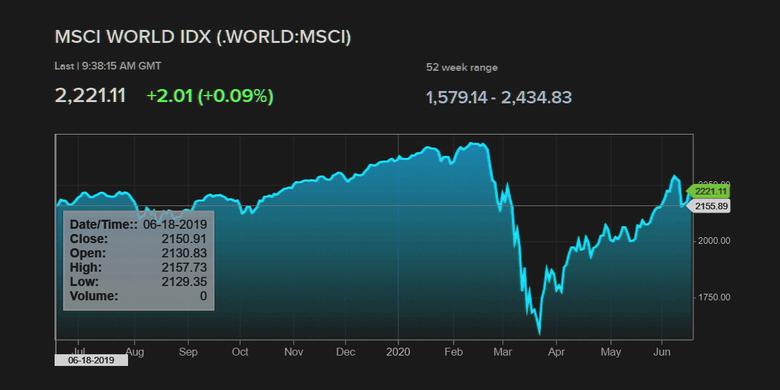

MSCI WORLD INDEX UPDOWN

REUTERS - JUNE 17, 2020 - Europe's shares added to their best gains in almost a month as safety plays lost their lustre on Wednesday, with hopes of a rapid economic recovery standing firm against a resurgence of global coronavirus cases.

Data showed U.S. retail sales bounced back sharply in May, but new infections have hit record highs in six U.S. states and China cut flights and closed schools to contain a fresh outbreak in Beijing.

The theme of a strong global economic rebound "will need to be balanced against the 2nd wave COVID risks which are more difficult to assess, and we would argue investors have assumed to be perhaps more modest than in reality," said MUFG's Head of Research Derek Halpenny.

Politics also lurked as a worry with India reporting 20 of its soldiers had been killed in clashes with Chinese troops at a disputed border site, while North Korea rejected a South Korean offer to send special envoys and said it would redeploy troops at the border.

That was enough to inject a tinge of caution into trading.

Japan's Nikkei eased 0.5%, after jumping almost 5% on Tuesday for its biggest daily gain in three months.

Europe's STOXX 600 saw its early 1% gains pruned nearly half [EU.] but all the main indexes were firmly in positive territory, and U.S. S&P 500 futures pushed up having spent most of the Asian session wavering either side of flat. [.N]

Trial results announced on Tuesday showed dexamethasone, used to reduce inflammation in other diseases such as arthritis, reduced death rates by around a third among the most severely ill COVID-19 patients admitted to hospital.

"It is one of the best pieces of news we've had through this whole crisis," Britain's Health Secretary Matt Hancock said.

MSCI's broadest index of World shares crawled 0.2% higher, having climbed 2.2% the previous day to reclaim a good portion of the ground it lost last week.

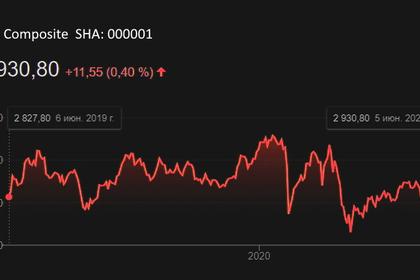

Chinese blue chips recovered from an early dip to finish steady. That followed a robust session on Wall Street overnight. The Dow ended Tuesday up 2.04%, while the S&P 500 gained 1.90% and the Nasdaq 1.75%.

Hopes for recovery had been bolstered by the data showing U.S. retail sales data jumped by a record 17.7% in May, recovering more than half the losses of the previous two months, though industrial output still lagged.

The Trump administration was also reportedly preparing an up-to $1 trillion infrastructure package, something that was initially promised more than three years ago.

PAST THE WORST

"There is little doubt that the global economy bottomed in April and is poised to post record-high growth rates over May and June, strongly lifting 3Q GDP above its 2Q trough," wrote economists at JPMorgan.

"But questions about the extent of lasting damage will have to wait for a number of months before being resolved."

Federal Reserve Chair Jerome Powell cautioned that output and employment would remain well short of their pre-pandemic levels for a long time, so there was a “reasonable probability” that more policy support would be needed.

All the talk of recovery caused headwinds for sovereign bonds, though U.S. Treasuries did recoup some of the losses posted in Asia.

Thirty-year yields were up 2 basis points at 1.55%, having risen by the most in a month on Tuesday, and 10-year German Bunds led a flurry of similar rises in Europe ahead of a 5 billion euro bond sale.

“The tension between better economic data and rising COVID-19 cases continues to drive market volatility,” said Antoine Bouvet, senior rates strategist at ING in London.

The dollar bounced modestly from recent three-month lows to stand at 96.978 against a basket of currencies.

The dollar was up a touch on the Japanese yen at 107.40, while the euro stood at $1.1268 from its recent top of $1.1422.

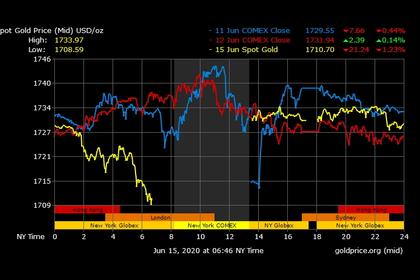

In commodity markets, gold was stuck at $1,725 and well within the $1,670/$1,764 range of the past few weeks.

Gains in oil prices slowed amid an increase in U.S. crude inventories. They had climbed 3% on Tuesday after the International Energy Agency (IEA) raised its oil demand forecast for 2020.

Brent crude futures swung 1% higher to $41.35 a barrel, while U.S. crude ticked up 16 cents to $38.54.

-----

Earlier: