ENERGY MARKET: HUGE VOLATILITY

MEOG - Dr. Leila Benali, chief economist at APICORP, on the region's energy investment outlook, and why gas will see strong investments in the next five years.

Can you briefly give me the overview from the MENA Energy Investment Outlook. What were the major findings?

From the MENA Energy Investment Outlook perspective, we've seen more or less the same trends here that we see globally. I mean, we are facing an unprecedented crisis. It is normal that we see cuts in investments. What is different this time is the cuts, compared to previous downturns, started much earlier. They have started as early as 2020.

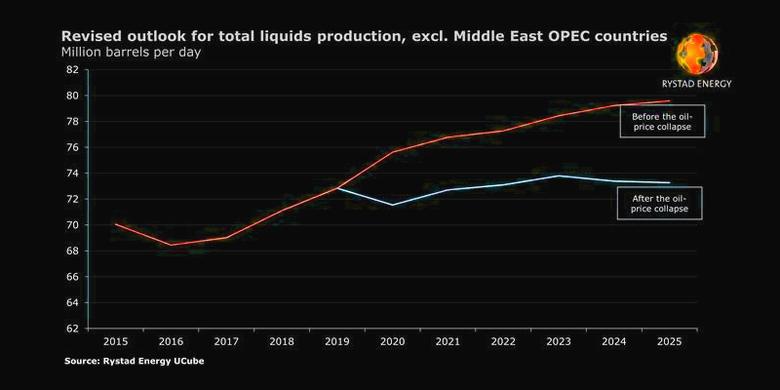

In previous downturns, you would likely see the cuts in CapEx starting the following year. We have seen companies start with cuts in investments globally, but there are some different trends between the MENA region and the rest of the world. No vertical in the energy industry was left apart and it is quite unprecedented. I mean, you see 20%, 30%, or even 40% reductions in CapEx among IOCs, NOCs, industrials and utilities.

One of the key highlights, I think, that we have seen in the MENA region compared to other regions is that we have seen a positive story as far as gas is concerned. The gas sector is the only sector where we saw an increase of $28 billion of potential investments over the next five years.

The other positive news in the MENA region is among the committed and planned investments that we have seen, and these investments are driven by AA-rated countries and strong countries, for example you have Saudi Arabia's gas programme which is still continuing, Saudi Arabia's power programme is still continuing. That is roughly $40 billion each. The UAE oil capacity programme is ongoing. That is more than $45 billion that we are assuming over the next five years.

In Egypt, we have seen continuation of the petrochemicals monetisation drive, and the power modernisation program, and that is also more than $30 billion to $35 billion over the next five years that will be channeled in those two sectors.

The three major countries where you will see the highest planned and committed investments are Saudi Arabia, the UAE and Egypt, and we are seeing more than $60 billion that should be injected in the energy sectors, respectively, over the next five years. There are some some good stories to tell when it comes to energy investments in the MENA region, despite the cuts given the unprecedented crisis that we have faced in 2020.

When do you expect the industry to start to see a recovery in oil prices and in oil and gas investments?

There are two recoveries that we have to watch. The first recovery is related to when economies, particularly in consumer markets, like Asia, the U.S., and parts of Europe, will open up again and resume not only normal life, but also travel and and trade among themselves. We, especially in the MENA region, we are looking at a potential W-shaped recovery compared to other regions where you might see more of a quick V-shaped recovery. And there are multiple reasons for that. From our perspective, given that we are looking into the MENA region as a commodity-dependent region directly or indirectly. We are looking into how commodity prices, not only oil and gas, but all commodities are going to recover over the next couple of years.

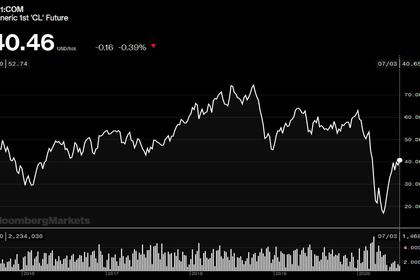

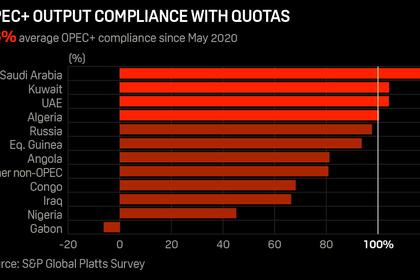

When you have a hole of -8 million barrels a day, or -9 million barrels a day, that is a quite deep hole. People are talking about a narrow band of $30 to $40 per barrel of Brent crude. I prefer to talk about an average because I think there will be a lot of volatility in the future.

The fact that we are seeing 20% to 30% capital cost cuts this year quite radically means that we will face huge volatility in the future, because these are supplies that will not be coming on time when demand will recover. There will be volatility in the next couple of years. It will take a bit more time to recover to a more structured, more balanced market. And I think that the suppliers are doing a good job in trying to find balance in the market. But I am concerned at this stage that we might see a couple of lows outside of that expected price band and also a few highs outside of that band.

In the report, you mentioned that capital cost cutting could lead to a wave of mergers and acquisitions. How will that impact the industry?

Because of the higher volatility that we will see in the future and because oil and gas companies will be under pressure to deliver a higher value proposition to shareholders, to preserve their dividends programmes, we are seeing a potential restructuring in the energy sector as a whole. That is something we were actually noticing before this crisis. We wrote a paper last year on the renewed relationship between institutional investors and private equity. We have seen a rapprochement between sovereign wealth funds and national oil companies. And part of it is also driven to provide those producers which are in the best fiscal position globally, and in the best leverage position, to be able to go through this type of crisis. So what we are seeing today is a potential restructuring that was already, I would say, happening.

The other part that I think is interesting is that this crisis is really confirming the need to become increasingly integrated in your value chain. You see oil and gas producers trying to add additional downstream into their business model to increase integration. You have those additional efficiency gains of 10% to 30% that can be captured.

After a couple of downturns already, after the 2008 crisis and the 2014 downturn, the oil and gas sector is reaching 2020 already heavily efficient. So, for example, oilfield services companies have already been squeezed. Their margins have already been squeezed so you have already seen a few companies filing for Chapter 11 that are natural targets for acquisition, especially when their fundamentals are strong.

Beyond that, in the oil and gas industry, there could be actually the emergence of a totally new type of player, larger players supported by strong institutional investors, including the sovereign wealth funds, which are largely integrated, integrated with downstream and petrochemicals, potentially with some assets in utilities and electricity.

And of course, the last interesting trend is the drive to digitalisation. These operators are coming already with squeezed margins, already efficient. I think that amount of efficiency that was driven between 2016 and today in the oil and gas value chain across the board is around 20% to 30% already. But the fact that you might have a bit more digitalization in oil and gas operations might create new types of players that are, in addition to being integrated, even more digitalised. So it is a sign of exciting changes that are happening.

What about the energy transition?

I think this is one major lesson that this crisis has taught us. We have learned that you can lock down 40% of the world's population for weeks and you can have 1.5 billion students home-schooled and you will still not be able to reach the Paris targets. That has increased the level of awareness among climate change circles in the energy sector and the non-energy side as well, that the issue of emissions and climate change has to be taken much more seriously than it has been in the past if we are to reach the Paris climate goals.

This is particularly true if we see a W-shaped recovery or a V-shaped recovery where economies are going back full steam to recover part of the GDP that has been lost in 2020 and 2021. It is increasingly evident that you will need to use all low-carbon technologies, of course, renewables, and gas, as a fuel, which is definitely the most versatile and can be used in all applications and transportation, industries, activities. Whether we like it or not, gas will continue to be used over the next couple of decades, at least, in all those applications.

Whatever we think about hydrocarbons, I think it is quite important for us that the fundamentals of gas, natural gas in general, remain strong, so gas is playing the role that is supposed to be playing and is economically sound to continue to play that role in the future.

-----

Earlier: