EUROPE'S SHARES UP

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

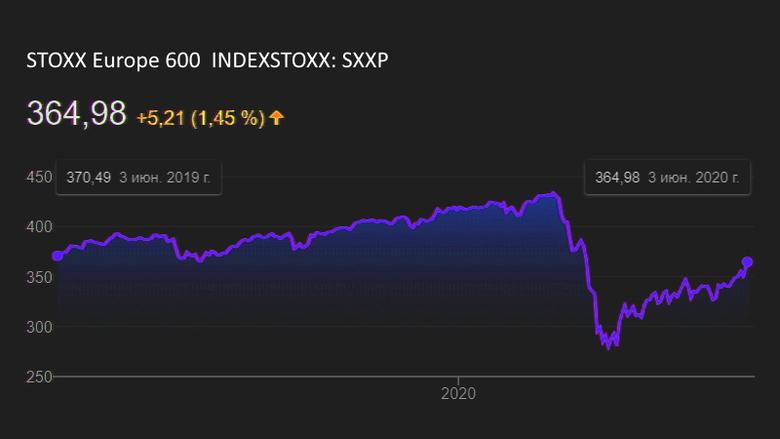

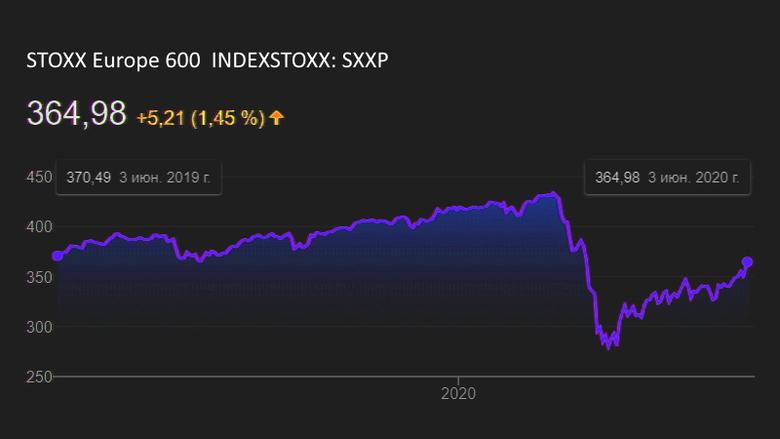

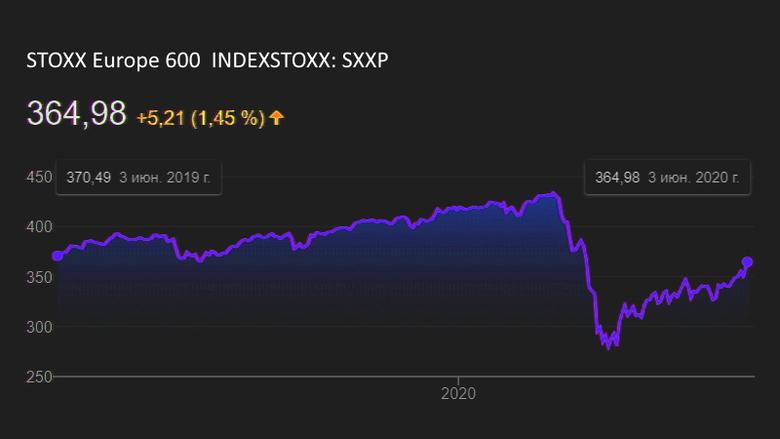

EUROPE'S SHARES UP

REUTERS - JUNE 3, 2020 - European shares joined a global rally on Wednesday as signs of a pickup in China's services sector activity offset concerns about Sino-U.S. trade tensions and widespread civil unrest in the United States.

The pan-European STOXX 600 rose 1%, hovering near three-month highs, led by gains in insurers .SXIP, automakers .SXAP, banks .SX7P and oil & gas .SXEP sectors.

A survey showed China's services sector returned to growth in May for the first time since January, even though employment and overseas demand remained weak.

Final data on euro zone business activity for May is due at 0800 GMT.

Massive stimulus from major central banks, hopes of a COVID-19 vaccine and improving economic data have helped the STOXX 600 recover about 35% from March lows, leaving it a little over 16% below February highs.

Among individual stocks, Renault SA (RENA.PA) jumped 7.6% after it finalised a 5 billion euro ($5.60 billion) loan from with the French government and Goldman Sachs upgraded its stock to “buy”.

French insurer AXA (AXAF.PA) rose 6.1% after revealing plans to halve its dividend amid the coronavirus crisis, but said it could propose an additional fourth-quarter shareholder payment if conditions improved.

Lufthansa (LHAG.DE) gained 1.7% as it vowed to step up restructuring measures after posting a first-quarter net loss of 2.1 billion euros ($2.35 billion).

French luxury goods group LVMH (LVMH.PA) edged up 0.4% after fashion trade publication WWD reported that its $16.2 billion takeover of Tiffany & Co (TIF.N) is looking less certain.

-----

Tags:

EUROPE,

INDEXES,

SHARES,

BONDS,

STOCKS