ASIA'S SHARES UPDOWN

REUTERS - JULY 31, 2020 - Asian shares turned lower in a choppy session on Friday as abysmal economic data from the United States and rising global COVID-19 cases darkened the mood, despite strong U.S. tech earnings and manufacturing recoveries in China and Japan.

European shares were expected to open broadly lower across the board, with Euro Stoxx 50 futures STXEc1 down 0.28%, German DAX futures FDXc1 0.49% lower and FTSE futures FFIc1 off 0.08%.

The U.S. dollar was also set for its worst month in a decade amid expectations the Fed will maintain its ultra-loose monetary policy for years.

U.S. GDP collapsed 32.9% in the second quarter, the deepest decline on record, while jobless claims rose last week, adding to signs the momentum of economic recovery has slowed.

Those figures overshadowed positive manufacturing data from China and Japan. China’s official Purchasing Manager’s Index (PMI) data showed that factory activity grew in July for a fifth straight month and at a faster pace, defying expectations of a slowdown, while Japan’s industrial output snapped four months of declines in June.

“We are seeing some tentative signs of an improvement in global trade flows as economies reopen, but the overhang from recessionary conditions in the developed world and rising infection rates are kind of a focus for investors at the moment,” said Ryan Felsman, senior economist at CommSec in Sydney.

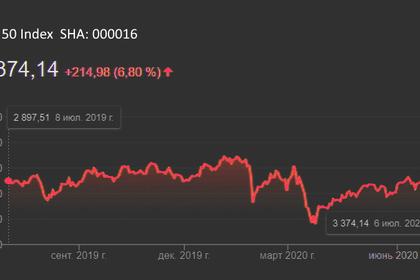

After rising in early trade, MSCI’s broadest index of Asian shares outside Japan .MIAPJ0000PUS turned lower. It was last down less than 0.1%.

Despite Friday’s losses, the index was still set for its second consecutive month of gains, adding more than 7.5% in July.

Australian shares were down 2.04% and Seoul's Kospi .KS11 ticked 0.64% lower. Japan's Nikkei .N225 dropped 2.82% as a stronger yen weighed on exporters.

Chinese blue-chips .CSI300 were last up 0.35% in a session that swung repeatedly between gains and losses.

Futures continued to point to a higher open on Wall Street on Friday. Apple (AAPL.O), Amazon (AMZN.O), Facebook (FB.O) and Alphabet (GOOGL.O) reported quarterly earnings on the same day for the first time ever, all topping Wall Street estimates.

“All of them punched the lights out with respect to their earnings numbers,” said National Australia Bank strategist Ray Attrill.

E-mini futures for the S&P 500 ESc1 rose 0.2%, and Nasdaq futures NQcv1 added 0.90%.

U.S. stock markets, oil prices and the dollar slid on Thursday as the new data underscored the deep economic impact of the coronavirus and U.S. President Donald Trump raised the possibility of delaying the November election.

On Wall Street, the Dow Jones Industrial Average .DJI fell 0.85%, the S&P 500 .SPX lost 0.38% and the Nasdaq Composite .IXIC added 0.43%.

In the currency market, the dollar slumped 0.40% against the yen to 104.30 JPY=, while the euro jumped 0.35% to buy $1.1888.

The greenback remains on course for its worst month in a decade, with the dollar index =USD dropping 0.15% to 92.655.

Crude oil recovered from an overnight slump, with global benchmark Brent crude LCOc1 rising 0.47% to 43.14 a barrel. U.S. light crude added 0.28% to $40.03 per barrel.

Gold also turned higher on the weaker dollar, with spot gold XAU= trading 0.61% higher at $1,971.52 per ounce, just short of record highs.

U.S. benchmark 10-year Treasury notes US10YT=RR yielded 0.5233%, down from a U.S. close of 0.541% on Thursday. The two-year yield US2YT=RR touched 0.1133% compared with a U.S. close of 0.121%.

-----

Earlier: