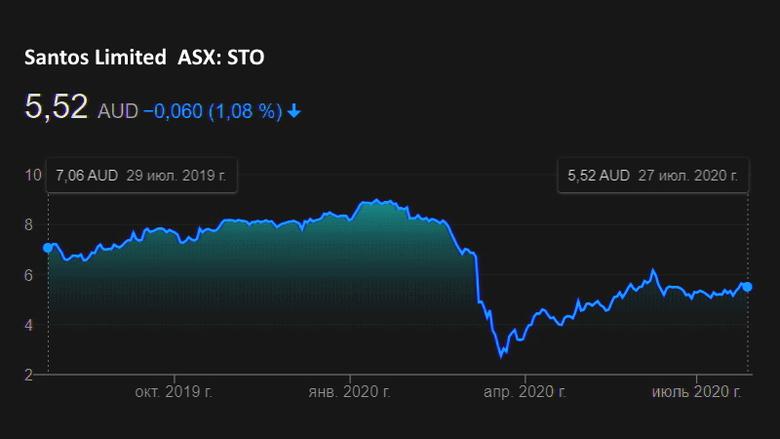

AUSTRALIA'S SANTOS REVENUE DOWN 11%

SANTOS - 23RD JUL 2020 - Record quarterly and half-year production

- Second quarter production of 20.6 mmboe was a record for Santos and 15% higher than the prior quarter

- The strong production result was driven by higher domestic gas production in Western Australia, continued strong onshore production and a higher equity interest in Bayu-Undan following completion of the ConocoPhillips acquisition

- Quarterly sales revenue of US$785 million was 11% lower than the prior quarter primarily due to lower liquids prices partially offset by higher domestic gas and LNG sales revenues

- Half-year production was up 4% to a record 38.5 mmboe. Santos’ disciplined operating model continues to drive strong onshore performance – first half Cooper Basin and Queensland equity gas production was up 18% and 5%, respectively. Initial results from horizontal wells in the Cooper Basin are promising

- Santos’ diversified portfolio of fixed-price domestic gas revenues cushioned the impact of lower oil prices. Half-year sales revenue was US$1.7 billion, 16% lower than the previous first half

Strong free cash flow and liquidity

- Strong operational and cost performance delivered US$431 million of free cash flow in the first half

- Targeting 2020 free cash flow breakeven oil price of US$25 per barrel

- Liquidity of over US$3 billion at the end of the quarter, comprising US$1.3 billion in cash and US$1.9 billion in committed undrawn debt facilities

- Approximately 60% of production volumes for the remainder of 2020 are either fixed-price domestic gas contracts or oil hedged at an average floor price of US$38 per barrel

Growth project optionality maintained

- The Santos-operated Barossa, Dorado and Moomba CCS major growth projects continue to progress toward investment-ready, subject to market conditions and relevant approvals

- The NSW Minister for Planning referred the Narrabri gas project to the Independent Planning Commission with a determination expected in the third quarter

Santos Managing Director and Chief Executive Officer Kevin Gallagher said the first half of 2020 had delivered record production volumes and strong free cash flow of US$431 million, despite significantly lower oil prices.

“Our disciplined, low-cost operating model continues to drive strong performance across our diversified asset portfolio and completion of the ConocoPhillips acquisition in late-May further boosted our production and cash flows.”

“The operating model allowed us to maintain activities key to sustaining strong operational performance across all of our core assets. As a result, we are realising lower costs from the initiatives announced in the first quarter and are targeting a free cash flow breakeven oil price of US$25 per barrel for 2020.”

“By maintaining our sustaining activities, production levels from our core assets are expected to remain relatively steady for the next five or six years, allowing us to continue to progress our major capital projects while maintaining capital discipline and flexibility in commitment timing.”

“As COVID-19 and the lower oil price continue to challenge us, we have remained resilient and kept production going, meaning our revenues have continued to flow. Our balance sheet is strong and we remain well positioned to leverage our growth opportunities when business conditions improve,” Mr Gallagher said.

-----

Earlier: