DEBT FOR EGYPT: $5.2 BLN

IMF - June 26, 2020 - The Executive Board of the International Monetary Fund (IMF) approved today a 12-month Stand-by Arrangement for Egypt, with access equivalent to SDR 3.76 billion (about US$5.2 billion or 184.8 percent of quota). The new arrangement aims to help Egypt cope with challenges posed by the COVID-19 pandemic by providing Fund resources to meet Egypt’s balance of payments needs and to finance the budget deficit. The Fund-supported program would also help the authorities preserve the achievements made over the past four years, support health and social spending to protect vulnerable groups, and advance a set of key structural reforms to put Egypt on a strong footing for sustained recovery with higher and more inclusive growth and job creation over the medium term.

After a strong track record of successfully completing a home-grown economic reform program supported by the IMF’s Extended Fund Facility in 2016-2019, Egypt was one of the fastest growing emerging markets prior to the COVID-19 outbreak. However, the significant domestic and global disruptions from the pandemic have worsened the economic outlook and reshuffled policy priorities.

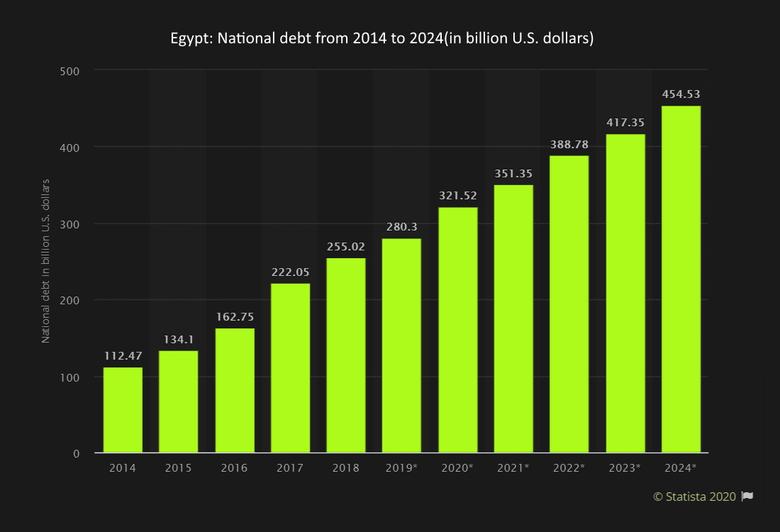

The authorities’ economic policy framework, supported by the SBA, aims to maintain Egypt’s macroeconomic stability with priorities to: (i) protect necessary social and health spending while avoiding an excessive build-up of public debt; (ii) anchor inflation expectation and safeguard financial stability while maintaining a flexible exchange rate; and (iii) implement key structural reforms to strengthen transparency, governance, and competition.

The Executive Board’s approval allows for an immediate purchase of the equivalent of SDR 1.4 billion (about US$2 billion). The remainder will be phased over two reviews.

Following the Executive Board’s discussion on Egypt, Ms. Antoinette Sayeh, Deputy Managing Director and Acting Chair, issued the following statement:

"Over the past few years, Egypt saw strong growth, falling unemployment, moderate inflation, buildup of strong reserve buffers, and significant reduction in public debt. The authorities were looking to broaden and deepen structural reforms begun under the Extended Fund Facility, but the COVID-19 pandemic has temporarily refocused government priorities to address the economic and health crisis. The government has responded decisively to the crisis with a comprehensive package that supports health care needs, the economy, and the most affected individuals and sectors. The Central Bank of Egypt has also taken several actions to support economic activity and borrowers.

"The new Stand-By Arrangement, together with recent RFI, supports the authorities’ ongoing efforts to mitigate the economic and social impact of the crisis while maintaining macroeconomic stability and safeguarding past achievements. Together with the support of Egypt’s development partners, disbursements from the SBA will help address large financing needs.

"Policies supported by the SBA will focus on addressing the immediate crisis needs including critical spending on health, social programs to protect the most vulnerable, and assist directly affected sectors while safeguarding medium-term fiscal sustainability, anchoring inflation expectations, and preserving exchange rate flexibility. Structural reforms will aim to continue strengthening the frameworks for public finances, improve governance and transparency, and reduce barriers to competition to ensure a path towards sustainable and inclusive private sector-led growth.

"As the economic recovery takes hold, fiscal policy will need to work toward resuming the downward trajectory of public debt. The Central Bank of Egypt aims to continue to provide a stable anchor for inflation expectation and financial stability while rebuilding reserve buffers and allowing orderly exchange rate adjustments.

"Achieving program objectives is subject to risks. At the global level, uncertainty about the severity and length of the downturn remains exceptionally high. On the domestic side, the authorities will need to continue their strong track record of steadfast policy implementation.

"Maintaining social cohesion during this crisis period will be paramount for the success of the program. Enhanced communication and transparency around the policies and their implementation will be crucial to ensure broad support for the government’s reform efforts on behalf of the Egyptian people."

-----

Earlier:

2020, April, 7, 11:45:00

RUSSIA'S NUCLEAR FOR EGYPT

ROSATOM’s TVEL Fuel Company, and the Egyptian Atomic Energy Authority have signed 10-years term contract for supply of low-enriched nuclear fuel components,

|

2020, January, 24, 13:05:00

UAE INVESTMENT FOR EGYPT $7.2 BLN

The UAE is currently the largest investor in Egypt with total investments exceeding AED26.5 billion (US$ 7.2 bn), according to Jamal Saif Al Jarwan, Secretary-General of the UAE International Investors Council.

|

2019, June, 4, 15:05:00

BP SELLS EGYPT

BP has agreed to sell its interests in Gulf of Suez oil concessions in Egypt to Dragon Oil, the Dubai-based oil and gas company. Under the terms of the agreement, Dragon Oil will purchase producing and exploration concessions, including BP’s interest in the Gulf of Suez Petroleum Company (GUPCO).

|