U.S. OIL EXPORTS UP 3 MBD

PLATTS - 24 Jun 2020 - US crude exports jumped back over 3 million b/d last week, for the first time in a month as exports to China remain strong, according to US Energy Information Administration June 24.

Weekly US crude oil exports averaged 3.16 million b/d for the week ended on June 19, EIA data showed. This marked the first time weekly US crude exports topped 3 million b/d since the week ended on May 22, when exports were reported at 3.18 million b/d.

CFlow, S&P Global Platts' trade flow software, estimated US crude exports for the week ended on June 19 at 3.10 million b/d, with more than a third of those exports projected to be destined for Chinese ports. According to cFlow, 8.03 million barrels, or 1.15 million b/d, of crude oil was exported to China from US ports for the week ended on June 19. Since the week ended on May 15, cFlow estimates that US crude exports to China have averaged 726,287 b/d.

China has been importing crude at high levels in recent weeks, as the world's largest crude importer has taken advantage of very low crude oil prices and available domestic storage. In May, crude imports to China have jumped 19.2% on the year to an all-time high of 11.34 million b/d, according to data from China's General Administration of Customs data. Such an increase in crude buying, Platts reported, has led to port congestion, particular in Shandong ports, causing some independent refiners to cut down operating rates.

Further, falling VLCC freight rates provide a further boost in the competitiveness of US exports. Since May, rates for the super tankers headed to the Far East have averaged $3.36/b for WTI-spec crude, over $1.50/b lower than the year-to-date average of $4.94/b.

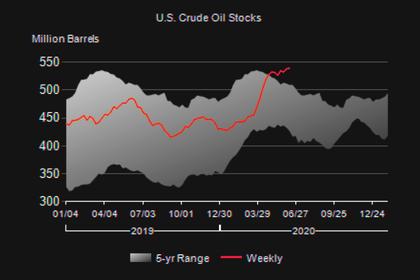

The structure of the forward curves in global oil prices have flattened in recent weeks from a super contango, where the price for prompt-delivered barrels are significantly lower than the price for forward-delivered barrels.

The spread between month one ICE Brent crude futures versus month six has narrowed from being as wide as minus $13.01/b on March 30, to just minus 64 cents/b on June 23, according to Platts data. As the contango has flattened, the incentive to place crude in storage to sell for a higher value at a later month as drastically decreased, causing far fewer VLCCs to be fixed for floating storage, thus bringing more tonnage into the spot market. The winding down of floating storage volumes, Platts reports, could take over six to nine months, according to Alphatanker, a market analysis division of shipping brokerage BRS.

Arbitrage to the Far East for WTI MEH crude is shown as open according to the Platts Analytics' Crude Arbflow calculator. WTI MEH arbitrage to Japan against local ESPO crude was shown open at a 97 cents/b incentive on June 22. Arbitrage for Mars crude delivered to China is shown as less supportive by Arbflow, with arbitrage for the grade against Dubai crude was shown as closed on June 22 at a 23 cents/b disincentive.

While arbitrage for Mars crude to China against Dubai has been shown as closed on average for each month since March by Arbflow, data from Kpler, a data intelligence company, shows that the last cargo of Mars crude exported by the US to China was shipped on May 24, 2020, and is projected to reach the port of Qingdao on July 16.

-----

Earlier: