STOCKMARKETS UPDOWN

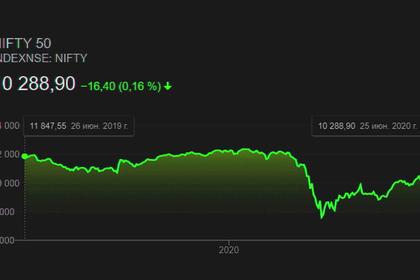

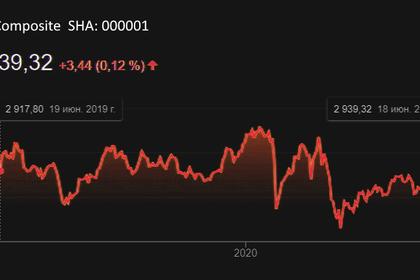

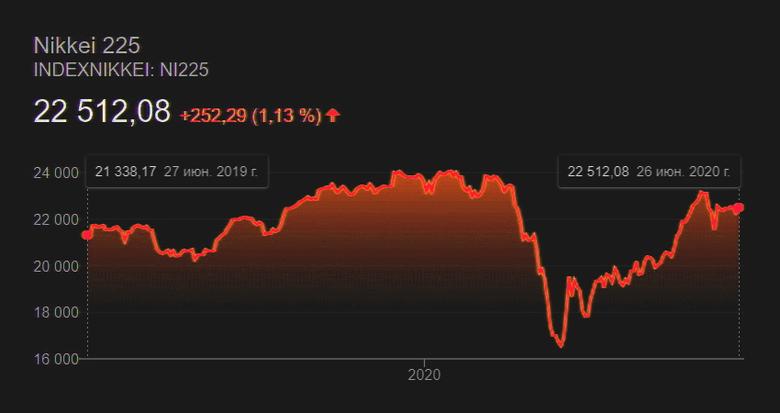

REUTERS - JUNE 26, 2020 - Asian stock markets ground higher on Friday, but are set to end a choppy week with only slight gains as surging coronavirus infections cast a shadow over encouraging economic data and checked hopes for a swift global recovery.

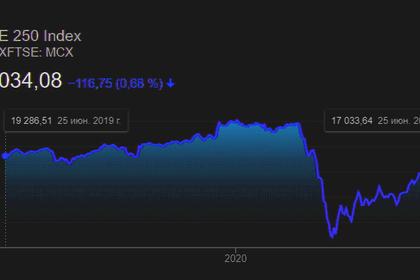

MSCI's broadest index of Asia-Pacific shares outside Japan MIAPJ0000PUS rose 0.5%, for a weekly gain of around 0.7%. Japan's Nikkei .N225 rose 1.3% to sit 0.4% higher for the week.

Bulls seem to have the upper hand in currency markets, with the U.S. dollar down 0.3% for the week, and riskier currencies such as the Australian dollar marginally ahead. [FRX/]

U.S. stock futures were 0.1% higher in afternoon trade in Asia, while European futures pointed to small Thursday gains extending. German DAX futures FDXc1, Britain’s FTSE futures FFIc1 and EuroSTOXX 50 futures STXEc1 all rose about 1%.

“We’re stuck in a bit of a range,” said Shane Oliver, chief economist at AMP Capital in Sydney. “There’s a degree of optimism that any second wave will be offset by stimulus ... but if we have to go back to a renewed lockdown then it’s a different story, and markets face a lot more downside risk.”

The moves followed a bumpy session on Wall Street, which finished in positive territory after a late surge led by banking stocks.

Still, volumes were light and plenty of headwinds remain.

The governor of Texas paused the state’s reopening as COVID-19 infections and hospitalizations surged and the United States set a new record for a one-day increase in cases.

Localised restrictions to slow the virus have now been re-imposed in parts of Lisbon in Portugal, western Germany, Australia’s Victoria state and Beijing. Australia’s biggest grocer also reinstated buying limits on toilet paper after another rush in stores.

The U.S. Senate also passed legislation that would impose mandatory sanctions on people or companies that back efforts by China to restrict Hong Kong’s autonomy, yet another potential Sino-U.S. flashpoint.

To become law it must also pass the House and be signed by President Donald Trump. Support for pro-democracy protests in Hong Kong has slipped, but retains backing of a slim majority, a survey conducted for Reuters showed.

Hong Kong's Hang Seng index .HSI fell 0.6% in on Friday, after being closed for a holiday on Thursday. Markets in China and Taiwan remain closed. [.HK]

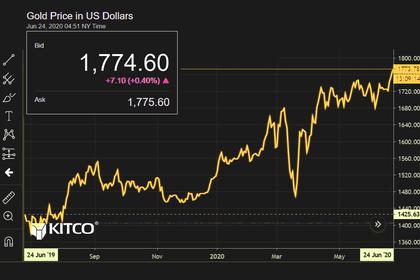

The U.S. Treasury market was quiet, with the yield on benchmark 10-year Treasuries US10YT=RR steady at 0.6807%. Gold XAU= held steady at $1,759.81 an ounce. [US/] [GOL/]

PAYBACK

The tug of war between bulls and bears this week has sent the S&P 500 .SPX ahead by as far 1.8% and down by as much as 2.4% on the week, with Thursday's gains leaving it flat.

Foreign exchange markets have likewise stalled, as the virus’ progress dents confidence in bets on further gains in hard-running riskier currencies.

“Having risen for three straight months, some payback may be due for stocks and currencies in July,” strategists at Singapore’s DBS Bank said in a note on Friday.

“We would avoid currencies – Indonesian rupiah, Australian dollar and New Zealand dollar – that appreciated most in June and Q2.”

Moves in majors were small on Friday, with the Aussie AUD=D3 steady at $0.6889, up 0.8% for the week, and the kiwi NZD=D3 edging ahead to $0.6444, for a 0.6% weekly gain. The Aussie has rallied 25% from March lows and the kiwi 18%.

After a mixed bag of U.S. data overnight, markets are looking for reassurance from European confidence surveys and U.S. spending data due later on Friday.

Oil prices, a barometer of energy consumption and so the global growth outlook, edged ahead to hold steady for the week.

U.S. crude CLc1 futures were last up 1.3% or 49 cents to $39.21 per barrel and Brent futures LCOc1 rose 1.4% to $41.62 per barrel.

-----

Earlier: