OIL PRICE CAP

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

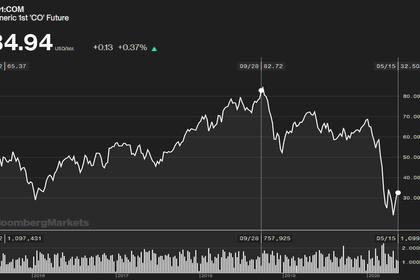

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OIL PRICE CAP

|

|

|

Andy Warr, contributor, Owner of Tophat Finance company.

Tophat Finance deals in transmission of trading data for financial instruments (FX, Indices Futures, OIL, Metals(XAG/,XAU)) with Quantitative Analysis and Research to interested clients so as to gain financial wealth & knowledge.

|

As the Oil Markets keep getting interesting,in relation to the OPEC Meeting regarding agreements and Quotas;

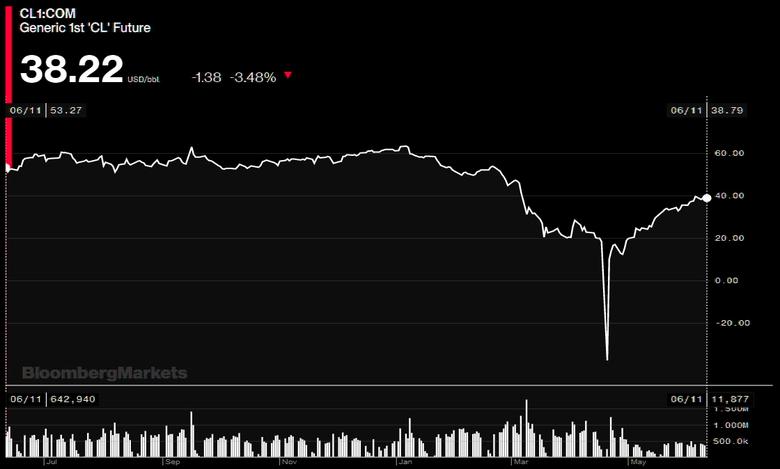

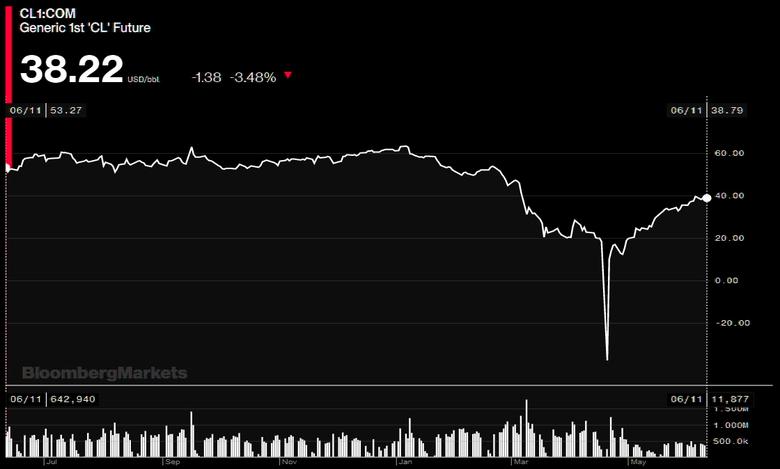

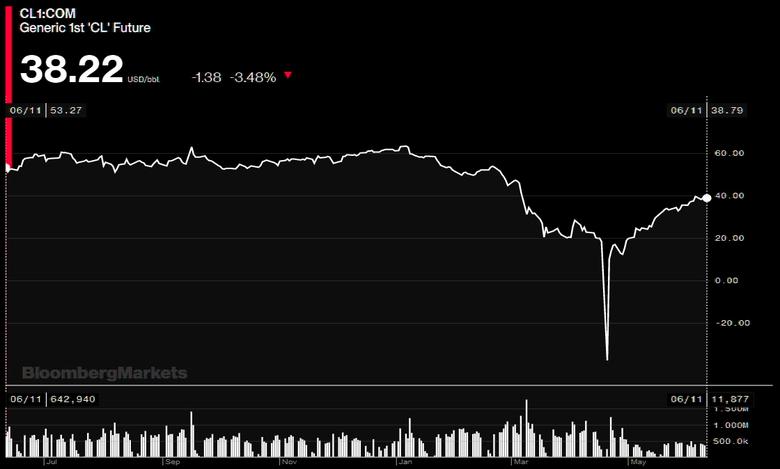

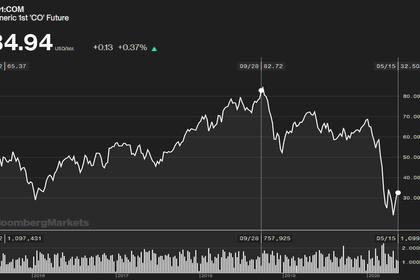

The WTI Cride still remains capped after the 40$/barrel breach earlier on in the week.

This corresponding attempt meets the March 3rd to March 8th Gap,as I write,WTI is trading at 38.06$/barrel.

A decisive close below 36.25$/barrel will prompt a seemingly BEARISH move towards the low price 30$/barrel range and a maximum test at 29.00$/barrel support zone.

Alternatively;a close past the 41.99$/barrel price handle will prompt a gap fill to the 45.25$/barrel.

On the radar is the EIA Crude Oil Stock Change and analysis of the just concluded OPEC Meeting.

Zoom in and Zoom out your binoculars;The Oil will be the rollercoaster of the year,you best get in early to have a front row seat :)

Regards,

Andy Warr.

TophatFinanceGroup.

-----

Earlier:

2020, June, 11, 10:25:00

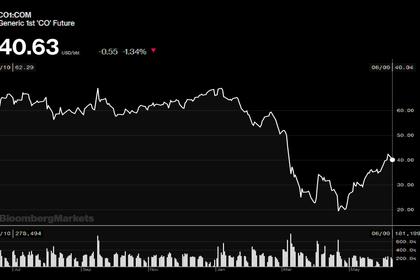

OIL PRICE: ABOVE $40 AGAIN

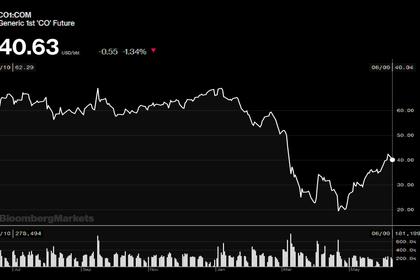

Brent fell 3.4%, or $1.42, to $40.31 a barrel, WTI dropped 4%, or $1.60, to $38 a barrel,

2020, June, 11, 10:15:00

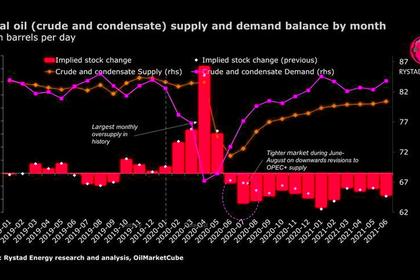

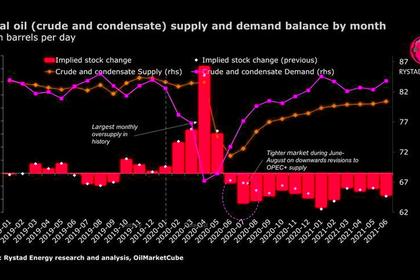

OIL MARKET DEFICIT 4 MBD

The imbalance is forecast to reach 4.6 million bpd in July, 4.2 million bpd in August

2020, June, 10, 12:55:00

OIL PRICES 2020-21: $37-$48

monthly Brent prices will average $37/b during the second half of 2020 and rise to an average of $48/b in 2021.

2020, May, 22, 13:17:00

OIL MARKET BALANCE

"When it comes to oil, there are signs that the market has tightened in recent weeks. The OPEC+ agreement, voluntary cuts outside OPEC-++, and production shut-ins are working together to start to rebalance the market. This will take time. As economies begin to open up, demand will follow, but the path to the next normal is not a straight line," Dr. Sultan Al Jaber, CEO of ADNOC Group and UAE minister of state said.

2020, May, 19, 11:55:00

OIL&GAS INDUSTRY: THE NEXT TRANSFORMATION

To change the current paradigm, the industry will need to dig deep and tap its proud history of bold structural moves, innovation, and safe and profitable operations in the toughest conditions. The winners will be those that use this crisis to boldly reposition their portfolios and transform their operating models. Companies that don’t will restructure or inevitably atrophy.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,