EUROPE'S SHARES DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

EUROPE'S SHARES DOWN

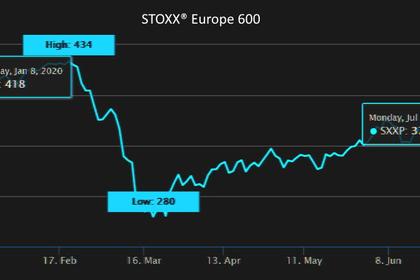

REUTERS - JULY 30, 2020 - European shares opened lower on Thursday as a clutch of dismal earnings reports took the shine off the U.S. Federal Reserve's vow to keep stimulus taps open to shore up a coronavirus-ravaged economy.

The pan-European STOXX 600 fell 0.4% by 0713 GMT, dragged by 1.5% declines in banking stocks .SX7P and carmakers .SXAP.

Britain’s Lloyds Banking Group (LLOY.L) swung to a rare pretax loss in the first half of 2020, while Volkswagen (VOWG_p.DE) unveiled a first-half operating loss and slashed its dividend.

Anheuser-Busch InBev (ABI.BR) jumped 9.4%, providing the biggest boost to the STOXX 600 after saying it was encouraged by a global beer sales recovery in June.

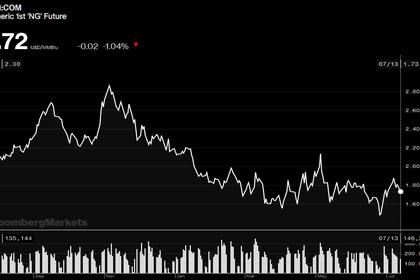

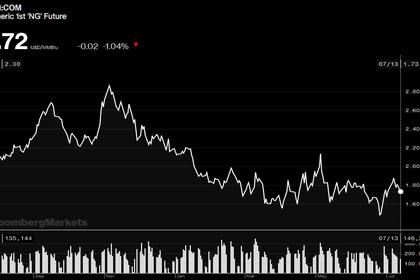

Weak oil prices weighed on the energy sector .SXEP even as Royal Dutch Shell (RDSa.L) avoided its first quarterly loss in recent history after bumper earnings in its trading business, while France’s Total (TOTF.PA) said it would maintain its dividend.

Asian stock markets and Wall Street overnight gained as Fed Chairman Jerome Powell promised to “do what we can, and for as long as it takes,” to limit economic damage from the pandemic and boost growth.

Investors are eyeing a slew of economic data, including German second-quarter GDP data, euro zone June unemployment numbers and final consumer confidence data.

-----

Earlier:

2020, July, 14, 12:45:00

EUROPE'S GAS DEMAND DOWN

Gas consumption in Q1 fell by more than 20% year on year in a number of EU countries, including Romania, Latvia, Finland and Slovakia.

2020, July, 14, 12:40:00

EUROPE'S GAS TO UKRAINE UP

Ukraine's total gas import capacity has expanded to 170 million cu m/d in 2020, up from the maximum capacity of 66 million cu m/d in 2019,

2020, July, 14, 12:30:00

E.EUROPE'S ENERGY TRANSITION €10 BLN

The Modernisation Fund will allocate around €14bn from the auctioning of allowances from the EU Emissions Trading System (EU ETS)

2020, June, 30, 12:50:00

EUROPE'S STOCKS UPDOWN

The pan-European STOXX 600 index looked set to post a more than 12% rise in the quarter

All Publications »

Tags:

EUROPE,

SHARES,

STOCKS,

INDEXES