GLOBAL OIL DEMAND UPDOWN

IEA - Oil Market Report - June 2020

Highlights

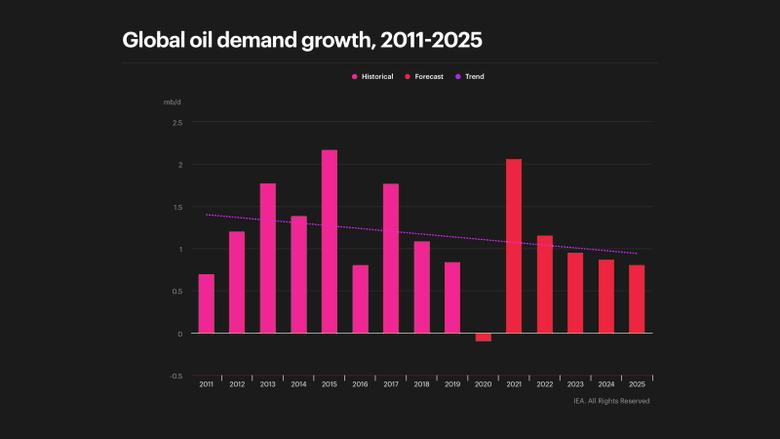

- Oil demand in 2020 is expected to fall by 8.1 mb/d, the largest in history, before recovering by 5.7 mb/d in 2021. Reduced jet and kerosene deliveries will impact total oil demand until at least 2022. The forecast for 2020 oil demand has been raised by nearly 500 kb/d to 91.7 mb/d, due to stronger than expected deliveries during the Covid-19 lockdown. In China, oil demand recovered fast in March-April and India’s demand rose sharply in May.

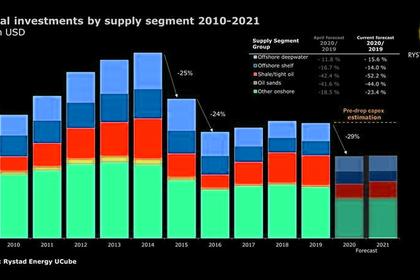

- Global oil supply plunged by 11.8 mb/d in May, driven by a record OPEC+ cut and economic shut-ins in the US, Canada and elsewhere. After tumbling by 7.2 mb/d in 2020, global oil output is set for a modest 1.7 mb/d recovery in 2021, assuming OPEC+ cuts ease, Norway, Brazil and Guyana deliver solid gains and Libya manages to sustain a rebound. US supply is poised to fall by 0.9 mb/d in 2020 and a further 0.3 mb/d next year unless higher prices unlock fresh investments in the shale patch.

- Global refining intake in April fell 6.6 mb/d month-on-month to just 68.8 mb/d, down 12.3 mb/d year-on-year and in May it was down by a further 1 mb/d. Large implied product stock builds set the stage for a subdued margin environment for the near future. After a 5.4 mb/d decline this year, refining activity is set to gain 5.3 mb/d in 2021, nearly recovering to 2019 levels, but below the 2018 historical peak.

- OECD data for April show that industry stocks rose by 148.7 mb (4.9 mb/d) to 3 137 mb, and were 208.3 mb above the five-year average. In the US, preliminary data show that commercial stocks in early June were at record highs, having built by about 1 mb/d in 2020. In 1Q20, government held stocks increased by nearly 2 mb, mainly product stocks in Europe. In May, floating storage of crude oil fell by 6.4 mb from its all-time high (172.2 mb in April) to 165.8 mb.

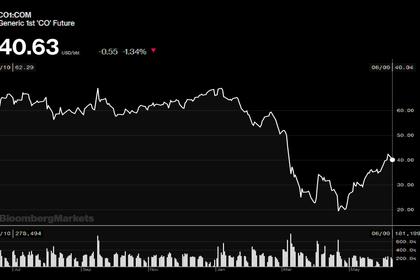

- Crude prices rose in May to the highest in three months as demand began to recover and global supply fell sharply. Rising prices squeezed product cracks, in particular diesel and jet/kerosene due to concerns about the global economy and the weak outlook for the aviation industry. Freight rates plummeted as OPEC+ cuts took effect. In early June, both WTI and Brent traded close to $40/bbl for several days before easing back slightly.

-

While the oil market remains fragile, the recent modest recovery in prices suggests that the first half of 2020 is ending on a more optimistic note. New data show that demand destruction in the early part of the year was slightly less than expected, although still unprecedented. On the supply side, record output cuts from OPEC+ and steep declines from other non-OPEC producers saw global oil production fall by a massive 12 mb/d in May. In addition to a 9.4 mb/d decline in OPEC+ supply last month, output from non-OPEC countries outside the deal has fallen by 4.5 mb/d since the start of the year. To further speed up the market rebalancing, OPEC+ decided on 6 June to extend their historic output cut of close to 10 mb/d through July.

- For demand, increased mobility indicators in the March-May period provided support: in particular, China’s strong exit from lockdown measures has seen demand in April almost back to year-ago levels. We have also seen a strong rebound in India in May, although demand is still well below year-ago levels. In the second half of the year the easing of lockdown measures in many countries should provide a boost. Even so, demand in 2020 is expected to be 8.1 mb/d lower than in 2019, with the biggest declines seen in the first half of the year. Our first forecast for 2021 as a whole shows demand growing by 5.7 mb/d, which, at 97.4 mb/d, will be 2.4 mb/d below the 2019 level.

- This 2.4 mb/d gap between 2021 and 2019 is largely explained by the dire situation of the aviation sector. Data from the International Air Transport Association show that passenger traffic in 2020 will be nearly 55% lower than in 2019. The industry will continue to be a drag on oil demand through 2021, with our first estimate showing that, having fallen by 3 mb/d in 2020, jet/kerosene demand will rebound by only 1 mb/d in 2021, leaving it below the pre-crisis level.

- Global oil supply is set to tumble by a massive 7.2 mb/d on average in 2020, and stage only a 1.8 mb/d increase in 2021 assuming 100% compliance with OPEC+ cuts. The recent improvement in oil prices that saw WTI trading for a few days close to $40/bbl is not enough to allow a significant increase in US output, which in June is estimated to have fallen to 10.5 mb/d, down by 2.4 mb/d from a record high seen in November. In the meantime, high crude and product stocks will limit the scope for producers in many countries to sell more to refiners. In the case of the US, data from the Energy Information Administration show that commercial stocks of crude oil and products have increased by about 1 mb/d since the start of the year and are at an all-time record high.

- In sporting terms, the 2020 oil market is now close to the half time mark. So far, initiatives in the form of the OPEC+ agreement and the meeting of G20 energy ministers have made a major contribution to restoring stability to the market. If recent trends in production are maintained and demand does recover, the market will be on a more stable footing by the end of the second half. However we should not underestimate the enormous uncertainties.

-----

Earlier: