CHINA'S GDP UP FASTER

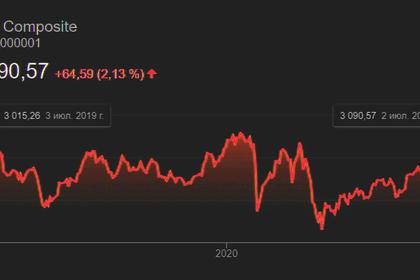

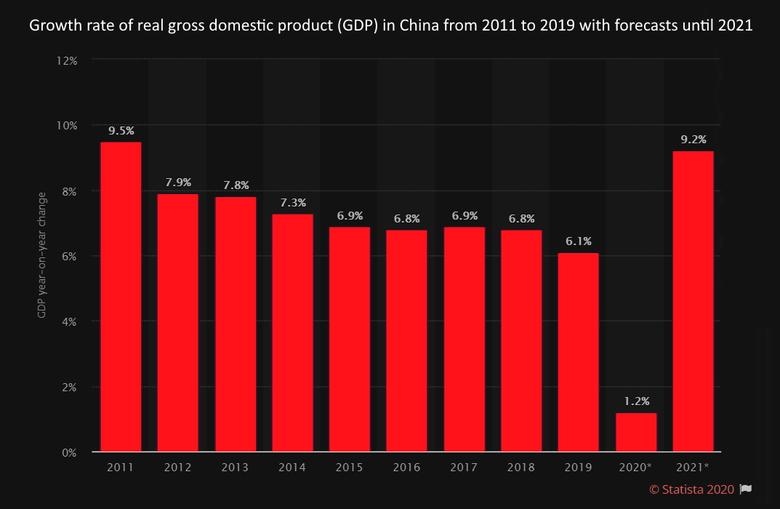

NIKKEI - July 16, 2020 - China's gross domestic product growth swung back to the black in the April-June quarter, driven by a recovery in production and spending amid coronavirus-induced headwinds, signaling a major turnaround despite the plunging global economy.

The 3.2% year-on-year growth announced by the National Bureau of Statistics on Thursday eclipsed the 6.8% contraction in the first quarter -- the first negative growth since 1992, when the country started announcing growth every quarter. The latest result also beat the median 1.1% forecast by economists surveyed by Nikkei.

Still, it is far below the 6% level recorded for the four quarters of 2019.

President Xi Jinping, in a letter to global chief executives, said that China's sound long-term economic growth fundamentals would not change and promised to continue reforms to attract business and investments, state media outlet Xinhua reported on Thursday.

On a quarter-on-quarter, seasonally adjusted basis, the world's second-largest economy grew 11.5% in the April-June term. Growth on an annualized quarter-on-quarter basis was around 55% in the same quarter, according to Nikkei's own calculation.

Overall growth declined 1.6% in the first half of 2020, but Beijing is upbeat about the rest of the year. "The steady economic recovery in the first half has laid a solid foundation for a sustained recovery in the second half," said an NPC spokesperson. China did not reveal the full-year target this year, something it normally does during its annual national legislative meeting.

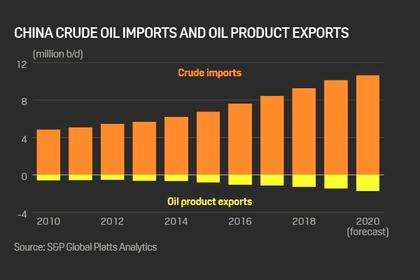

While exports grew 0.1% and imports contracted 9.7% during the quarter, economists expect trade to pick up in the second half along with the rest of the global economy.

In fact, monthly trade in U.S. dollar terms bounced into positive territory in June after contracting in May. Exports grew 0.5%, thanks to demand for personal protective equipment and pharmaceutical products, while imports surged 2.7%, largely powered by electronic components and commodities.

Apart from the recovery in trade, growth in the second quarter was driven by the agriculture sector, which rose 3.9%, higher than 3.5% in the previous quarter.

While fixed asset investments in infrastructure, commercial buildings and other areas took a beating, demand for excavators, integrated circuits and industrial robots pushed up industrial-product output 4.4%, compared with the previous quarter's 8.4% contraction.

Total retail sales remained negative at 3.9% but recovered from the 7.6% logged in the first quarter, partly due to spending on basic living goods and medical supplies.

An exporter in the southern manufacturing hub of Guangzhou told the Nikkei Asian Review that seaports have been fully operational since May. While overseas demand for textile and shoes have yet to reach half of last year's sales, orders for auto parts and household products are at pre-COVID levels.

"Market uncertainties remain but our business has stabilized for now," said Chen Zhijian, chief executive of Yige Trading.

Nomura China's chief economist, Lu Ting, attributed second-quarter growth to the country's success in controlling the coronavirus and policy support.

Even so, headwinds remain as a large part of the world is still preoccupied with the pandemic.

"The uncertainties and destabilizing factors are increasing significantly," warned a customs official on Tuesday, citing existing economic tensions with the U.S. as a potential spark that may hinder trade growth in the second half.

China may have tamed the spread of the virus but many remain wary of a rebound.

"Business income is 50% less than last year," said Li Hua, a hairdresser in Shanghai. Residents of the city are generally fussy about their appearance, explained Li, but added that regular customers have stopped coming for premium services that include a perm and dye. "There isn't really a need as people don't gather as much these days."

In addition, the country is facing some of its worst flooding in decades. Since June, heavy rainstorms have hit about 64% of the southern region. Areas along the Yangtze River -- China's longest inland waterway -- have been inundated, displacing over 44 million people.

In Wuhan, one of the affected downstream cities and a key industrial hub, waters remained above the warning level as of Wednesday.

Michael Einhorn, President of Dealmed, one of the largest medical supply distributors in the U.S., told Nikkei that he is already having problems getting much-needed supplies out of Wuhan.

Economists at Capital Economics said recovery in the second half will slow after the initial boost from business reopenings has passed. Yet, with consumer confidence and fiscal stimulus on the rise, China's GDP will return to pre-coronavirus levels by the end of the year, faster than any other major economy.

-----

Earlier: