CHINA'S OIL STOCKS UP

PLATTS - 29 Jul 2020 - China's crude stockpiles reached a record high level in July as refiners struggle to digest mass crude oil cargoes purchased during the second quarter, while domestic fuel consumption slowed amid widespread flooding across 23 provinces during the month.

As a result, the high inventory has dampened China's crude oil demand for delivery in the third quarter as it might take a while to destock, industry officials and market sources said July 29.

Data intelligence firm Kpler said China's crude inventory hit a fresh high of 889.35 million barrels in the week beginning July 20, comparing to 874.84 million barrels in a month ago and 766.21 million barrels in the same week a year ago.

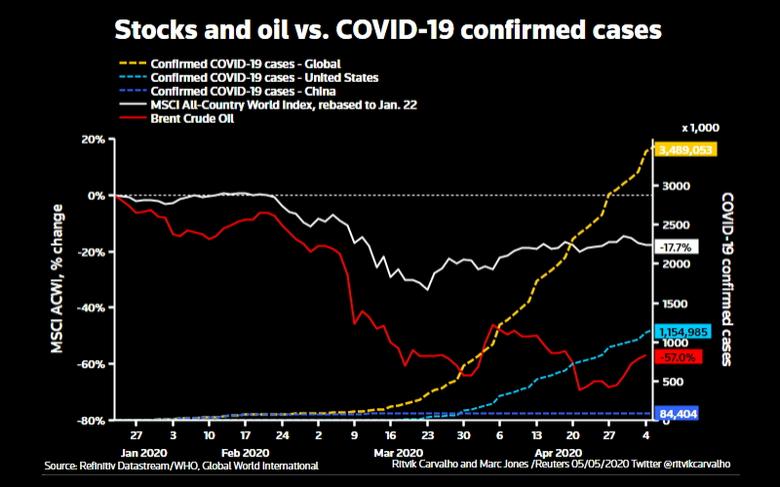

The surge in inventory came as little surprise as Chinese refiners have been aggressively buying crude oil since late first quarter in order to take full advantage of low oil prices.

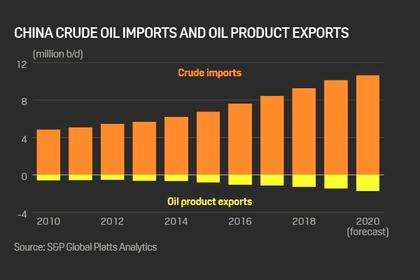

China's crude oil imports, through both shipping and pipelines, surged 34.4% year on year to hit a record high of 12.99 million b/d in June and this has caused serious port congestion along the Easter provinces, Platts previously reported.

Kpler data showed that China's crude seaborne imports in July hover at about 11.09 million b/d, steady from 11.18 million b/d in June.

Combined with stable domestic crude output at 3.91 million b/d over the first-half of 2020, China's overall crude supplies are set to rise over 16 million b/d in July, according to S&P Global Platts estimates.

Signs of waning Chinese crude oil demand and requirement for Q3 has directly hit price differentials for various OPEC+ export crude grades, as well as the Platts benchmark Dubai price structure.

Chinese refiners' top crude picks, Oman and ESPO Blend grades, have taken a hit recently with price differentials for the Middle Eastern and Russian grades falling to multi-week lows.

The spread between front-month Platts cash Dubai and same-month Dubai swap may also struggle to push above the $2/b premium threshold in Q3 as Chinese refiners put the brakes on crude procurement activities, trading desk managers in Beijing, Hong Kong, Seoul and Singapore said.

The physical Dubai crude market structure has weakened, with the spread between front-month Platts cash Dubai and same-month Dubai swap averaging 80 cents/b to date in July, down from the June average of 84 cents/b, Platts data showed.

FLOOD CAPS THROUGHPUT

Meanwhile, crude throughput in July remained at a high level after hitting all-time-high of 14.14 million b/d in June, as state-run Sinopec and PetroChina's flagship refineries have resumed operations after their scheduled maintenance.

But the throughput levels are capped as the widespread flooding in about 23 provinces forced refineries, especially those located along the Yangtze river line, to lower their operation rates amid weakening consumer and industrial fuel consumption.

In total, at least 20 state-owned refineries across the country, which have no maintenance plan, have cut run rates in July by 1-17 percentage points from June. These comprise seven refineries under PetroChina, 12 from Sinopec, and Sinochem's only refinery Quanzhou Petrochemical, Platts data showed.

On the other hand, independent refineries' run rates declined about six percentage points from June amid narrowing margins and slowing sales.

Independent and state-owned non-major refineries account for about 31% of China's refining capacity, with the oil giants accounting for about 69%.

ONGOING PORT CONGESTION

In addition, the volume of floating crude cargoes in Chinese waters remains at four times of the levels in normal days, despite easing slightly from the record high, port sources said on July 29.

There were 88.26 million barrels of crude on tankers idled in Chinese waters for seven or more days in the week beginning July 27, edging down from the all-time high of 88.4 million barrels seen in the week beginning June 29, Kpler said on July 29.

This means the volume of new arrivals still exceeds China's port handling capacity, leaving the cargoes to be discharged in August which will sustain China's crude imports and inventory levels in the month.

-----

Earlier: