GLOBAL OIL INVENTORIES WILL DOWN

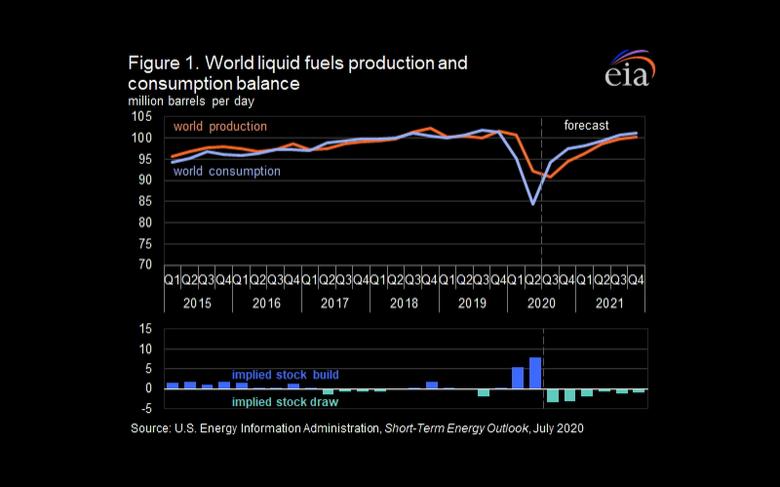

U.S. EIA - July 8, 2020 - The disruptions to global petroleum supply and consumption as a result of the 2019 novel coronavirus disease (COVID-19) and associated mitigation efforts have been significant. As road and air travel fell sharply when economies around the world went into lockdown in the first quarter and early second quarter of 2020, global liquid fuels consumption fell more quickly than production. Based on the mismatch between production and consumption of liquid fuels, the U.S. Energy Information Administration (EIA) estimates that global oil inventories increased by almost 1.3 billion barrels from the start of 2020 through the end of May. Inventory growth caused Brent crude oil spot prices to fall from a monthly average of $64 per barrel (b) in January to $18/b in April. In late April, when price declines were the steepest, market participants had concerns about the ability of global storage capacity to hold the quickly rising inventory. The situation in global oil markets has now shifted, however, and EIA’s July Short-Term Energy Outlook (STEO) forecasts global stock draws in every quarter moving forward through 2021.

EIA estimates that in June 2020, global consumption of petroleum and other liquid fuels was up 10 million barrels per day (b/d) from April levels as economies worldwide began to emerge from lockdown. EIA estimates global supply fell by 12 million b/d during the same period as a result of reduced production from Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+), and from price-driven declines and curtailments in the United States and Canada. EIA now estimates that these supply and demand drivers have shifted global oil markets from 21 million b/d of oversupply in April to inventory draws in June (Figure 1).

EIA expects global oil inventories to generally draw through the end of 2021 as global oil demand continues to recover. Although EIA’s forecast consumption of global liquid fuels of 101.1 million b/d in the fourth quarter of 2021 will still be less than during the same period of 2019, it is 16.7 million b/d more than in the second quarter of 2020. EIA also expects global oil supply to rise in the coming quarters. However, voluntary output restraint from OPEC+ producers, along with the lingering effects of low crude oil prices on U.S. tight oil production, are likely to limit supply increases. As a result, EIA expects global oil inventories to decline by an average of 1.8 million b/d through the end of 2021, eliminating most of the surplus that accumulated in early 2020. These inventory draws will likely put upward pressure on oil prices, but that pressure will be partly offset by large current oil inventories, particularly in the second half of 2020, and large spare crude oil production capacity. The trajectories of both supply and demand are highly uncertain, however, and EIA will continue to closely track incoming data and oil market drivers in the coming months and adjust its forecasts accordingly.

U.S. consumption of liquid fuels reached its recent low point so far this year in April at an average of 14.7 million b/d, down 5.4 million b/d from April 2019. Initial data show consumption increased to 16.1 million b/d in May and to 17.5 million b/d in June as states relaxed COVID-19-related restrictions. EIA expects consumption will continue increasing in the second half of the year as economic activity accelerates.

EIA forecasts that U.S. consumption of petroleum and other liquid fuels will average 18.9 million b/d in the second half of 2020, up from an average of 17.7 million b/d in the first half of the year. EIA forecasts that annual consumption in 2020 will average 18.3 million b/d, down 2.1 million b/d from 2019 (Figure 2). On a volumetric basis, almost half of the decrease in 2020 of U.S. consumption of liquid fuels is reduced gasoline use. On a percentage basis, however, jet fuel consumption declines the most (31%) in 2020 from 2019, followed by residual fuel oil (20%), gasoline (10%), and distillate (10%). EIA forecasts U.S. consumption of liquid fuels will increase to 19.9 million b/d in 2021 but still remain below the 2019 levels.

EIA estimates that annual U.S. crude oil production will average 11.6 million b/d in 2020, down 0.6 million b/d from 2019 because of reduced drilling activity and production curtailments related to low oil prices. This 2020 production decline would mark the first annual decline since 2016. EIA expects production to decline slightly through the first half of 2021 and then generally increase for the rest of the year as prices and economic conditions become more favorable for oil drilling.

EIA estimates that U.S. crude oil production in June averaged 11.0 million b/d, down 1.9 million b/d from the record level reached in November 2019. The declines occurred because producers quickly curtailed production and reduced drilling activity in response to falling prices. As of July 2, Baker Hughes reported the lowest active drilling rig count in the United States on its records, which date back to 1987. Adding to the June drop in U.S. crude oil production were declines in the Federal Offshore Gulf of Mexico stemming from shut-in production in response to Tropical Storm Cristobal.

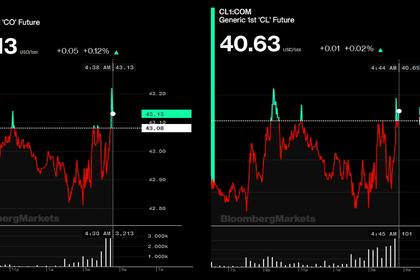

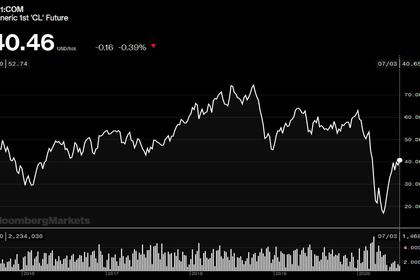

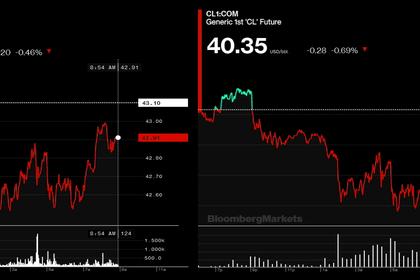

Although crude oil prices have increased, they are not currently high enough to encourage a significant recovery in drilling. Typically, crude oil price changes lead to changes in crude oil production in tight oil basins after about six months. However, current market conditions forced U.S. producers to curtail production more quickly as the WTI spot price dropped below $20/b in April and below $40/b during most days in June. With EIA’s West Texas Intermediate (WTI) crude oil price forecast averaging $39/b during the second half of 2020, EIA expects onshore production in the Lower 48 states will decline from 9.0 million b/d in July 2020 to 8.5 million b/d in April 2021, the lowest monthly level for the duration of the forecast.

EIA expects some growth in U.S. crude oil production to resume in mid-2021 as oil prices increase. However, EIA’s forecast WTI prices remain below $50/b through 2021, and production could be limited based on an uncertain capital environment. EIA expects crude oil production in the Lower 48 states to increase to 8.7 million b/d in the fourth quarter of 2021, up 40,000 b/d compared with the fourth quarter of 2020. Total U.S. crude oil production is forecast to increase to 11.1 million b/d in the fourth quarter of 2021, an increase of 30,000 b/d compared with the fourth quarter of 2020. However, the growth late in the year does not offset year-over-year declines from earlier in 2021. EIA’s forecast annual average U.S. crude oil production in 2021 is 11.0 million b/d, down 620,000 b/d compared with the forecast 2020 average.

EIA finalized this month’s forecast before a U.S. District Court ordered on July 6 the temporary closure of the Dakota Access Pipeline. EIA will continue to monitor any court and pipeline developments. The August STEO will reflect the latest events and effects of this closure, which could affect oil prices and wellhead economics during the forecast period, particularly in the Bakken region of North Dakota.

U.S. average regular gasoline and diesel prices rise

The U.S. average regular gasoline retail price rose less than 1 cent per gallon from the previous week to $2.18 per gallon on July 6, 57 cents lower than the same time last year. The West Coast and East Coast prices each rose more than 1 cent to $2.77 per gallon and $2.10 per gallon, respectively, and the Rocky Mountain price rose 1 cent to $2.33 per gallon. The Gulf Coast price fell more than 1 cent to $1.86 per gallon, and the Midwest price declined nearly 1 cent to $2.10 per gallon.

The U.S. average diesel fuel price rose nearly 1 cent from the previous week to $2.44 per gallon on July 6, 62 cents lower than a year ago. The West Coast price rose more than 1 cent to $2.96 per gallon, the Gulf Coast price increased 1 cent to $2.20 per gallon, the Midwest price rose nearly 1 cent to $2.31 per gallon, and the East Coast and Rocky Mountain prices each rose less than 1 cent to $2.53 per gallon and $2.35 per gallon, respectively.

Propane/propylene inventories rise

U.S. propane/propylene stocks increased by 2.2 million barrels last week to 76.8 million barrels as of July 3, 2020, 5.3 million barrels (7.5%) greater than the five-year (2015-19) average inventory levels for this same time of year. Gulf Coast, Midwest, and East Coast inventories increased by 1.2 million barrels, 0.8 million barrels, and 0.1 million barrels, respectively, and Rocky Mountain/West Coast inventories increased slightly, remaining virtually unchanged.

-----

Earlier: