result of the revision of long-term price assumptions used for investment appraisal, bp has also revised the price assumptions it uses in value in-use impairment testing and these are now aligned to bp’s revised investment appraisal price assumptions.

bp has also revised its carbon prices for the period to 2050 and these now include a price of $100/teCO2 in 2030 ($2020 real).

Intangible assets review

bp is also reviewing its intent to develop some of its exploration prospects and consequently is assessing the carrying values of the group’s intangible assets.

Estimated impairment charges and exploration write-offs

bp’s impairment and intangible assets assessments are in progress and it is not possible at this time to precisely determine the impact of the revised impairment testing price assumptions, or the outcome of the assessment of intangible assets, on the group’s financial statements.

However, bp currently estimates that non-cash, pre-tax impairment charges against property, plant & equipment (PP&E) in the range of $8 billion to $11 billion, and write-offs of exploration intangibles in the range of $8 billion to $10 billion, will be reported in its second-quarter 2020 results.

bp currently estimates that the aggregate second-quarter 2020 non-cash, post-tax PP&E impairment charges and exploration intangible write-offs will be in the range of $13 billion to $17.5 billion.

Further information will be provided in bp’s second-quarter 2020 results, expected to be released on 4 August 2020.

-----

Earlier: