U.S. OIL IMPORTS DOWN 36%

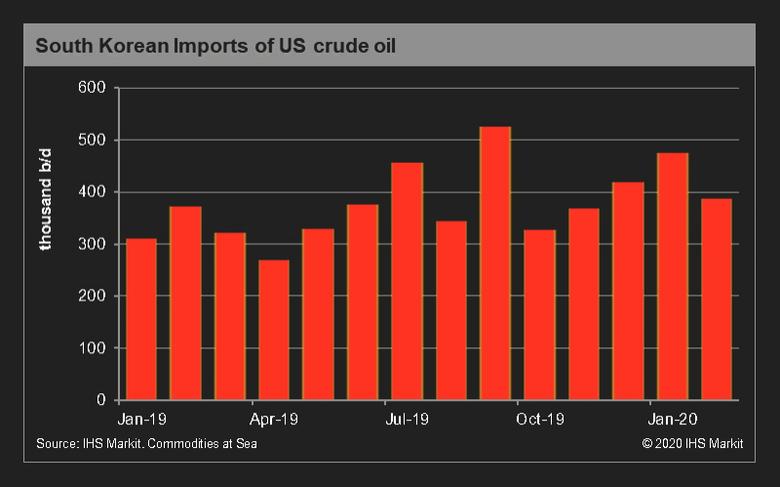

PLATTS - 24 Jun 2020 - South Korea's crude oil imports from the US in May dropped 35.7% from a year earlier, which marks the biggest decline since the country began US crude imports, data released by Korea National Oil Corp. showed June 24.

South Korean refiners imported 7.407 million barrels of US crude in May, compared with 11.516 million barrels a year earlier, according to the KNOC data.

The 35.7% decline was the sharpest since South Korea began US crude imports on a regular basis in 2015.

The May shipments were down 50% from 14.827 million barrels in April that marked the biggest since South Korea began US crude imports, breaking the previous record high of 14.78 million in July 2019.

South Korea's US crude imports marked the first decline in December last year when shipments fell 2.1% from a year earlier, and second time in February this year when US shipments fell 0.9% year on year.

The decline in May was largely attributable to less competitive prices of North American grades, as well as tepid domestic and regional fuel demand as economic activities slowed down due to restrictions to contain the spread of COVID-19, according to a refinery official in Seoul.

US-ASIA ARBITRAGE WINDOW

Major refiners across South Korea, China and Southeast Asia said Asia's overall US crude imports could recede from Q3 as they no longer find WTI, Bakken and Eagle Ford grades attractive, S&P Global Platts reported previously.

Platts data showed the spread between WTI MEH (Magellan East Houston) on a CFR North Asia basis and Abu Dhabi's Murban on an Asia delivered basis has averaged $2.91/b to-date in Q2, widening from 54 cents/b in Q1 and 11 cents/b in Q4 2019. The spread between WTI MEH and Iraq's flagship Basrah Light on an Asia-delivered basis has averaged $2.02/b to date in Q2, widening from $1.48/b in Q1 and $1.35/b in Q4 2019.

Despite the latest hike in Saudi OSP differentials for July-loading cargoes bound for Asia, many refiners would continue to favor Persian Gulf cargoes over US export grades, including WTI Midland and Eagle Ford, due to the prevailing high long-haul freight rates, Platts reported previously.

MIDDLE EASTERN, NORTH SEA CARGOES

The KNOC data showed South Korea's crude imports from its top supplier Saudi Arabia climbed 14.7% year on year to 28.857 million barrels in May, from 25.154 million barrels a year earlier, driven by Aramco's lowering of export prices earlier this year.

Imports of Iraqi crude dropped 44.2% on year to 5.34 million barrels in May, South Korea's import of Iraqi crude has declined since November 2019 when the country received 13.54 million barrels.

South Korea received 2.057 million barrels of Forties from the UK, marking the first North Sea crude shipment since August last year when it took 2.024 million barrels.

South Korea's total crude imports in May fell 6.3% from a year ago to 78.83 million barrels.

-----

Earlier: