CHINA'S OIL THROUGHPUT UP 9%

PLATTS - 16 Jul 2020 - Crude oil throughput at China's domestic refineries jumped 9% year on year to an all-time-high of 14.14 million b/d in June, absorbing some of the record high imports for the month, and the volume is set to stay high in July.

It was also the first time that China's crude throughput rose above 14 million b/d, National Bureau of Statistics data released July 16 showed.

The previous record high was 13.84 million b/d in December 2019.

On a barrels-a-day basis, the volume was 3.3% higher than the 13.69 million b/d registered in May.

NBS releases data in metric tons, which S&P Global Platts converts to barrels using a 7.33 conversion factor. On a metric-ton basis, the 57.87 million mt in June was 0.1% lower than the 57.9 million mt in May, NBS data showed.

The strong growth in throughput was primarily driven by record high crude imports in recent months and is expected to remain high in July to make room in storage for cargoes waiting in Chinese waters because of port congestion.

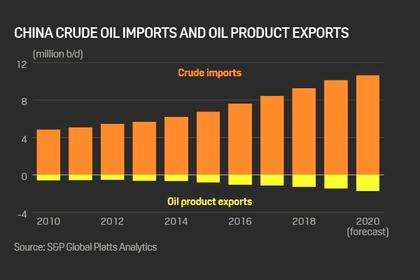

Chinese state-run and independent refiners took full advantage of low oil prices in the second quarter and bought aggressively, resulting in crude imports surging 34.4% year on year to hit a fresh high of 12.99 million b/d in June, 14.6% more than the previous record of 11.34 million b/d in May, data from the General Administration of Customs showed on July 14.

As a result, China's state-owned refineries lifted run rates to 80% in June from 76% in May and 79% in June 2019, data collected by Platts showed.

In the independent sector, Zhejiang Petroleum & Chemical continued to boost run rates to nearly 130% of its nameplate capacity of 20 million mt a year in June, up from around 120% in May, while the 20 million mt/year Hengli Petrochemical (Dalian) maintained rates at around 115% in June, stable from May, Platts data showed.

While the average run rate at the small-scale independent refineries in Shandong also hit 79% in June from the previous record high of 77.9% in May.

HIGH INVENTORIES SEEN CAPPING FURTHER INCREASES

However, high product inventory is likely to cap any throughput increase in July, analysts and refining sources said.

"Severe flooding in the rich, downstream Yangtze River region will hit demand after COVID-19, and our oil product inventory has already hit tank top," a refining source with Sinopec in Central China said.

"Oil product exports will remain low in July despite high product inventory. We cannot lift throughput further," a Shanghai-based Sinopec refiner said.

In January-June, China's throughput was 12.85 million b/d due to the strong year-on-year increase in June.

As a result, throughput in the first half of this year was flat from H1 2019 on a barrels-a-day basis, following year-on-year falls of 1.7% over January-May and 4.2% over January-April due to the coronavirus pandemic.

Domestic crude output also grew 0.7% year on year to a three-year high of 3.97 million b/d in June, the NBS data showed. The previous high was 3.99 million b/d in June 2017.

Analysts attributed the steadily growth to Chinese government's call to secure energy supplies by lifting domestic production in recent years.

"The upstream investment of recent years is gradually translating into production," a Beijing-based analyst said but warned the growth would slow down again because oil companies had cut capital expenditure this year due to low oil prices.

Over January-June, Chinese crude output rose 1.1% year on year to 3.91 million b/d, the data showed.

-----

Tags: CHINA, OIL,