CHINA'S GAS DEMAND WILL UP

GAZPROM - June 26, 2020 - Interview with Alexey Miller, Chairman of Gazprom Management Committee, on outcomes of Shareholders Meeting

- Mr. Miller, the outcomes of Gazprom's Shareholders Meeting were announced today. Could you please tell us what are your five highlights from last year?

-

It was an extremely eventful year for Gazprom. If you want me to choose just five highlights, I would certainly start with the development of the resource base. We expanded our capacities at the new gas production center in Yamal, which is of key importance to our country. In 2019, we followed up the development of the Bovanenkovskoye field by starting to develop the Kharasaveyskoye field, which is located farther north and is unique in terms of reserves.

A second highlight was the successful operation in the autumn/winter season. Our performance was confident as usual, thanks in large part to underground storage facilities. In 2019, we brought their deliverability to an all-time record of 843.3 million cubic meters per day. As a result, the reliability of our gas supplies in winter reached a new level.

Clearly, a third highlight goes to our projects in external markets. We enhanced our export potential and launched not one but two new export corridors – TurkStream and Power of Siberia. This means even more reliable supplies to the West in parallel with the implementation of long-term strategic agreements with China in the East.

Russian gas processing projects are the fourth highlight. Their significance for Gazprom has been growing tremendously in recent times. Last year, we passed the halfway point in the construction of the Amur Gas Processing Plant and kicked off the project in Ust-Luga. Both of those facilities will join the ranks of the largest facilities in the world. I would also like to single out the successful project finance deal for the Amur GPP. The EUR 11.4 billion transaction is the largest deal in the history of Gazprom.

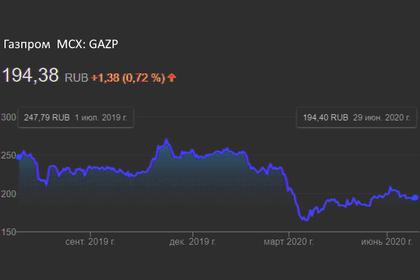

My fifth and, I suppose, last highlight is our financial performance. Gazprom remains steady in its work. The Company is very durable, as evidenced by our dividends We are going to pay out RUB 360.8 billion, essentially the record-breaking level of last year, despite the challenging situation that is currently facing the global economy at large and the energy sector in particular.

- Has this challenging situation affected the Company's projects in any way? What are the current plans and what is Gazprom working on?

-

Gazprom has a clearly outlined goal-setting system. Among our goals is the annual replenishment of the resource base. Thanks to geological exploration activities, our reserve replacement ratio consistently exceeds 1. It has been like this for the past 15 years, and it will remain so in 2020. Yamal accounts for the bulk of the new reserves. This year has already seen a discovery of another major field in the region, which we named 75 Years of Victory.

At present, Gazprom's investment activity is primarily focused on Yamal and the East. In Yamal, we continue the pre-development of the Kharasaveyskoye field: in June, as planned, we started production drilling there. Recently, we began building a comprehensive gas treatment unit. We welded and laid one-fifth of the connecting gas pipeline to Bovanenkovo. As early as 2023, first gas from the field will be fed into the Unified Gas Supply System.

We have a very heavy workload at the Kovyktinskoye field in the Irkutsk Region. We continue to build wells. This year, we are starting to construct the first CGTU and the section of Power of Siberia stretching from Kovyktinskoye to the Chayandinskoye field.

Active work is being done at the Sakhalin gas production center: this year, two wells will be hooked up at the Kirinskoye field.

As our geographic reach keeps expanding, the gas we are extracting keeps changing in composition. We are producing increasingly more multi-component, ethane-containing gas. This refers to not only the new eastern fields – Chayandinskoye and Kovyktinskoye – but also the deeper-lying deposits in the Nadym-Pur-Taz region of Western Siberia.

This is the tangible reason for the significant enhancement of our processing activities. In the East, we are building the Amur Gas Processing Plant. In the West, we are constructing the complex in Ust-Luga. These facilities will be among the largest in the world. Moreover, the Amur GPP will be the biggest global producer of helium, while the complex in Ust-Luga will have the largest output of liquefied natural gas in Northwestern Europe. And, of course, processing generates added value, which means a sizable additional monetary flow.

As regards our work in the European market, we continue providing reliable gas deliveries to our consumers. We hold our position as the largest exporter there. The period the gas market is going through today is not an easy one. There are difficulties for all of its participants, but we have a larger reserve to withstand any challenges. Gazprom has a whole range of significant advantages, such as a robust resource base, a well-balanced trading portfolio, along with flexible conditions of supplies and modern tools for trading. That is why we step up our cooperation activities even at this time; for instance, we have just signed a new long-term contract for gas supplies to Greece.

Speaking of the financial situation, Gazprom maintains a high level of stability and reliability. By the beginning of this year, we accumulated a significant liquidity cushion amounting to over USD 22 billion across the Group. Investors show a great deal of trust in us; this year, we placed two issues of bonds in US dollars and euro, and two ruble bonds, all of them on very favorable terms. On Monday, we are going to close one more deal in US dollars.

According to all of the “Big Three” international agencies, i.e. S&P, Moody's and Fitch, Gazprom's long-term credit ratings remain unchanged, whereas the ratings or the rating outlooks for many foreign oil and gas companies have been lowered by at least one of those agencies.

By the way, a decline in gas demand is not a universal trend for foreign markets. For instance, China is continuously ramping up both gas consumption and gas imports.

- In general, how would you assess the potential for cooperation between Gazprom and China?

-

The potential is very high. China's demand for gas will grow at a very high pace. Last year, gas consumption in China grew by almost 10 per cent, thus exceeding 300 billion cubic meters. In 15 years, the demand for gas in the country may double.

Today, Gazprom is supplying gas to China via the Power of Siberia gas pipeline. In just a few years, we will increase the supply volume to 38 billion cubic meters. The supplies via Power of Siberia will grow faster than both the imports of LNG and the gas supplies from Central Asia to China.

I would like to note that Gazprom and its Chinese partners are currently negotiating an increase of gas supplies via the Power of Siberia pipeline by 6 billion cubic meters, i.e. to 44 billion cubic meters of gas per year, as well as the ways to arrange gas supplies from Russia's Far East, along with the construction of Power of Siberia 2 and the western route. Considering all of this, we can say that in the foreseeable future the volume of pipeline gas exported to China will exceed 130 billion cubic meters, which is comparable with our supply volumes to the traditional markets.

- As for gas grid expansion in Russian regions, what is the main item on your agenda?

-

The main item, of course, is the task set by the President of Russia as regards the implementation of the gas supply and gas grid expansion programs in Russian regions. We have been given totally clear timeframes for the stages and completion: the years 2024 and 2030.

-----

Earlier: