U.S. LNG: THE LOWEST LEVEL

U.S. EIA - Natural gas deliveries to U.S. LNG export facilities decline to the lowest level since October 2019

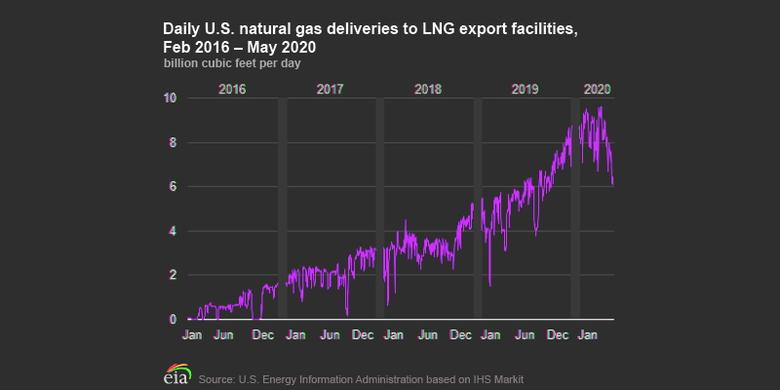

Natural gas deliveries to U.S. facilities producing liquefied natural gas (LNG) for export ("LNG feedgas") declined to 5.6 billion cubic feet per day (Bcf/d) on May 24, 2020, and averaged 6.7 Bcf/d from May 1 through May 26, according to data by IHS Markit. This was the lowest level of LNG feedgas deliveries since October 2019, despite 2.0 Bcf/d baseload (2.3 Bcf/d peak) of new liquefaction capacity that was commissioned over this period.

Declining levels of feedgas to LNG export facilities (and LNG export volumes) reflect a seasonal decline in LNG demand in the major consuming markets in Asia and Europe, as well as the reduction in global LNG demand resulting from mitigation efforts related to the corona virus (COVID-19), and historically low global LNG spot prices, which reduce economic viability of U.S. LNG exports. Lower levels of U.S. LNG exports are expected to continue through the summer as buyers have cancelled as many as 20 cargoes for June delivery and up to 45 cargoes for July delivery, according to trade press reports.

U.S. LNG feedgas and exports set new records this winter (December 2019–February 2020), averaging 8.3 Bcf/d and 7.6 Bcf/d, respectively, over this period, supported by the strong LNG demand in Europe and Asia. U.S. LNG feedgas continued to remain at high levels in March and April, averaging 8.6 Bcf/d and 8.2 Bcf/d, respectively, before declining below 6 Bcf/d from May 20 through May 24.

In January 2020, 74 LNG export cargoes were loaded in the United States—the highest monthly volume to date—followed by 66 cargoes in February, 71 cargoes in March, and an estimated 61 cargoes in April. EIA also estimates that 40 cargoes were loaded between May 1 through May 24, which amounted to an estimated 5.8 Bcf/d of LNG exports, compared to 7.0 Bcf/d exported over the same period in April. The Sabine Pass, Corpus Christi, and Cameron terminals had the largest reductions in vessel loadings in May. Announced cancellations of 20 LNG export cargoes in June and up to 45 cargoes in July could reduce LNG exports by an estimated 2.3 Bcf/d in June and more than 5.0 Bcf/d in July.

U.S. LNG export capacity has rapidly expanded in recent years and will continue to expand through this summer.

In 2019

- Two new facilities—Cameron LNG and Freeport LNG—placed the first two of their liquefaction units (called trains) in service.

- Corpus Christi LNG commissioned its second train.

- Elba Island started LNG production from the first five of its small-scale Moveable Modular Liquefaction System (MMLS) units.

These liquefaction trains in 2019 added a combined 3.3 Bcf/d baseload (3.7 Bcf/d peak) of new liquefaction capacity.

In 2020

- The third train at Freeport LNG began commercial operations.

- The third train at Cameron LNG is expected to come online this summer.

- The remaining MMLS units, 8 through 10, at Elba Island are expected to come online this summer.

These liquefaction trains in 2020 will add a combined 2.7 Bcf/d baseload (3.0 Bcf/d peak) of new liquefaction capacity, bringing the total liquefaction capacity to 8.9 Bcf/d baseload (10.1 Bcf/d peak).

-----