AUSTRALIA'S WOODSIDE LOOSES $4 BLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

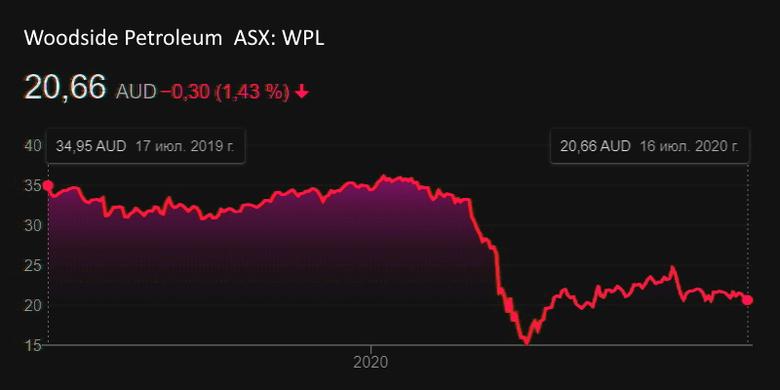

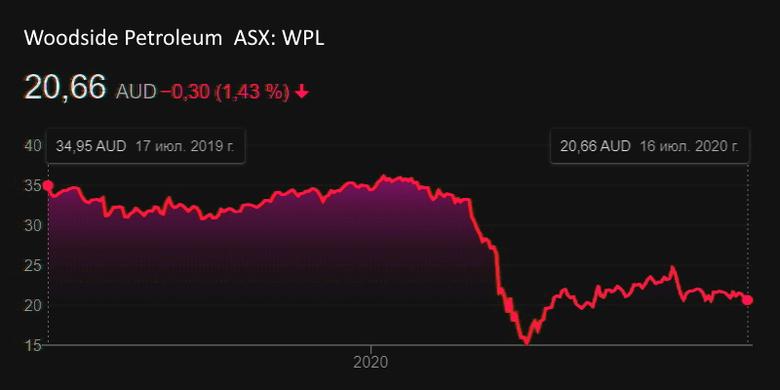

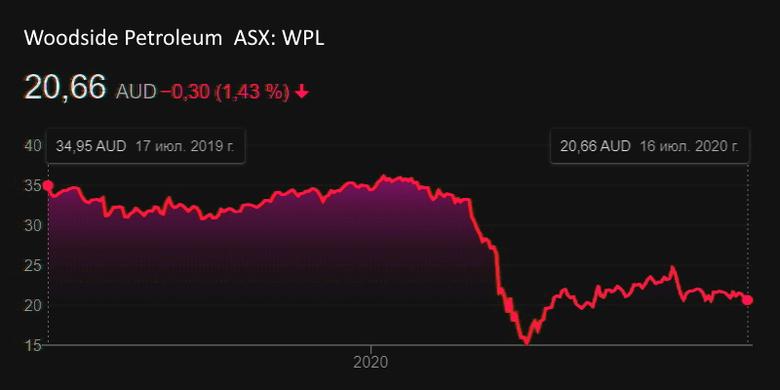

AUSTRALIA'S WOODSIDE LOOSES $4 BLN

ENERDATA - 16 Jul 2020 - The Australian independent gas producer Woodside Petroleum has announced non-cash, post-tax impairment losses of US$3.92bn, including US$2.76bn for oil and gas properties (Pluto, NWS Gas, Wheatstone, Okha, Ngujima-Yin in Australia and Sangomar in Senegal) and US$1.16bn for exploration and evaluation assets (WA-404-P, WA-430-P and Sunrise in Australia, and Kitimat LNG in Canada), leading to a post-tax loss of US$4.37bn. The company will also recognise a non-cash, post-tax onerous contract provision for the Corpus Christi LNG sale and purchase agreement of US$447m.

In March 2020, Woodside decided to reduce its planned expenditure in 2020 by around 50% to AUD2.4bn (US$1.5bn), including a 60% cut in investment expenses to AUD 1.7-1.9bn (US$1-1.2bn), and its operating spending by AUD100m (US$61m), due to the coronavirus pandemic and the fall in oil prices. To reduce its expenditure, Woodside will defer the major turnaround for the trains 3 and 4 of its Karratha Gas Plant (NorthWest Shelf LNG plant), to September 2020 and August 2021, respectively. In addition, Woodside Petroleum will postpone a final investment decision (FID) on its 6 Mt/year Scarborough LNG project and on the 5 Mt/year expansion of its 5 Mt/year Pluto LNG from mid-2020 to 2021. Moreover, Woodside Petroleum delayed to an unknown date the FID for the 3.9 Mt/year Browse LNG project worth AUD30bn (US$18.2bn). In October 2019, the company already deferred the FID from late 2020 to the first half of 2021.

-----

Tags:

AUSTRALIA,

WOODSIDE,

GAS,

FINANCE