RENEWABLE ENERGY PURCHASES

By Ron Miller Principal Reliant Energy Solutions LLC

ENERGYCENTRAL - We see headlines like “McDonald’s Buying Large Blocks Of Renewable Energy” and may wonder how this really works. Are they putting solar panels and wind turbines on their property?

McDonald’s is buying 380 MW of “virtual power” from wind and solar projects for 2,500 of its restaurants. The renewable energy is about the same as taking 140,000 cars off the road for one year. The company set a goal to reduce greenhouse gas (GHG) emissions by 36% by 2030 from the 2015 energy baseline. McDonald’s will buy renewable energy generated by Aviator Wind West, a wind power project located in Coke County, Texas and a solar project located in Texas.

Both of these projects will impact the local community by jointly generating over $200 million in local tax revenue and helping to provide about 600 new short-term construction, operations, maintenance jobs, as well as 13 long-term jobs.

Buying renewable energy certificates (RECs) give companies like McDonald’s a way to offset their carbon footprint while providing a market for renewable energy and allows the renewable developer to have a long-term REC revenue stream to justify the investment anywhere in the US and at different pricing options. A REC is the environmental benefit for one megawatt-hour of energy, but not the energy itself.

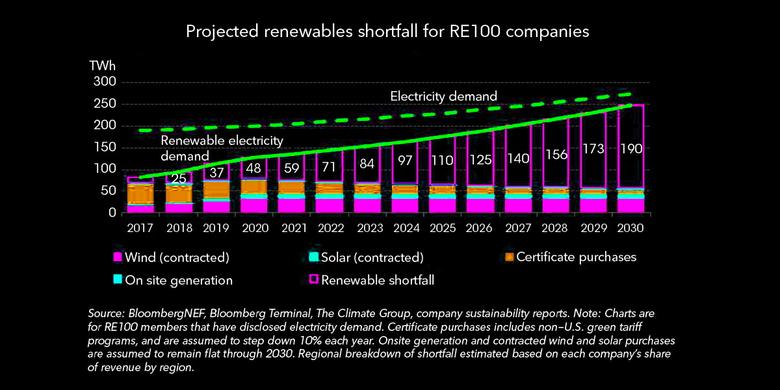

Sixty percent of Fortune 100 companies have set greenhouse gas emission goals. Companies including Walmart, Starbucks, and Johnson & Johnson have all pledged to obtain 100 percent of their electricity from renewable resources.

Energy is fungible in that we don’t have separate transmissions systems for coal, nuclear, gas, solar, wind, biomass, geothermal and hydro generated energy. All energy sources enter the grid meeting transmission specifications, and the different energy sources are indistinguishable in the grid.

The pros of buying RECs include:

- Reducing your carbon footprint, contributing less to pollution and climate change, being more socially responsible

- Promoting your company’s commitment to renewable energy

- Building stronger relationships with community and encouraging dialogue about renewable energy

- Driving more renewable energy generation projects

In 2017, green power products (unbundled RECs) were the most popular purchases by corporate customers, as they accounted for about 46% of renewables-generated electricity sales.

A bundled REC includes the environmental benefit of the renewable energy along with the electricity produced. An unbundled REC includes only the environmental benefit of the renewable energy.

Corporate contracting for utility-scale wind and solar had a record year in 2018 with 4.81 gigawatts (GW) or 4,810 megawatts of deals completed. The majority of renewable capacity is now being built with innovative "virtual" power purchase agreements (VPPAs), though "physical" PPAs are still available.

Source: Renewable Energy Buyers Alliance (REBA)

Renewable Energy Buyers Alliance (REBA) members have now built 14.08 GW of renewables in 17 states using 154 PPAs, VPPAs and green tariffs designed to incorporate their principles. REBA principles are: 1) the investment has to "enable access to or help drive the development of new renewable energy projects and 2) minimize the total cost to the company.

"The market is evolving toward customers, especially corporate buyers, who want to directly support new projects," commented NREL Research Scientist and report lead author Eric O'Shaughnessy.

Initially, most corporate purchases were physical PPAs, but that has shifted to larger projects contracted through VPPAs, which NREL calls financial PPAs. "There are more projects built with physical PPAs, but the megawatts of capacity is bigger for financial PPAs," O'Shaughnessy said.

There are now 23 green tariffs in place, according to WRI. In the first ten months of 2018, businesses had built 678.5 MW of new renewables with them, bringing the total green tariff build to 1778.5 MW. There are another 1,070 MW being negotiated.

Cummins, a Fortune 500 company, targeted a 32% company-wide reduction in energy use intensity and greenhouse gas emissions intensity by 2020, and moved forward with its first VPPA, choosing a portion of the output of a wind project in PJM's Indiana market. The project is at a distance from Cummins' Indiana location in regulated investor-owned utility (IOU) Duke Energy's territory. Cummins added two requirements: 1) the project had to have significant environmental and social impact, and 2) it funded a locally-supported Indiana project, reducing Indiana emissions and creating Indiana jobs.

Cummins will pay a fixed price for the 15-year term of the contract, and the project's electricity will go into the PJM day-ahead and real-time markets serving the region where the project is located. The VPPA is a good deal as the developer receives a guaranteed, long-term fixed price contract to enable financing for the project, but Cummins gets a floating market price in return. The project developer of the wind farm takes responsibility for managing the delivery and sale of the electricity produced on the merchant market.

VPPAs add value to a corporate buyer both because they provide low-cost, fixed-price power and RECs for more than a decade and because they represent an additional renewable resource coming onto the grid.

Using a VPPA format, the buyer doesn’t take legal title to the energy. The buyer continues to receive physical power from its utility or retail provider, allowing the buyer to utilize a VPPA in a different region than where it uses electricity.

The buyer agrees to pay the seller a fixed price for every MWh renewable energy generated by the project. This fixed PPA price is the guaranteed price the developer will receive for its project.

Similar to a physical PPA, the seller in a VPPA is typically a renewable energy project developer who builds, owns and operates the project. The fixed PPA price it receives from the buyer under the VPPA is the revenue source used to finance the construction of the project.

The advantages of a VPPA renewable energy transaction for a corporation like McDonald’s are:

- Fixing long-term energy prices

- Taking advantage of all-time low costs of renewable energy and the developer capturing the value of declining tax benefits

- Eliminating energy price volatility

- Avoiding scope 2 emissions

- Satisfying customer demands for cleaner industrial processes

- Providing an opportunity to save money

What are the key project considerations for a successful VPPA?

- Location of solar or wind resources

- Contracting for a renewable project on the same electric grid/state as company’s electrical load

- Markets with “open access” or “nodal” markets work best

- Length of the agreement as 15 to 20 years, similar to a home mortgage

- Long-term power price forecasts

- Performance security for a buyer to ensure project completion

- Accounting treatment

- Locational basis risk for the change in energy prices at two differing points of sale

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----