U.S. ENERGY STRATEGY ROLE

CSIS - Just before the world shut down to battle Covid-19, the U.S. Congress was negotiating all sorts of bills designed to advance energy innovation, energy technology deployment, and energy manufacturing. The Senate Energy and Natural Resources Committee, for example, put forward the American Energy Innovation Act, a carefully thought out and negotiated down payment toward a more deliberate energy innovation strategy for the United States. The bill was criticized as too modest because it stayed well within the bounds of the committee’s jurisdiction (no tax incentives or policy adjustments that would have waded into the territory of other committees). But it did lay out some important steps toward recognizing that the United States must redouble its efforts to compete in the advancement of strategically important sectors like battery storage and nuclear power. While the bill failed to advance due to a disagreement over a hydrofluorocarbon amendment, it, along with many other bills, represents an important opportunity to advance a conversation about the future of U.S. energy competitiveness, innovation, and industrial strategy. While society remains in the midst of a pandemic-induced economic shutdown, opportunities to take action on this agenda remain on ice, but as soon as the conversation about how to “build back better” starts in earnest, this theme may be back even bigger than before.

The last remaining bipartisan area of agreement in Washington is concern over U.S. competitiveness relative to other countries, particularly China. According to the Council on Competitiveness, no matter the measure or sector of the economy, the United States is either newly lagging or weakening in its leadership across the board. Solutions to this problem include fixing the education system and fostering STEM education, investing more money in research and development, and playing modern-day whack-a-mole through punitive trade measures to “level the playing field” against foreign competitors, here again particularly China. From Elizabeth Warren to Joe Biden, and from Mitt Romney to Donald Trump, politicians are worried about U.S. competitiveness because Americans feel the pressure that greater global competition puts on the U.S. economy and leaves them wondering about our collective future.

Energy plays a strategic role in almost everyone’s thinking about the future of the U.S. economy. Members of the Trump administration think cheap energy for domestic consumption and growing energy exports are the recipe for growth. Proponents of a Green New Deal think a mass mobilization of government policy and resources will bring about a new economic and social compact for the country. Even the political space between these two extremes is occupied by voices in favor of mostly free-market dimensions to the energy sector but with either enhanced energy innovation in one or more strategically important technologies or policies designed to steer a free-market economy toward lower carbon-resources through the implementation of a carbon price (some people favor both).

This sentiment extends beyond Washington into nearly every corner of the United States—where state and local jurisdictions see their energy sectors, whether anchored in extractive industries like coal, oil, and natural gas, or energy manufacturing industries like wind, solar, battery technologies, nuclear, or biofuels, as an important part of their growth strategy and often tied to trade and competition with other countries.

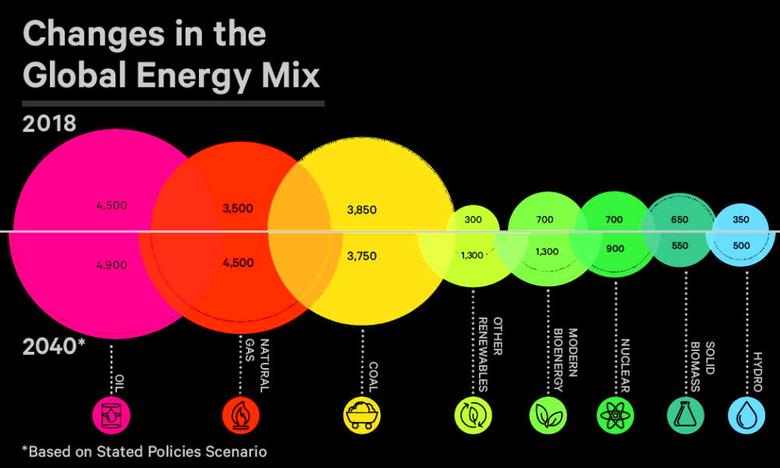

Energy is a great sector for thinking about strategic competition. First, unlike many other technology or commodity areas, energy is a basic input into any economy, without which no real economic growth, security, and national security can exist. Second, the competitive landscape for energy is changing in some profound ways. From an era of resource scarcity where owners and producers of energy resources held all the market leverage to an era of energy abundance where producers of energy resources—increasingly diverse and affordable resources as well—must compete for access to markets and new consumers. Gone are the days when having a large resource base automatically conferred strength and advantage. Oil market dynamics, even before the recent crash in demand, were a perfect example of this decline in market power by producers. This is particularly true in light of the widespread assumption that lower carbon fuels and technologies will be more competitive and more desirable going forward and the corresponding assumption of diminishing future value for high carbon resources like coal, oil, and natural gas (absent emissions controls), which currently make up over 80 percent of energy consumption.

Despite this rare bipartisan area of agreement, few people in policymaking circles would use the terms “industrial strategy” to describe their prescribed solution to nearly any area of economic policymaking. Opposition to this term has more to do with semantics and a romanticized view of the free-market capitalist system they think drives the U.S. energy sector. In fact, the United States has routinely engaged in and continues to support elements of industrial policy with regard to the development of our energy industry. The United States has tax incentives for nearly all energy resources, favorable or unfavorable regulations for specific energy resources depending on the administration, liability coverage for technologies like nuclear power, and infrastructure investments to support energy resource development. No energy resource in the United States has come about without some form of government support. Industrial policies or support and even innovation policy, however, are not the same as an industrial strategy. The difference is a distinction about what kind of goals or attributes you want to instill in your economy through the use of law, regulation, and investment. On this point, there are different views.

Early in 2017, Senator Marco Rubio published a report on U.S. competition relative to China called the Made in China 2025 and the Future of American Industry report (after China’s strategic planning document). In the report, the senator outlines several areas where the Chinese have laid out a strategy to be the world leader in specific technologies. In the energy sector, these include nuclear power, renewable electricity, battery technologies, and electric vehicles. The report concedes that “the U.S. cannot escape or avoid decisions about industrial policy” and that “in a world of state competition for valuable industries, a domestic policy of neutrality among activities is itself a selection of priorities.” Rather than losing out on several areas of strategic competition with China and failing to have the kind of vibrant economy we hope to see (characterized by Marco Rubio as one with “dynamism” that creates lots of new small businesses that can scale), the United States should engage in debate about how to have economic outcomes that are better for our core strategic interests and population as a whole.

Other proponents of a more deliberate industrial strategy come from different perspectives, each of which lends a particular color to their approach. Economist Marianna Mazzucato recommends the appropriate place for more state-led intervention is in creating an overarching goal for a national economy that has some societal value. In her case, she recommends decarbonization to fight climate change. This idea is central to some of the themes found in the Green New Deal and many of the policy platforms put forth by progressive democratic candidates for president. Proponents of a form of localized, innovation-driven competitiveness like Simon Johnson, advocate for local innovation clusters. This idea of local economic revitalization through innovation forms a sort of subnational industrial strategy in many states. Finally, some voices in the national security community advocate greater government intervention, strategy, and robust support for reinvigorating the U.S. nuclear industry on the grounds of national security.

The drumbeat for more careful consideration of the shape of the U.S. economy has only intensified since the onset of Covid-19. The realization that our economy, supply chains, and industrial base are vulnerable is a rude awakening for nearly everyone. Just last week, Senator Rubio doubled down on his call for a more deliberate industrial strategy by calling for a more resilient U.S. economy in the wake of this global pandemic. Some Democrats see the potential for a once in a decade stimulus and infrastructure package supported by robust energy and climate policy agenda from Biden’s platform as one of the biggest potential opportunities to save the economy and the planet. All this while, the idea of a greater government role in the private industry doesn’t seem quite as far-fetched, as government crafts a multitude of stimulus efforts to bail out industries—most notably in the energy sector with a proposal to take equity shares in exchange for support of the U.S. oil and gas industry.

What would an industrial strategy for the U.S. energy sector look like? The first step would be to set some goals, as in what energy segments do we want to compete? Anyone watching the energy transition underway knows this means making all forms of energy more competitive in a low carbon energy system—don’t fight to momentum, lean into it. The second step is to invest in innovation to ensure the United States has a hand in inventing our energy future. For instance, the local innovation ecosystem idea has particular promise. The third step is to invest in infrastructure that catalyzes broader transition. This is not just about money but about negotiating a path forward for infrastructure projects that might find opposition in local communities or across state lines. This third step could also allow for a robust jobs program—focused on infrastructure jobs that put people back to work in socially distant compliant ways in the near term.

The fourth step is to create market pull incentives such as policies, standards, tax incentives, and pricing policies (yes, that’s a euphemism for a carbon price if that’s your preferred mechanism) that allow the deployment of technology to happen faster, make us more competitive and help to bend the curve on emissions. The fifth step is to coordinate our domestic competitiveness strategies with other countries. Which countries shall we cooperate with as part of our R&D strategy? Which countries do we need and want as part of our diversified supply chain? And what is our commercial strategy to deal with and compete again countries to drive U.S. competitive advantage while at the same time creating positive momentum to a low carbon technology future?

The important thing is not to cut our nose off to spite our face. Multilateral institutions and international cooperation offer the United States perhaps the greatest strategic advantage we could hope for—by setting standards of behavior and shaping market participation that can create the market conditions under which we succeed and the entire world benefits. The United States has very few limitations when it comes to our clean energy potential. And each of these steps can be applied to nearly every energy resource and technology we have that can be done in ways to let competition thrive within the context of some overarching strategic goals.

One final note of caution. The United States cannot outcompete China or any other country by simply cutting off access to our market or trying to damage their industries. We can’t compete by playing whack-a-mole. There may be very good reasons for the United States to confront China on a range of trade or security issues, but getting tough on China is no substitute for launching a viable U.S. strategy to compete in the field of clean energy technologies. Strategic competition can drive our actions, but shared global interests that also serve U.S. interests should also factor into the equation.

While society remains shut down and people are still in danger, very little of this will move forward in a coordinated way. But the chance that government intervention in the economy grows to previously unimagined levels over the coming months and perhaps longer is very real here in the United States and elsewhere around the world. When all is said and done and it comes time to rebuild, the energy sector will likely be viewed as an important part of that process. The point is that our policy disagreements about innovation policy or industrial strategy revolve around degrees of government involvement and preferred policy mechanisms—not about whether the sector is important to our collective future. We can and should have vigorous debates about those things but do so with the clear-eyed recognition that failure to move forward has a cost. Everyone knows we need to do better, try harder, and act faster to increase our competitiveness in the rapidly changing field of energy. Once the economy is ready to be rebuilt, the opportunity will open once again. The faster we decide how to capitalize on it, the better.

-----