GLOBAL SHARES DOWN

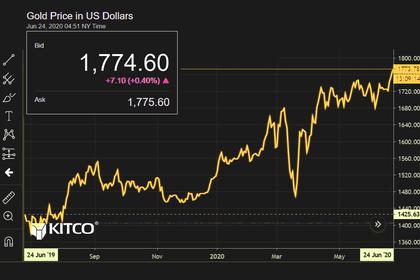

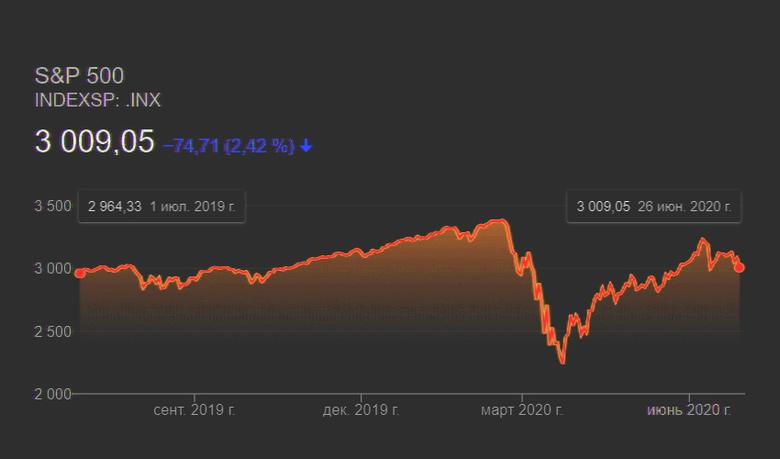

REUTERS - JUNE 29, 2020 - World shares hit two-week lows and oil fell nearly 2% on Monday as the relentless spread of the coronavirus curbed optimism on the global economy, prompting investors to take shelter in safe-haven bonds and gold.

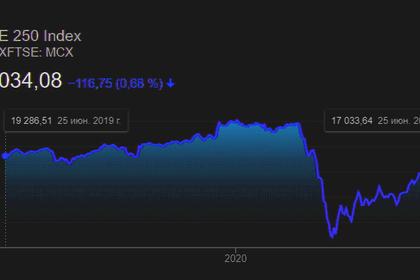

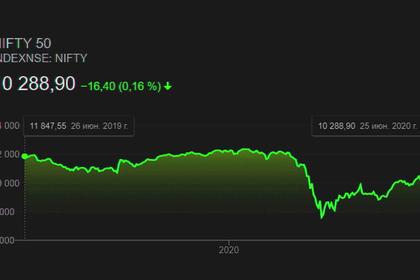

European stocks opened slightly lower, after Asian shares ended deep in the red playing catch up with Wall Street's ugly close on Friday as some U.S. states reconsidered their reopening plans.

The global death toll from COVID-19 reached half a million people on Sunday, with one quarter of those in the United States, where cases have surged in a handful of southern and western states.

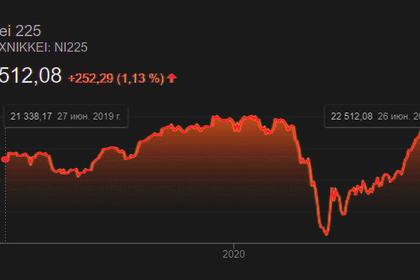

MSCI's world shares index was off 0.2%, hitting its lowest level since June 15 dragged down by Japan's Nikkei shedding 2.2% and Chinese blue chips off 0.9%. E-Mini futures for the S&P 500 were up 0.1%.

"The market is caught in a real battle between recovery optimism and news of increasing cases in certain geographical areas such as the U.S," said John Woolfitt, director of trading at Atlantic Capital Markets.

"I think this battle will remain until the U.S. get a handle on it."

Sovereign bonds benefited from the shift to safety with yields on U.S. 10-year notes near 0.64%, having briefly been as high as 0.96% early in June. German government bond yields clung to one-month lows on Monday.

The U.S. dollar has generally gone in the opposite direction, rising to 97.334 against a basket of currencies from a trough of 95.714 earlier in the month.

It had less luck on Monday, easing back to 107.18 yen, though it remained well within the recent range of 106.06 to 107.63. The euro stood at $1.1245 having found solid support around $1.1167.

"Financial markets remain extremely fragile, having to weigh worsening virus news against improving economic data," said Marija Veitmane, senior strategist at State Street Global Markets.

It is an important week for U.S. data with the ISM manufacturing index on Wednesday and payrolls on Thursday, ahead of the Independence Day holiday. Federal Reserve Chair Jerome Powell is also testifying on Tuesday.

"U.S. economic data will reinforce that the economy is through the worst of the recession in our view," said CBA currency analyst Joseph Capurso.

"But a double‑dip recession is possible if widespread restrictions are reimposed, leading to a surge in the dollar."

In commodity markets, gold held near its highest since early 2012 at $1,773 an ounce.

Oil prices slipped amid concerns the pandemic would slow the reopening of some economies and thus hurt demand for fuel.

Brent crude futures fell 69 cents to $40.33 a barrel, while U.S. crude lost 62 cents to $37.87.

-----

Earlier: