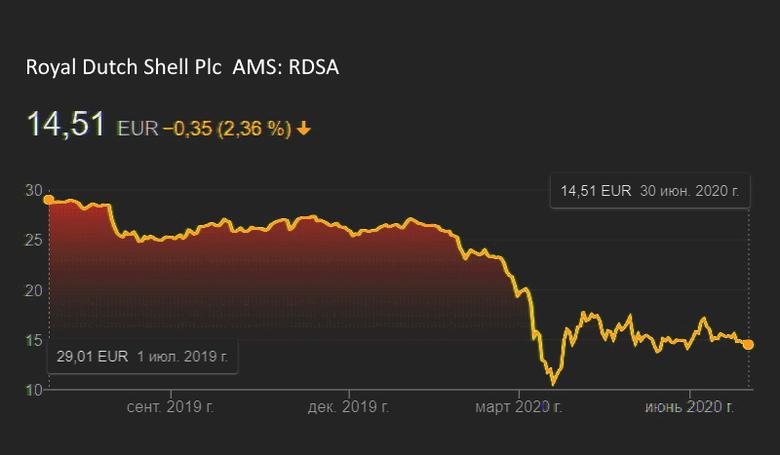

SHELL WRITE OFFS $22 BLN

SHELL - Jun 30, 2020 - Shell second quarter 2020 update note

This is an update to the second quarter 2020 outlook provided in the first quarter results announcement on April 30, 2020. The impacts presented here may vary from the actual results and are subject to finalisation of the second quarter 2020 results.

Unless otherwise indicated, presented post-tax earnings impacts relate to earnings on a current cost of supplies basis, attributable to shareholders, excluding identified items.

In addition, given the impact of COVID-19 and the ongoing challenging commodity price environment, Shell continues to adapt to ensure the business remains resilient. In light of this, Shell is announcing today a revised long-term commodity price and margin outlook, which is expected to result in non-cash impairments in the second quarter results. Details of the outlook and impairments are provided in the later part of this document.

Integrated Gas

- Production is expected to be between 880 and 910 thousand barrels of oil equivalent per day

- LNG liquefaction volumes are expected to be between 8.1 and 8.5 million tonnes

- Additional well write-offs in the range of $250 to $350 million are expected compared with the second quarter 2019. No cash impact is expected in the second quarter

- Deferred tax charges are expected to have a negative impact on earnings in the range of $100 to $200 million. No cash impact is expected in the second quarter

- Trading and optimisation results are expected to be below average

- As previously communicated, more than 90% of our term contracts for LNG sales in 2019 were oil price linked with a price-lag of typically 3-6 months. Consequently, the impact of lower oil prices on LNG margins became more prominent from June onwards

- CFFO in Integrated Gas can be impacted by margining resulting from movements in the forward commodity curves. Margining inflows are not expected to be significantly different from those received in the first quarter 2020

Upstream

- Production is expected to be between 2,300 and 2,400 thousand barrels of oil equivalent per day. Although this production range is higher compared with the outlook previously provided, it has had a limited impact on earnings in the current macro environment

- Updates related to receivables and inventory provisions are expected to have a negative earnings impact in the range of $200 to $400 million compared with the second quarter 2019. No cash impact is expected in the second quarter

- As previously communicated, CFFO is expected to be negatively impacted by the Lula unitisation settlement in Brazil of around $500 million, for which the earnings impact was recognised in the third quarter 2018

- While earnings are expected to show a loss, CFFO is not expected to reflect equivalent cash tax receipts due to the build-up of deferred tax positions in a number of countries. Additionally, due to phasing impacts, tax payments are expected in the second quarter

Oil Products

- Refinery utilisation is expected to be between 67% and 71%

- Realised gross refining margins are expected to be significantly lower compared with the first quarter 2020 and are expected to be offset by higher trading and optimisation results

- Oil Products sales volumes are expected to be between 3,500 and 4,500 thousand barrels per day, driven by a significant drop in demand related to the impact of COVID-19

- Updates related to receivables provisions are expected to have a negative earnings impact in the range of $200 to $300 million. No cash impact is expected in the second quarter

- Working capital in Oil Products are typically impacted by movements between the quarter opening and closing price of crude along with changes in inventory volumes. Inventory volumes are expected to be higher compared with the end of the first quarter 2020, impacting working capital negatively

Chemicals

- Chemicals manufacturing plant utilisation is expected to be between 75% and 79%

- Chemicals sales volumes are expected to be between 3,400 and 3,700 thousand tonnes

Corporate

- Corporate segment earnings excluding identified items are expected to be a net expense at the lower end of the $800 to $875 million range for the second quarter. This excludes the impact of currency exchange rate effects

- CFFO is expected to be impacted by a working capital outflow in respect of margining and settlement of operational foreign exchange instruments.

Revised commodity price and margin outlook and impairments

In the second quarter 2020, Shell has revised its mid and long-term price and refining margin outlook reflecting the expected effects of the COVID-19 pandemic and related macroeconomic as well as energy market demand and supply fundamentals. This has resulted in the review of a significant portion of Shell’s Upstream, Integrated Gas and Refining tangible and intangible assets.

The Refining asset valuation updates reflect Shell’s strategy to reshape and focus its refining portfolio to support the decarbonization of its energy product mix, leveraging assets and value chains in key markets. The Upstream and Integrated Gas asset valuation updates, including of related exploration and evaluation assets, are largely driven by the change in long-term prices with some impacts due to a changed view on the development attractiveness. A revision in the decommissioning and restoration provision discount rate assumption from 3% to 1.75%, reflecting a lower interest rate environment, has impacted the asset values tested for impairment.

- The following price and margin outlook have been assumed for impairment testing:

- Brent: $35/bbl (2020), $40/bbl (2021), $50/bbl (2022), $60/bbl (2023) and long-term $60 (real terms 2020)

- Henry Hub: $1.75/MMBtu (2020), $2.5/MMBtu (2021 and 2022), 2.75/MMBtu (2023) and long-term $3.0/MMBtu (real terms 2020)

- Average long-term refining margins revised downwards by around 30% from previous midcycle downstream assumption

- Based on these reviews, aggregate post-tax impairment charges in the range of $15 to $22 billion are expected in the second quarter. Impairment charges are reported as identified items and no cash impact is expected in the second quarter. Indicative breakdown per segment is as follows:These impairments are expected to have a pre-tax impact in the range of $20 to $27 billion. The Goodwill intangible assets were assessed and no impairment charge on Goodwill is expected to be recorded in the second quarter

- Integrated Gas $8 – $9 billion, primarily in Australia including a partial impairment of the QGC and Prelude asset values

- Upstream $4 – $6 billion, largely in Brazil and North America Shales

- Oil Products $3 – $7 billion across the refining portfolio

- Impairment calculations are being progressed: the range and timing of the recognition of impairments in the second quarter are uncertain and assessments are currently ongoing

- The revised outlook for commodity prices and refining margins could impact overall deferred tax positions, which will be reviewed after the finalisation of the operating plan later in 2020

Other

- Gearing is expected to increase by up to 3% due to the impairments. Additional impacts to reported gearing levels are expected due to pensions revaluations associated with the current interest rate environment along with other usual quarterly movements

- As per previous disclosures, CFFO price sensitivity at Shell Group level is still estimated to be $6 billion per annum for each $10 per barrel Brent price movement

- Note that this price sensitivity is indicative, is most applicable to smaller price changes than those in the current environment and in relation to the full-year results. This excludes short-term impacts from working capital movements and cost-of-sales adjustments

- In order to enhance our disclosures and market communications, a quarterly press release will be published as of the second quarter 2020, in addition to the quarterly unaudited results. The quarterly press release will provide a summary of key messages and key performance drivers and should not be considered in isolation from, or a substitute for, financial information presented in compliance with Generally Accepted Accounting Principles (GAAP). To further simplify market communications, with effect from the second quarter, “CCS earnings attributable to shareholders excluding identified items” will be renamed to “Adjusted earnings” while the definition remains unchanged

Consensus

The consensus collection for quarterly earnings and CFFO excluding working capital movements, managed by VARA research, is scheduled to be opened for submission on July 8, 2020, closed on July 22, 2020, and made public on July 23, 2020.

-----

Earlier:

2020, May, 19, 11:40:00

SAUDI ARABIA'S INVESTMENT $7.7 BLN

The $300 billion Public Investment Fund bought stakes in global corporate leaders such as Boeing, Facebook, Disney, Marriott and Starbucks. It also invested in two big US banks, Citigroup and Bank of America, and took holdings in oil giants BP, Total and Royal Dutch Shell.

|

2020, May, 14, 15:45:00

SHELL INVESTMENT TO NIGERIA'S LNG

Shell announced that all conditions for its Final Investment Decision (FID) on a new LNG processing unit at Nigeria LNG (NLNG) have now been met.

|

2020, May, 8, 11:30:00

SHELL, ENECO WIND POWER

Shell and Eneco are participating in the tender for Hollandse Kust (noord) through their joint venture CrossWind.

|