U.S.: PROLONGED RECOVERY

REUTERS - JUNE 16, 2020 - Federal Reserve Chair Jerome Powell on Tuesday begins the first of two days of testimony before U.S. lawmakers in which he will map out how the United States faces an uncertain, uneven and prolonged economic recovery from the novel coronavirus crisis that will likely require continued monetary and fiscal support.

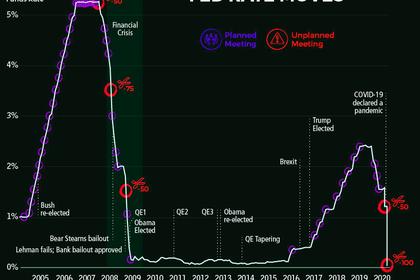

The U.S. central bank last week kept interest rates unchanged near zero and made clear it plans years of extraordinary stimulus as the nation grapples with steps toward fully reopening its economy amid some state and local surges in cases, and with no vaccine in sight.

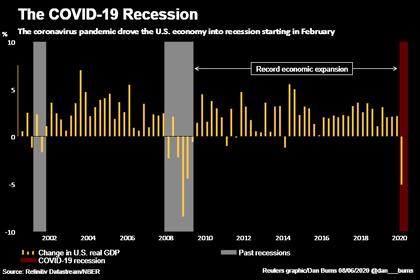

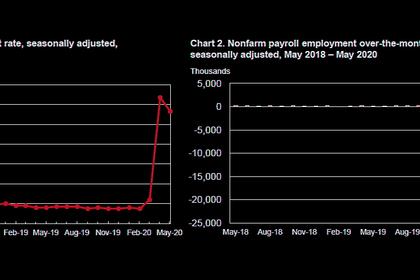

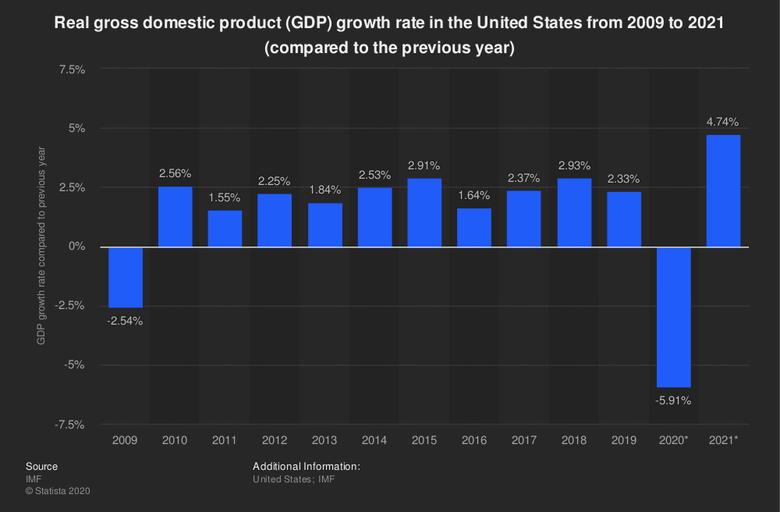

Fed officials currently forecast the economy shrinking at a 6.5% annualized rate in 2020 and see unemployment remaining elevated for several years. Powell said last week that he sees millions, particularly low-wage workers, remaining out of work for the foreseeable future with no easy re-entry into employment.

There are currently more than 20 million people unemployed as a result of the epidemic, which has killed more than 115,000 people in the United States, with minority communities among those hardest hit on both fronts.

"It is a long road. It is going to take some time," Powell said last week.

Powell appears before the Senate Banking Committee at 10 a.m. EDT (1400 GMT) on Tuesday and will appear before the House Financial Services Committee on Wednesday at 12 p.m. EDT (1600 GMT).

FRAGILE RECOVERY

Ahead of his testimony, the Fed said in its semi-annual report to Congress on Friday that it expects households and businesses to suffer "persistent fragilities" and that both the central bank and Congress may need to do more to prevent long-term economic scarring. Several Federal Reserve policymakers have recently called on lawmakers to spend further.

Congress has so far allocated nearly $3 trillion in financial relief, including direct payments to households and a forgivable loan scheme for small businesses, while the Fed has launched a dozen programs to pump trillions of dollars of credit into the economy.

On Monday, the Fed launched its long-awaited Main Street lending program, which will offer up to $600 billion in loans to U.S. businesses with up to 15,000 employees or with revenues up to $5 billion.

The Fed may come under scrutiny from lawmakers about whether the program, three months in the making, has come too late to help many companies, as well as targeted questions about its overall plans for the future.

Officials have promised to maintain ongoing Fed bond purchases at least at the current pace and said last week it is currently considering its options for any criteria that must be met before it even contemplates raising interest rates again.

Other options tentatively being discussed include the possibility of adopting yield curve caps, in which the Fed would target a particular yield and buy enough bonds to keep the rate from rising above that target level.

-----

Earlier: