ОПЕК+ РОССИЯ: РОСТ СПРОСА НА НЕФТЬ

МИНЭНЕРГО РОССИИ- Москва, 18 июня. - Министр энергетики Российской Федерации Александр Новак в интервью телеканалу «Россия 24» рассказал об итогах 19-го заседания Совместного Министерского мониторингового комитета стран ОПЕК и не-ОПЕК, динамике спроса на нефть, а также справедливости нынешних нефтяных котировок.

По словам Министра, в рамках заседания все участвовавшие в нем представители стран высказали схожие оценки текущей ситуации на рынке.

«У всех стран и секретариата ОПЕК оценки роста спроса сходятся – при текущей динамике роста спроса и исполнения соглашения отмечается общее планомерное сокращение. Причем, даже у стран, не входящих в ОПЕК+, - примерно на 3,5 млн. баррелей», - сказал он.

Если тенденция продолжится, то участники Соглашения смогут достаточно быстро выйти на снижение нефтяных запасов до среднего 5-летнего значения, отметил Александр Новак.

«Вероятно, это произойдет к концу этого года или к середине следующего. Мы наблюдаем продолжающийся рост спроса по мере снятия режима самоизоляции. При этом, с учетом действующего Соглашения, на баланс спроса и предложения мы должны выйти уже в ближайший месяц-два», - подчеркнул он.

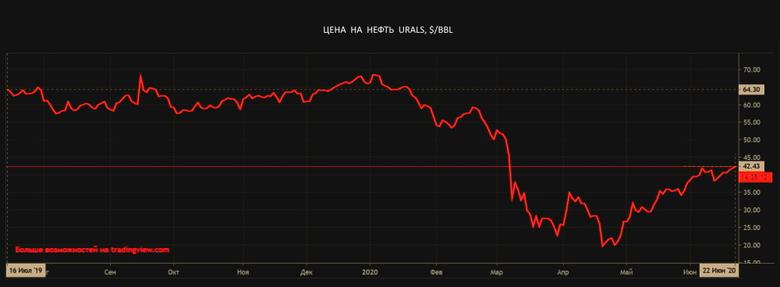

Ценовая тенденция, по мнению главы Минэнерго России, в настоящий момент полностью отражает происходящее на рынке.

«Текущая ситуация на рынке нефти позитивно влияет на котировки - они отражают реальную ситуацию и колеблются около $40», - добавил Министр.

-----

ОПЕК+ РОССИЯ: РОСТ СПРОСА НА НЕФТЬ

REUTERS - JUNE 19, 2020 - Oil prices rose more than 1% on Friday, adding to gains in the previous session, after OPEC producers and allies promised to meet commitments on cutting supply and two major oil traders said demand was recovering well.

Brent crude LCOc1 futures rose 61 cents, or 1.5%, to $42.12 a barrel by 0639 GMT, the highest in more than a week. U.S. West Texas Intermediate (WTI) crude CLc1 futures climbed 60 cents, or 1.5%, to $39.44 a barrel. Both contracts rose about 2% on Thursday and are heading for weekly gains of nearly 9%.

Plans by Iraq and Kazakhstan to make up for overproduction in May on their supply cut commitments supported the market. The promises came out of a meeting by a panel monitoring compliance by the Organization of Petroleum Exporting Countries and its allies, a grouping called OPEC+.

Prices are showing "solidity at these levels, as oil markets ignore the concerns rolling across other asset classes at the moment," said Jeffrey Halley, senior market analyst at OANDA.

"That suggests that prices are supported by physical buyers (which) is welcome as it implies that physical demand across the globe is recovering, with its implications for economic growth," he added.

Brent moved into backwardation on Thursday for the first time since early March, with the August contract rising to 9 cents above September LCOc1-LCOc2 on Friday.

Backwardation occurs when near-term contracts are trading at higher prices than outer months, compared with a contango market structure where outer months trade at higher prices.

Fears about dwindling storage capacity had sent the market into steep contango, as wide as $5, as coronavirus lockdowns hit near-term demand and Saudi Arabia and Russia glutted the market with crude in April.

Comments from global oil traders Vitol and Trafigura on a rebound in oil demand in June, reported by Bloomberg, also buoyed the market, ANZ said.

Traders shrugged off another build in U.S. crude inventories to a new record. Crude stocks USOILC=ECI rose by 1.2 million barrels last week to 539.3 million barrels, compared with expectations from a Reuters poll for a decline of 152,000 barrels.

On the technical side, CMC Markets chief strategist Michael McCarthy pointed to strong resistance in the WTI contract between $40 and $41. Analysts see that level as the point at which more U.S. producers will revive shut-in wells.

-----

Earlier:

2020, June, 19, 10:50:00

OIL PRICE: ABOVE $42

Brent rose 61 cents, or 1.5%, to $42.12 a barrel, WTI climbed 60 cents, or 1.5%, to $39.44 a barrel.

2020, June, 17, 12:50:00

OIL PRICE: NOT ABOVE $41 ANEW

Brent was up 29 cents, or 0.7%, at $41.25 a barrel, WTI rose 17 cents, or 0.4%, to $38.55 a barrel.

2020, June, 16, 14:25:00

OIL PRICE: NOT ABOVE $41 YET

Brent rose 77 cents, or 1.94%, at $40.49 a barrel, WTI gained 61 cents, or 1.64%, to $37.73 a barrel.

2020, June, 16, 14:05:00

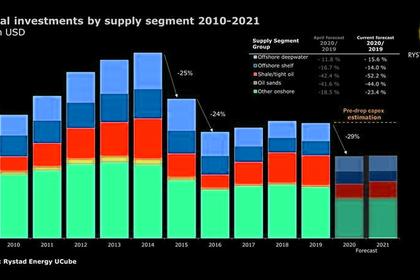

GLOBAL UPSRTEAM INVESTMENTS DOWN

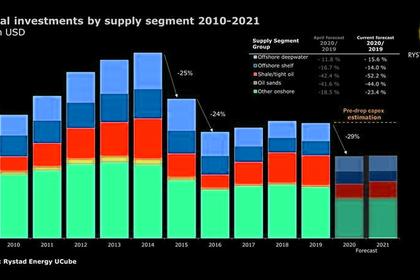

Spending is also expected to be largely flat in 2021, landing only marginally higher than 2020 at $386 billion. Before the Covid-19 pandemic, expected total upstream investment would maintain last year’s levels, both in 2020 and 2021.

2020, June, 16, 13:55:00

U.S. PRODUCTION: OIL (-93) TBD, GAS (-693) MCFD

Crude oil production from the major US onshore regions is forecast to decrease 93,000 b/d month-over-month in June from 7,725 to 7,632 thousand barrels/day, gas production to decrease 693 million cubic feet/day from 81,254 to 80,561 million cubic feet/day .

2020, June, 15, 14:00:00

OIL PRICE: ABOVE $38 YET

Brent was down 15 cents, or 0.4%, at $38.58 a barrel, WTI was down 49 cents, or 1.3%, at $35.77.

All Publications »

Tags:

ОПЕК,

РОССИЯ,

НЕФТЬ,

ДОБЫЧА,

ЦЕНА