THE NEW CHINA'S COAL

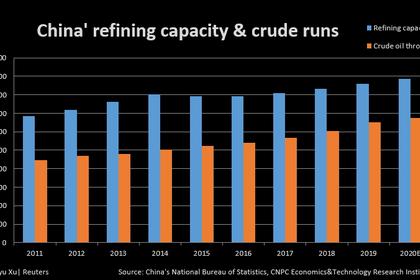

FT - JUNE 25, 2020 - China is approving plans for new coal power plant capacity at the fastest rate since 2015, in a sign that pressure to stimulate the economy is undermining a transition towards cleaner energy sources. New coal plant projects proposed this year in China would add more than 40GW to the country’s power supply, according to new data — comparable to the entire existing fleet of South Africa.

The news will fuel concerns that urgent efforts to stimulate economies devastated by virus lockdowns will push global emissions to levels higher than those recorded before Covid-19. Survey data from the Global Energy Monitor and the Centre for Research on Energy and Clean Air also show that China approved the construction of more coal power plant capacity in the period to mid-June than in all of 2018 and 2019 combined.

China is already the world’s biggest emitter of greenhouse gases and pollution levels there have quickly rebounded after lockdown. “It is very concerning if China goes ahead and builds this degree or quantity of coal fired power,” said Sam Geall at the University of Sussex and editor of China and the Environment. “It could lead to a disaster in terms of the climate.”

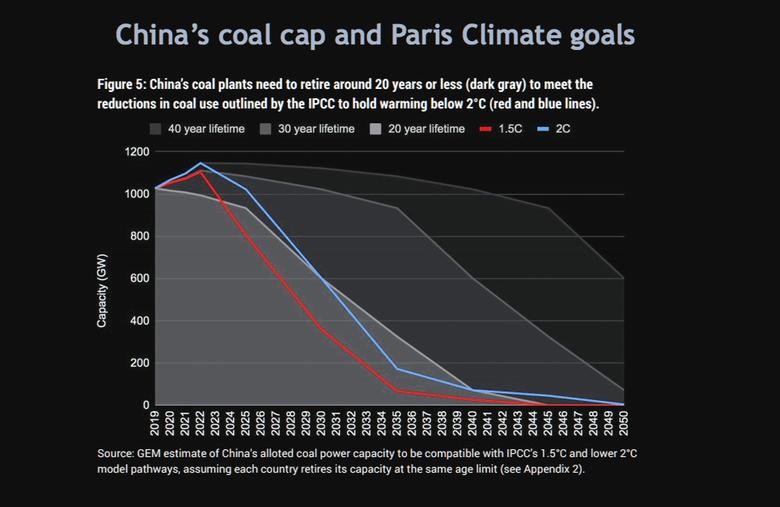

China’s energy policy will be crucial to determining the success of the Paris climate agreement, which aims to limit global warming to less than 2C. The new coal plants, often used by regional and provincial governments as a means to stimulate their economies, threatens to compromise environmental targets set by China’s central government. “In the past year or so, we seem to be seeing quite mixed messages coming from the centre on the future of coal,” added Mr Geall. Last week six Chinese ministries stated the need to “consolidate the work of resolving excess coal production”, signalling Beijing’s apparent concern over the pace of new projects.

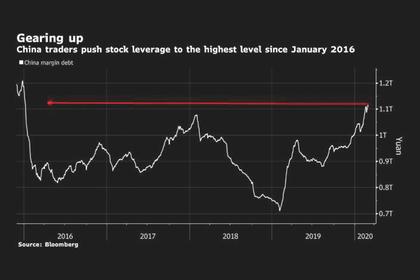

Christine Shearer, programme director for coal at Global Energy Monitor, said: “It really looks like the provinces are taking the initiative to build a lot of coal plants and the central government is now getting alarmed at how many there are.” A boom in coal plant approvals comes against the backdrop of rising industrial activity after growth turned negative in the first quarter for the first time in more than 40 years. Infrastructure stimulus has helped push steel production to record levels this year at a time when output from other big producer nations has fallen.

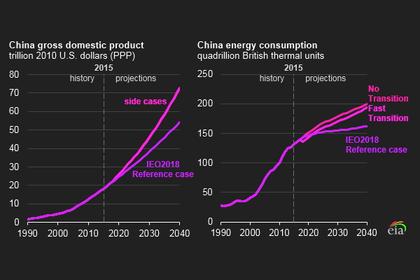

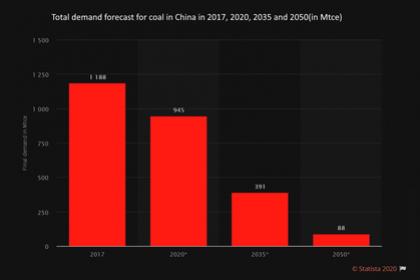

“It does look like a response to the slowdown after Covid-19, because we started to see a big increase in permitting after March,” Ms Shearer added. The rise in the number of planned coal plants follows a five-year period in which China tried to reduce its dependence on the heavily polluting commodity. China is the world’s largest producer and consumer of coal and last year it still made up more than half of its energy mix. China pledged to reach a peak of carbon emissions by 2030 as part of the Paris climate change agreement. In 2016, the government suspended construction of hundreds of coal plants as the country grappled with overcapacity and pollution. But many of the projects were restarted as economic growth slowed.

Concerns are growing that the world’s two largest polluters, China and the US, will both fail to curb their emissions with the Trump administration preparing to withdraw formally from the Paris pact in November. While blocs such as the EU are preparing to make their climate goals a central part of economic stimulus measures, the new data suggest that China risks moving in the opposite direction. In addition to plans for new plants, China’s production of coal has also increased this year. In the first five months of the year, it produced almost 1.5bn tonnes, up 0.9 per cent year on year.

Robert Rennie, global head of market strategy at Westpac, a bank, said the international coal market remained depressed, with prices down about 20 per cent this year. He said the existence of quotas on imports to China limited the potential benefits to exporters in Australia, where miners have shipped large quantities of iron ore to China. “Whether the heavy industrial policy we’re looking at and improving air quality can necessarily coexist I think is questionable,” he added.

-----

Earlier: